Because the starting of 2023, a brand new type of non-fungible tokens (NFTs), often called Bitcoin Ordinals Inscriptions, has ignited widespread curiosity within the crypto house.

The recognition of Inscriptions might be attributed to their novelty and the distinctive worth proposition they provide. They supply a approach for customers to immortalize messages on the immutable Bitcoin blockchain, including a brand new layer of performance to Bitcoin’s utility as a retailer of worth. This has opened up a brand new avenue for creativity and private expression inside the Bitcoin ecosystem, permitting customers to create an enduring legacy on the blockchain.

Furthermore, the appearance of Inscriptions signified a big milestone for Bitcoin, marking its entry into the NFT house, a website beforehand dominated by Ethereum and different good contract platforms.

Nevertheless, the surge in reputation of Inscriptions had a big impression on the Bitcoin community. The elevated demand for these novel NFTs led to a considerable rise in transaction prices and community congestion, leading to an unprecedented spike in mining revenue because of the elevated transaction fees.

Nevertheless, latest knowledge means that the passion surrounding Inscriptions has cooled off. Varied miner-related metrics point out a return to pre-Inscriptions ranges, signaling market normalization.

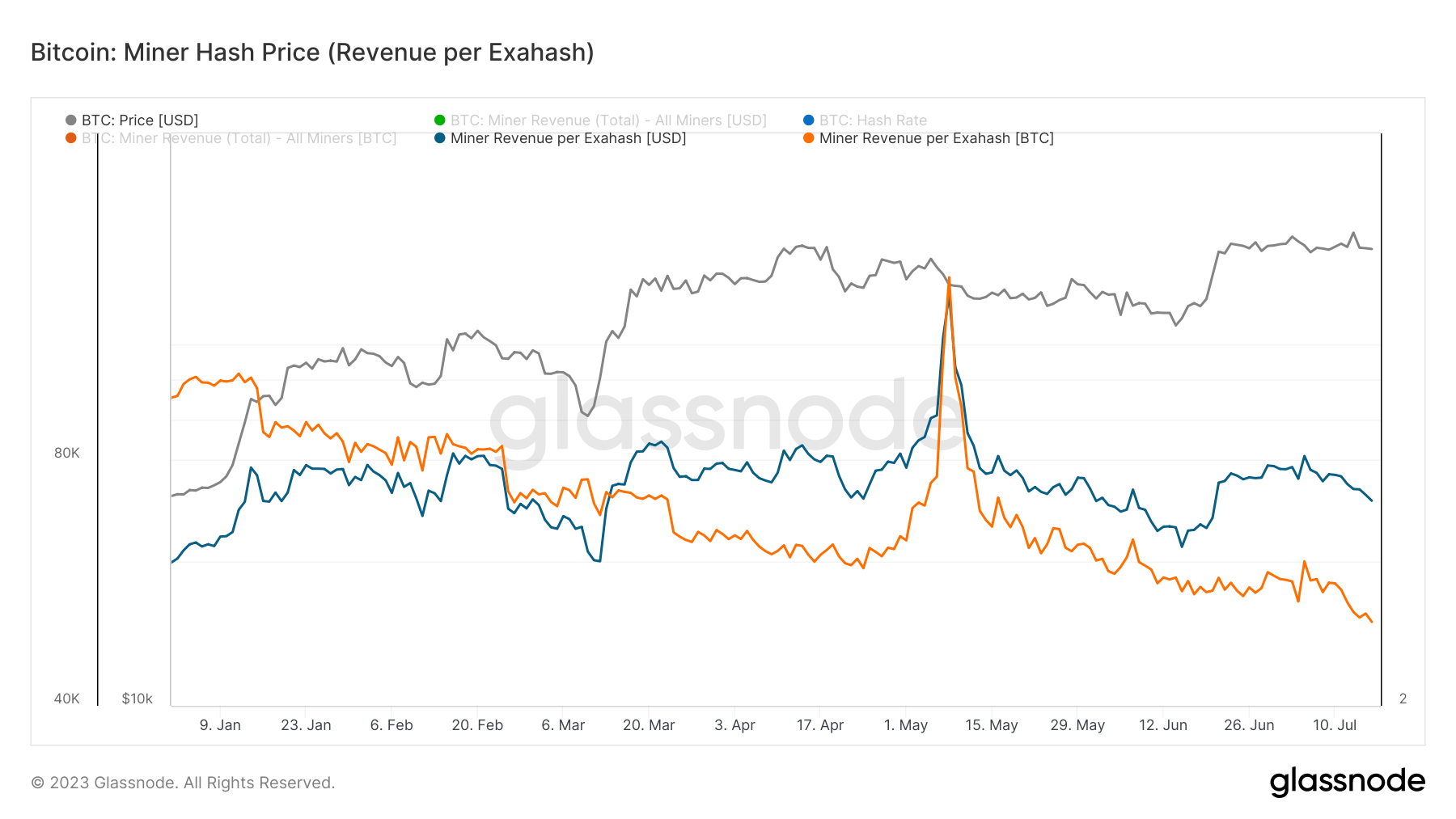

Miner income per exahash, a measure of the income miners earn for every exahash of computational energy they contribute to the community, has seen a big lower since its peak on Could 8, 2023. The USD-denominated income per exahash decreased by greater than 44% since Could 8, following a 110% rise from January to Could.

