- MSTR has been added to the MSCI Index and could boost visibility and investment

- MSTR extended its recovery on the price charts, reclaiming the $1500-mark on Wednesday

Jim Cramer, the host of CNBC’s Mad Money financial show, is in the news today after he cautioned investors against buying MicroStrategy shares to gain exposure to Bitcoin [BTC]. Instead, Cramer, known for his bold market projections, asked his audience to directly invest in BTC.

Despite Cramer’s “Do not buy MicroStrategy stock” calls, however, MSTR recorded an impressive recovery on Wednesday. By doing so, it posted gains of over 15% on the charts, double the gains registered by BTC in the same period.

MicroStrategy stock rallies after MSCI inclusion

Here, it is worth noting that MicroStrategy stock could have benefited from a double boost. The first catalyst could have been its inclusion in the MSCI (Morgan Stanley Capital International) index.

In fact, Bloomberg ETF analyst Eric Balchunas called it a ‘big deal’ for MicroStrategy, given the index’s popularity among investors. This will increase MicroStrategy’s visibility and investment opportunities.

Secondly, Bitcoin’s upswing on Wednesday from its range-low also bolstered MSTR’s recovery. Especially since key technicals flashed green on the price charts.

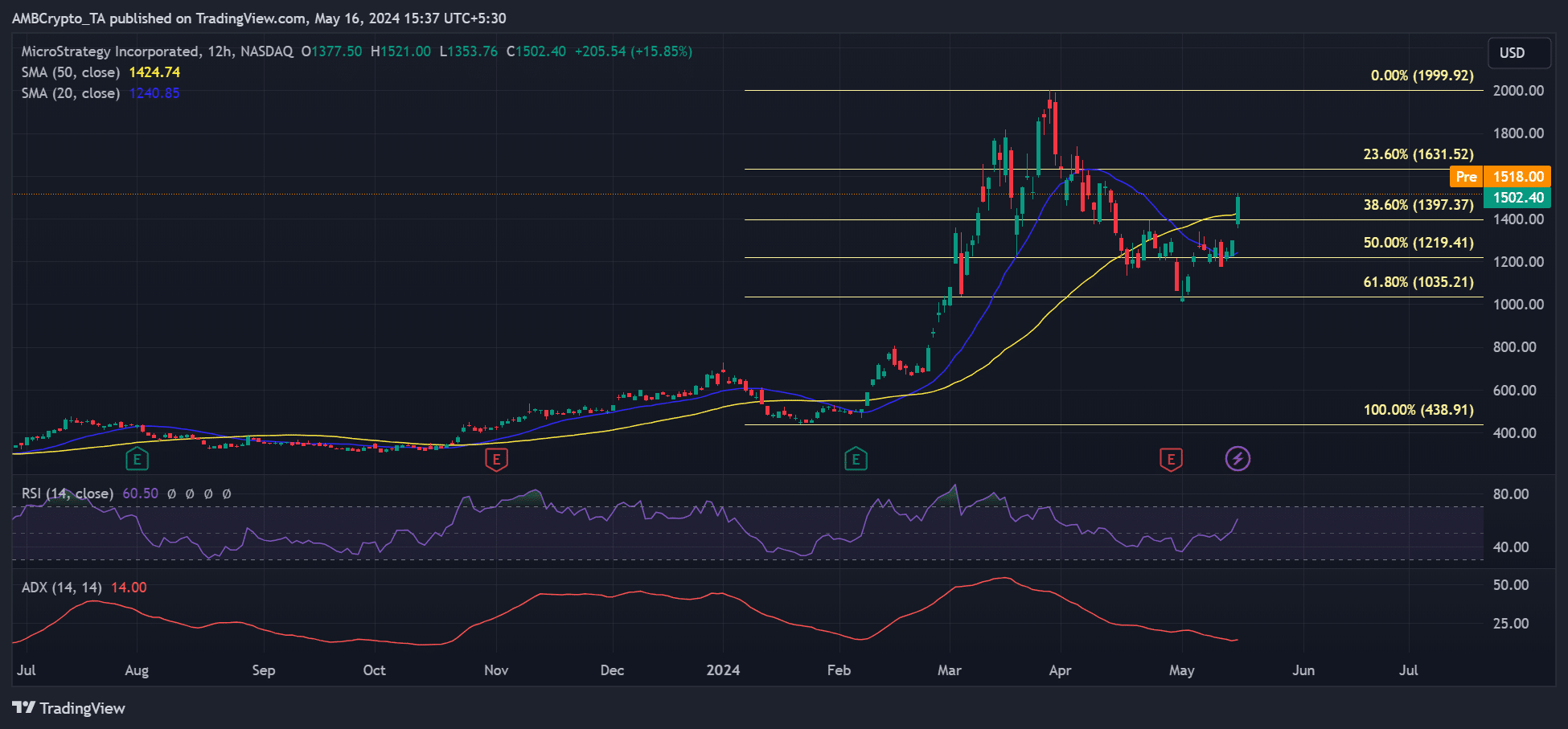

After peaking in March at $1999, MSTR slumped to $1009 towards the end of April. However, May’s recovery has been steady, pushing the stock above the 50% ($1219) and 38.6% ($1397) Fib placeholders, respectively.

Additionally, its price broke above the 20-day SMA (Simple Moving Average (blue), indicating more buyers jumped on the MSTR bandwagon on Tuesday (the day of the MSCI inclusion update). The market closed above $1500 on Wednesday and effectively flipped the market structure bullish on the higher timeframe charts.

Ergo, MSTR could record more upside with the immediate bullish target at $1631 before eyeing the ATH of $1999. The RSI (Relative Strength Index) underlined massive buying strength too, with the same supporting all bullish projections.

That being said, at press time, the price momentum was still neutral based on the ADX’s (Average Directional Movement) reading below 20 (14). Hence, caution should be paramount.

Also, it’s worth noting that MSTR was up over 100% when its YTD (year-to-date) performance was compared to BTC’s 50%. However, the strong correlation between MSTR and BTC means the king coin’s extended recovery towards the range-high of $71k could pull MSTR further up on the price charts.

![Microstrategy stock [MSTR] reclaims $1500 DESPITE Jim Cramer’s advice](https://www.breakingaltcoinnews.com/wp-content/uploads/2024/05/MSTR-FI-1000x600-750x375.jpeg)