BNB price has been beneath immense strain for the previous few weeks amid a decline in market volatility and danger urge for food. The asset has crashed by almost 5% up to now week, greater than 25% up to now quarter, and 4.75% within the 12 months up to now. At press time, Binance Coin was buying and selling decrease at $234.7. BNB’s complete market cap has slipped by 2% over the past day to $36 billion, rating it the 4th cryptocurrency. Alternatively, the overall quantity of BNB traded over the identical interval has jumped by 37.45%.

Financial Issues

BNB value has been within the crimson for a number of weeks now amid a decline within the crypto market sentiment and a scarcity of momentum to maintain an upward trajectory. The worldwide crypto market cap has plunged by almost 2% over the past day to $1.15 trillion, whereas the overall crypto market quantity elevated by 23%. Bitcoin, the biggest cryptocurrency by market capitalization, has been vary certain for the previous few weeks, weakening the market sentiment. Most altcoins, together with Ethereum, XRP, Dogecoin, Cardano, Solana, Polygon, and Polkadot, have been within the crimson for the previous week.

The Crypto Worry and Greed Index, which measures the important thing feelings driving the cryptocurrency market, has declined to a Worry degree of 49. A Worry studying normally signifies that traders are having doubts in regards to the market, ramping up the promoting strain towards the backdrop of a decline in danger urge for food.

Traders will probably be carefully watching the discharge of the FOMC assembly minutes for July, trying to find clues in regards to the Fed’s financial expectations and rate of interest path. Since their final assembly in July, there have been combined indicators about whether or not the central financial institution would proceed with its rate of interest hike marketing campaign or whether or not it might hit pause quickly.

US Treasury yields hit an nearly 10-month excessive on Wednesday buoyed by expectations that the Federal Reserve shouldn’t be but accomplished with its fast financial tightening cycle. On Tuesday, Minneapolis Federal Reserve President Neel Kashkari famous that the central financial institution continues to be a great distance from chopping charges. An atmosphere of upper rates of interest tends to be bearish for danger property equivalent to shares and notably cryptocurrencies.

BNB Worth Technical Evaluation

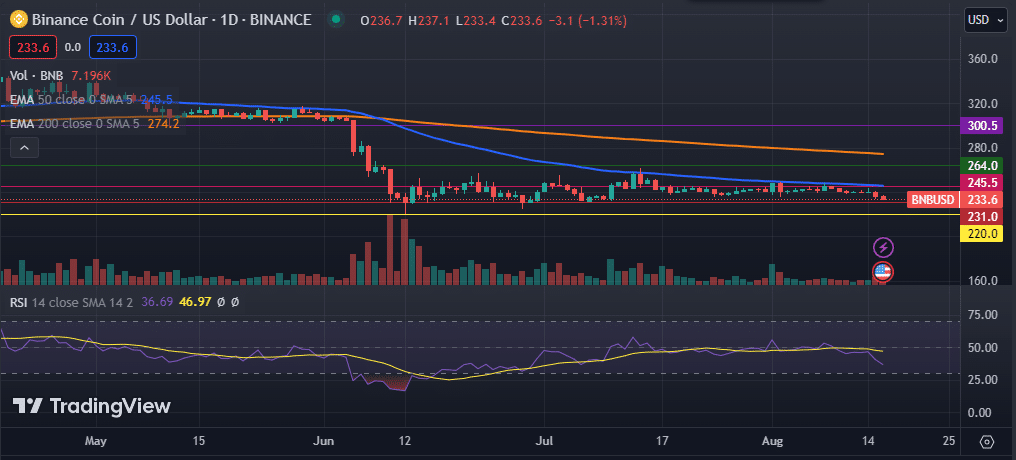

BNB value has failed to begin a contemporary incline over the previous two months, after dealing with a powerful rejection on the vital resistance zone of $300. The digital asset stays beneath the 50-day and 200-day exponential transferring averages, in addition to the 50-day and 100-day easy transferring averages.

Its Relative Energy Index (RSI), in addition to the Transferring Common Convergence Divergence (MACD) indicator, has dropped beneath the sign line, hinting at a rise in promoting strain. The Bollinger Bands have narrowed as seen on the every day chart, indicating a decline in market volatility.

Subsequently, I anticipate the BNB value to fall additional within the coming days amid world financial uncertainty. If this occurs, the following assist ranges to look at will probably be $230 and $220. On the flip facet, a transfer above the 50-day EMA at $245.5 may pave the way in which for additional will increase.