When denominated in BTC, miner income noticed an analogous development, reducing by 48% since Could 8.

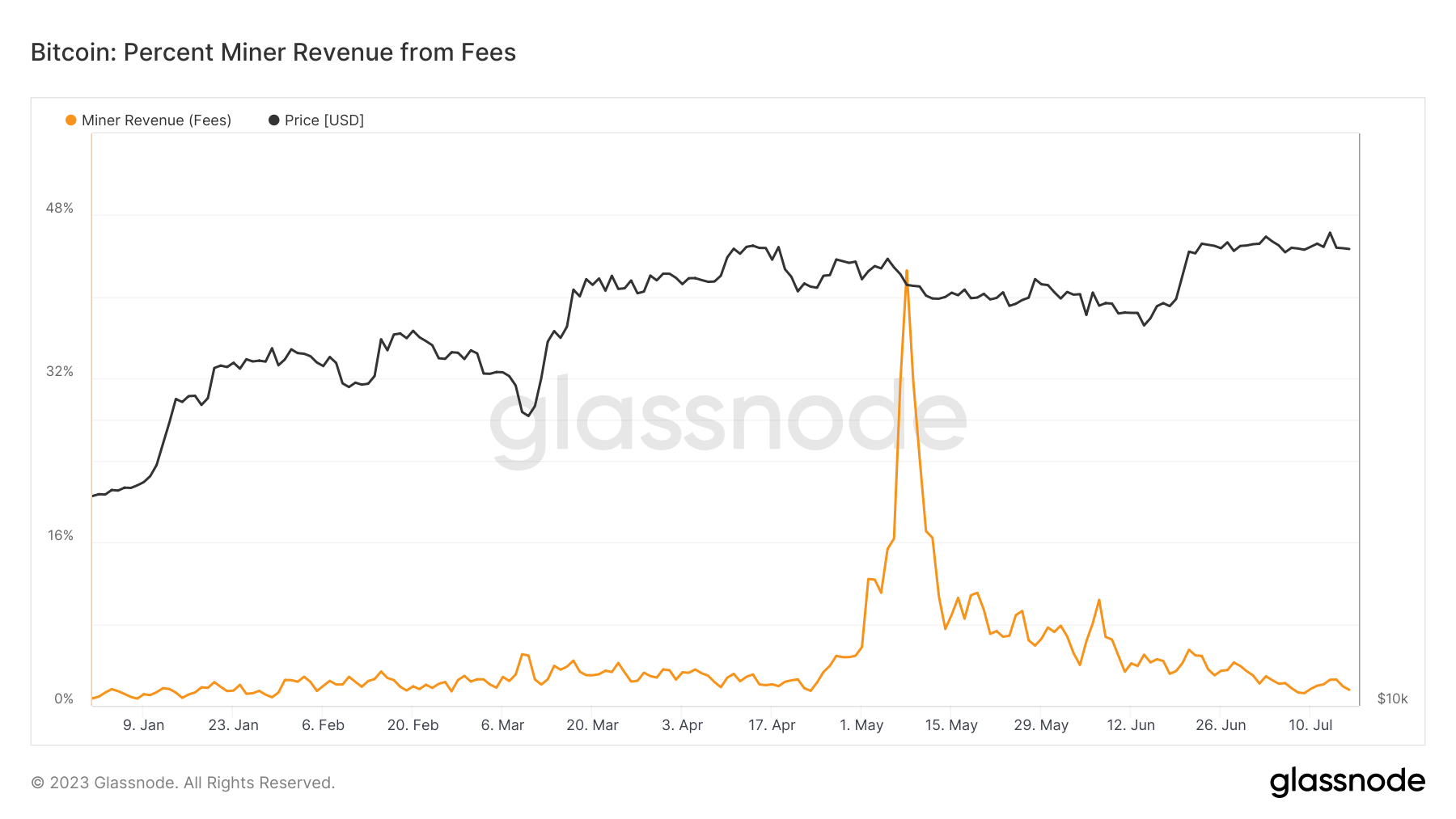

The Inscriptions craze had a big impression on the composition of miner income. On Could 8, transaction charges accounted for 42.59% of all miner income, marking the second-highest recorded degree. The all-time excessive was recorded on December 22, 2017, throughout Bitcoin’s rally to $20,000, when transaction charges comprised 43.57% of complete income.

To place this into perspective, the share of miner income from transaction charges on January 1, 2023, was a mere 0.73%. As of June 16, 2023, transaction charges account for round 1.56% of miner income, indicating that the majority revenue is derived from block rewards.

The normalization of miner income and the lower in transaction charges recommend that the market has adjusted to the Inscriptions phenomenon. Whereas the Inscriptions development supplied a brief monetary boon for Bitcoin miners, it seems that the Bitcoin community is returning to its typical operations.

This return to normalcy is a optimistic signal for the Bitcoin community, indicating its resilience and talent to adapt to new developments and tendencies.