Binance, the world’s largest cryptocurrency alternate, has misplaced 1 / 4 of its market share previously three months as a US watchdog pursues it for alleged violation of federal legal guidelines.

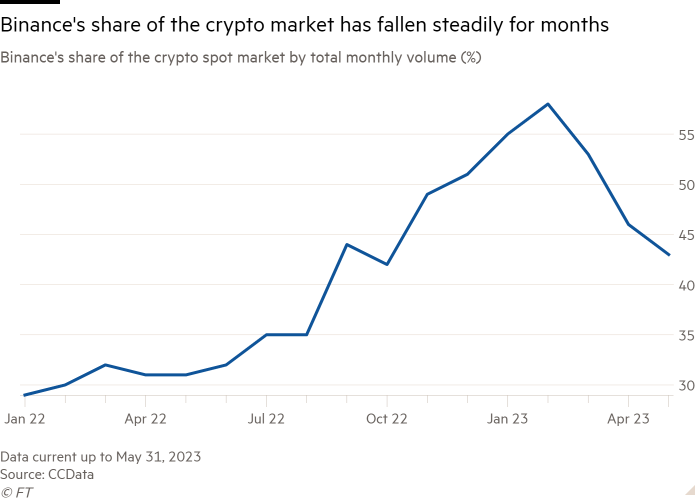

The group, which says it has no headquarters, managed 57.5 per cent of the typical month-to-month quantity on the world’s crypto exchanges at its peak in February. However that has now dropped to 43 per cent, in keeping with analysis supplier CCData.

The sharp decline has come as Binance runs into harder industrial competitors, larger scrutiny of its actions from US regulators, and following the top of a free buying and selling promotion.

In February New York regulators shut down the issuance of a Binance-branded stablecoin. Stablecoins are a sort of crypto token used as a retailer of worth between bets within the crypto market as a result of they’re designed to trace the worth of the greenback and different conventional currencies.

On the time the coin, referred to as BUSD, accounted for roughly 40 per cent of the corporate’s month-to-month buying and selling quantity.

“The top of BUSD issuance has had an impression on the quantity of liquidity on the alternate, that compounds the strain on Binance, figuring out their branded stablecoin was within the media and so they have been compelled to desert it,” stated Ilan Solot, co-head of digital property at London-based monetary providers group Marex.

Weeks later the Commodity Futures Buying and selling Fee, the US derivatives regulator, filed a lawsuit towards the alternate, claiming a lot of Binance’s reported buying and selling quantity and profitability had come from “in depth solicitation of and entry to” US prospects. Binance stated on the time it disagreed with the CFTC’s allegations.

Its market share has additionally been hit by the ending of a promotion providing prospects free buying and selling in a variety of bitcoin pairs, which had fuelled progress late final yr however which led to March.

“As soon as these ended, buying and selling quantity naturally went down and that clearly impacts their short-term share of the market share,” Solot stated.

Whereas Binance’s grip available on the market has thinned, different exchanges — together with OKX, BitMex, Bybit and Bullish — have bolstered their market shares since March.

Binance’s slipping market share comes because it plans a spherical of job cuts, which the corporate stated on Wednesday was “not a case of proper sizing” however as a substitute represented a re-evaluation of whether or not the corporate “has the correct expertise and experience in important roles”.

Binance was based in 2017 and has grown from a workforce of 30 to greater than 8,000 workers. Its chief technique officer Patrick Hillmann on Wednesday described the cuts as a “historic operational problem” following the corporate’s “exponential progress these previous 5 years”.

Binance declined to verify the variety of workers that might be affected by the job cuts. One particular person accustomed to the matter stated Binance had beforehand made cuts of between 5 and 12 per cent of its workforce.

Current crypto market circumstances have additionally performed a job in Binance’s resolution to trim its headcount, in keeping with one other particular person accustomed to the matter.

“[Market factors] imply we’d pivot or refocus our [resources] . . . it doesn’t take a genius to place these issues collectively,” they stated.

After a number of years of turbocharged progress, many crypto firms have been compelled to retrench by final yr’s business downturn, wherein the worth of tokens reminiscent of bitcoin dropped by about 70 per cent and lots of large names, together with Celsius Community and FTX, went underneath. Amongst them Coinbase and Crypto.com have made giant cuts to their very own workforces.

Regardless of cuts elsewhere, Binance stated it continued to recruit for lots of of vacancies throughout crypto’s historic downturn. Chief government Changpeng Zhao stated on Wednesday the corporate had a “backside out” coverage the place individuals who have been “not sturdy matches” depart.

“This ‘programme’ is fixed. I push for it on a weekly foundation,” he stated.