That is an opinion editorial by Logan Chipkin, knowledgeable author who creates instructional content material about Bitcoin and different subjects.

In “The Fiat Standard,” economist Saifedean Ammous argues at size that the US federal authorities has been propagandizing the lots into selecting “low cost industrial substitutes” and “massively decreasing (its) meat consumption” since no less than 1916.

As Ammous wrote:

“…the ADA (American Dietetics Affiliation) is answerable for formulating the dietary tips taught at most diet and medical colleges worldwide, that means it has for a century formed the best way nutritionists and medical doctors (mis)perceive diet. The astonishing consequence is that the overwhelming majority of individuals, nutritionists, and medical doctors immediately assume that animal fats is dangerous, whereas grains are wholesome, needed, and secure!”

In different phrases, although a meat-centered eating regimen is superior to a grain-centered one, the federal government and its quasi-private companions succeeded in persuading tens of millions of individuals into choosing the latter.

Ammous raises the subject of dietary tips as only one instance of how a fiat normal distorts an trade, however there’s one other lesson on this story that Bitcoiners must grapple with:

Even when your product is one of the best in the marketplace, governments (and different entities) are able to spreading narratives that persuade residents to decide on an inferior various.

If it occurred with meals, it might occur with cash.

A CBDC Punch-Counterpunch

On July 10, 2023, Karin Strohecker revealed an article in Reuters titled, “Twenty-Four Central Banks Will Have Digital Currencies By 2030, Survey Shows.” Apparently, a pair dozen central banks have been making “nice” progress of their improvement of central financial institution digital currencies (CBDCs). Strohecker wrote that these central banks have been “engaged on digital variations of their currencies for retail use to keep away from leaving digital funds to the personal sector (emphasis added) amid an accelerating decline of money.”

This purported motivation behind CBDCs has been brewing for some time — in August 2022, the European Central Financial institution (ECB) launched a report referred to as “Towards The Holy Grail Of Cross-Border Payments.” In it, the authors in contrast the deserves and demerits of assorted technological implementations of a cross-border fee answer that is likely to be “fast, low cost, common and settled in a safe settlement medium.” Of the candidates they thought of, they concluded that “Bitcoin is least credible” and that “the interlinking of home on the spot fee programs and future CBDCs, each with a aggressive FX conversion layer” are the 2 most credible options.

Whereas the ECB overlooked any comment concerning the dangers that CBDCs pose to residents’ privateness and sovereignty, River Monetary responded with a report of its personal. Spearheaded by River’s Sam Wouters, this report does clarify the gaping gap within the ECB’s argument for CBDCs, in addition to the technological obstacles that Bitcoin ought to beat if it’s going to be adopted worldwide.

