- U.S lawmakers want to ban CBDCs, but 94% of central banks are not so sure

- Stablecoins have been adopted cautiously amid regulatory concerns

Despite the U.S. House of Representatives passing a bill to ban the Federal Reserve from issuing a Central Bank Digital Currency (CBDC), interest in CBDCs continues to grow globally.

Findings of the survey

According to a recent survey by the Bank for International Settlements (BIS), 94% of central banks are now exploring CBDCs, compared to 90% in 2021.

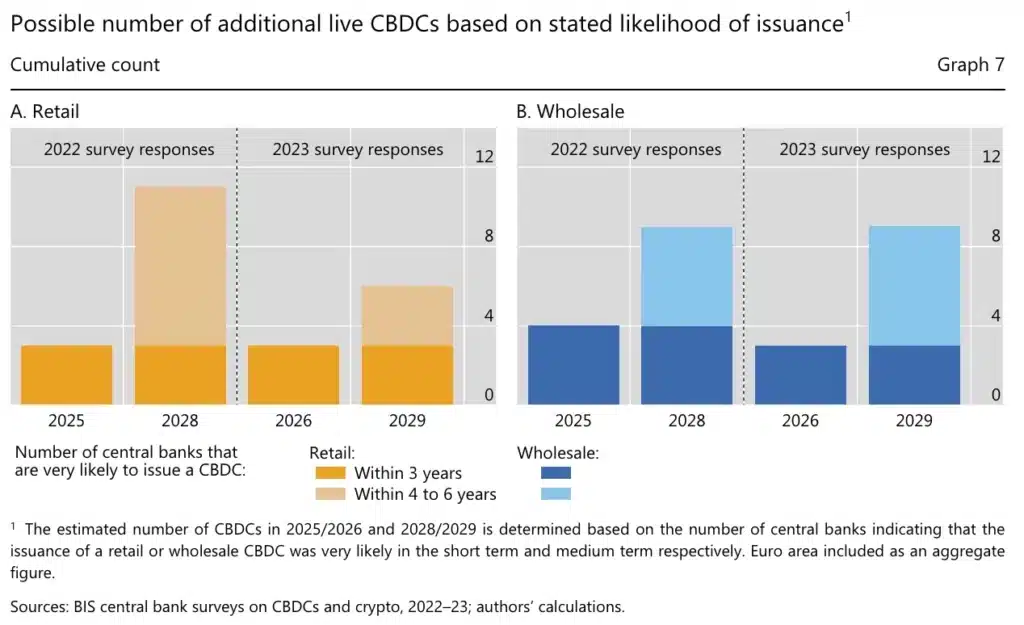

The survey, which included 86 banks as participants, also found that these banks are more likely to implement wholesale CBDCs rather than retail CBDCs in the next six years.

For context, wholesale CBDCs facilitate transactions between banks and financial institutions, while retail CBDCs are for public use, like buying coffee.

Providing further insights on the same, BIS researchers noted,

“The survey suggests that central banks are proceeding at their own speed, taking diverse approaches and considering different design features.”

They added,

“For retail CBDCs, more than half of central banks are considering holding limits, interoperability, offline options and zero remuneration.”

Here, it’s worth noting that many in the financial sector fear a CBDC could increase government surveillance and control, hampering innovation, and limiting freedoms. Hence, the latest report has come as a massive relief to market participants concerned about these implications.

Popular around the world?

Interestingly, countries around the globe have been considering digital currencies for years now, with China being an early pioneer. Nigeria and the Bahamas were among the first to issue their own CBDCs too.

On the contrary, former U.S. President Donald Trump has firmly opposed the idea. In a campaign speech in New Hampshire, he vowed to prevent the creation of a U.S CBDC if re-elected, calling them a “dangerous threat to freedom.” He said,

“As your President, I will never allow the creation of a central bank digital currency. Such a currency would give our federal government the absolute control over your money.”

Earlier this week, he had also claimed,

Stablecoin adoption lags behind

It’s also important to note that despite the rapid exploration of CBDCs by central banks in advanced economies, the adoption of stablecoins remains relatively modest.

In fact, as of May 2024, the total market capitalization of cryptocurrencies stood at $2.7 trillion. Stablecoins constituted only a small fraction, accounting for just 6% of the cumulative crypto market cap, which amounts to approximately $161 billion.

This disparity implies that while major cryptocurrencies hold a strong position, stablecoins have been adopted cautiously.

Shedding light on the same, the report concluded,

“On crypto, the survey indicates that, to date, stablecoins are rarely used for payments outside the crypto ecosystem. Moreover, about two out of three responding jurisdictions have or are working on a framework to regulate stablecoins and other cryptoassets.”

Hence, as things unfold, it would be interesting to see how discussions on digital currencies shape global economic policies and financial innovations.