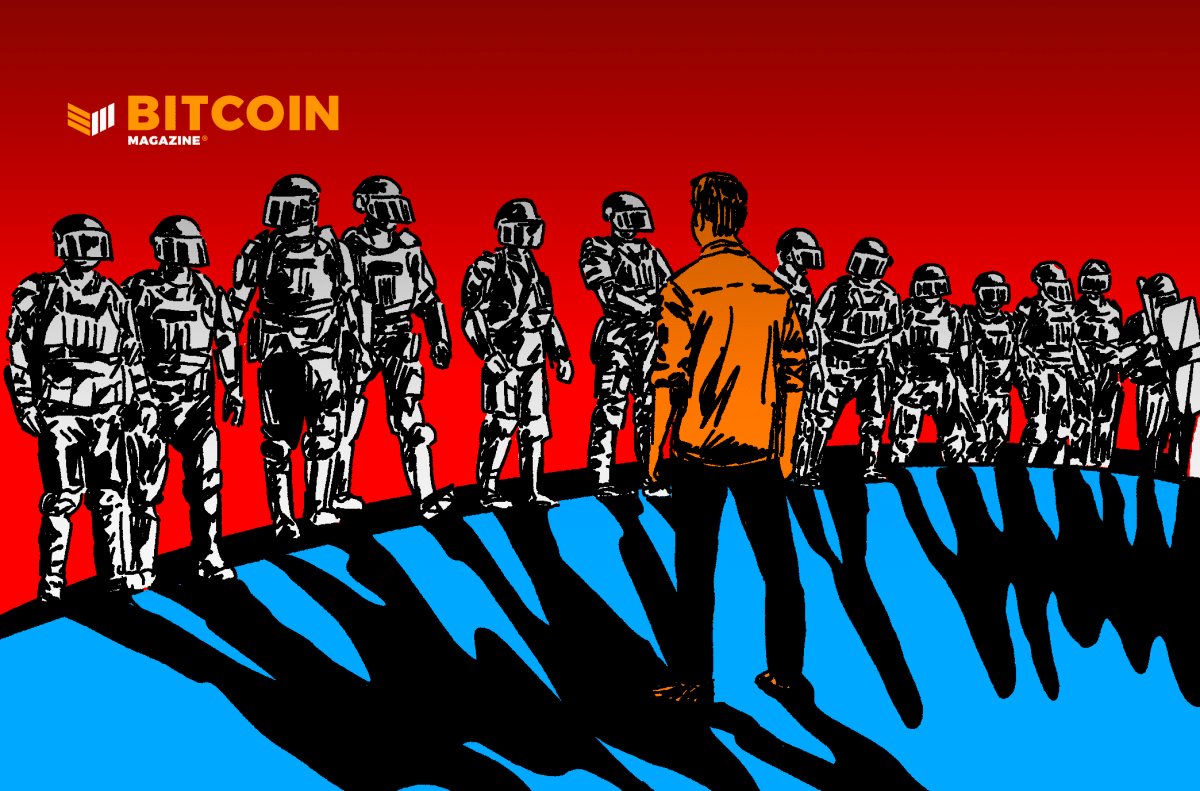

Readers can overview the technical and quantitative arguments of each ECB and River Monetary for themselves — my goal in mentioning this punch-counterpunch is that the battle between freedom-money and tyranny-money is not one that we are going to win by default, and that it’s as a lot a battle for hearts and minds as it’s for product superiority. Very like the propaganda marketing campaign that persuaded folks to modify from more healthy diets to people who the federal government most well-liked, central banks are levying their greatest phrases, movies and different advertising methods to persuade those who CBDCs are superior to Bitcoin.

And, in the long run, their victory is feasible.

Understanding The Training Course of

We know that Bitcoin solves humanity’s many financial issues much better than CBDCs do. We acknowledge the havoc that rampant inflation wreaks on nations. We perceive that missing a retailer of worth is the reason for so many anti-civilizational behaviors. However that’s not sufficient. If others don’t perceive the fiat origins of those issues, they don’t stand an opportunity of appreciating Bitcoin as their answer. Whether or not or not central banks acknowledge the significance of this data within the battle over the way forward for cash, they’re definitely taking each alternative they will to unfold concepts that push Bitcoin to the outskirts and earn CBDCs widespread acceptability.

“Bitcoin dangerous, CBDCs good,” the folks assume. And that’s all central banks want, the inferiority of their product be damned.

As Wouters rightly identified in his report:

“Nice strides have been made in schooling, but when Bitcoiners who’re much less skilled in schooling wish to speed up adoption, they’d profit from gaining a deeper understanding of the schooling course of to take possession of it and change into more practical. This begins by understanding the hole between their perspective and information and that of the recipient… (S)ome folks contained in the Bitcoin area usually are not conscious sufficient of how tough it’s for the common particular person to undergo this journey.”

As a lot as Wouters heroically explains the “how,” “what,” and “why” of the technological enhancements that may assist Bitcoin obtain widespread adoption, none of those holds a candle to folks’s concepts about cash. Even when Bitcoin finally turns into as simple to make use of as bank cards or money, the lots might nonetheless reject it in favor of CBDCs for purely-ideological causes. Grain could have defeated meat as soon as once more.

That is no cause to despair. Bitcoin isn’t inevitable, no. However victory is doable, and its destiny is essentially decided on the ideological battlefield. The hole between our deepest clarification of financial economics and most of the people’s views on the topic is huge. The identical goes for the issues that fiat cash continues to trigger, the risks of CBDCs, and the way and why Bitcoin is a panacea for many of our cash issues.

The academic effort earlier than us is big, however, within the face of the enemy’s propaganda, needed. And it’s thrilling — billions of persons are about to study concerning the best civilizational battle they hadn’t even recognized was occurring proper underneath their noses.

Our conflict is an ideological one. Bitcoin doesn’t must undergo the identical destiny as meat — and the commercial sludge that’s CBDCs can perish within the sewers of historical past. Now we have persuading to do.

This can be a visitor publish by Logan Chipkin. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.