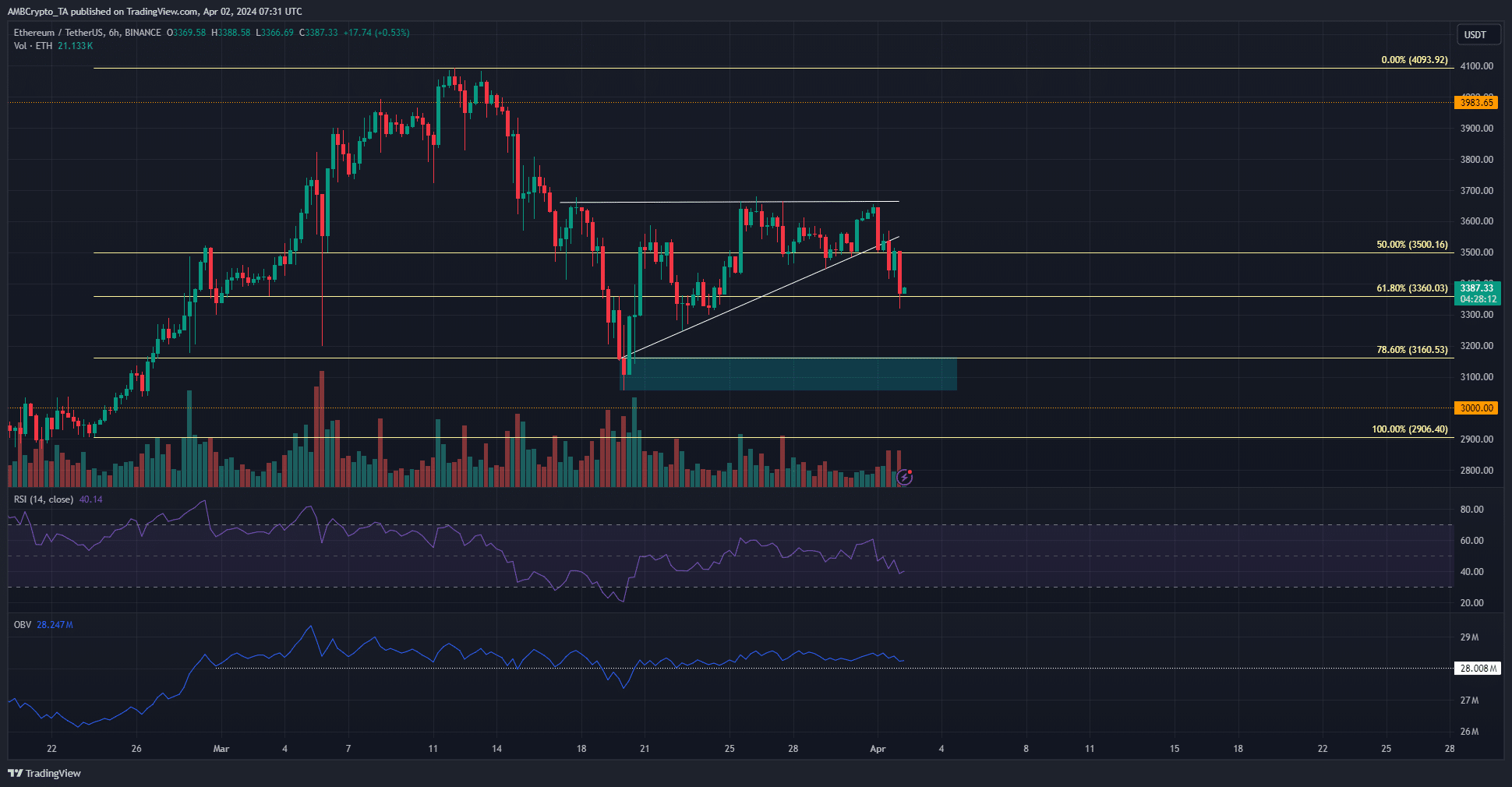

- Ethereum could see its market structure flipped bearishly upon a descent below $3050.

- The momentum and selling pressure were rising steadily and could force more losses.

The past 24 hours saw a strong wave of selling pressure. Bitcoin [BTC] and Ethereum [ETH] noted losses of 7%-8% each, and a deeper drop appeared likely. The $3.5k level was a key short-term support for ETH.

Crypto analyst Ali Martinez noted that a bear pennant formation was brewing. If it came to fruition, a drop to $2.8k could be on the cards. Will the bears fulfill this prediction?

The bear pennant or the demand zone- who will win this round?

AMBCrypto highlighted the pennant formation in white. Based on the length of the flagpole, a drop to $2.6k could commence. The $2.8k-$2.9k was a region where ETH consolidated in February before its push beyond $3k.

Hence, it could serve as support on the way down and repulse the bears. The $3.1k region was also a lower timeframe bullish order block which saw a significant reaction from the price earlier this month.

The trading volume has decreased over the past two weeks as Ethereum formed a bearish pattern. The break beneath the rising trendline confirmed the pattern was playing out. A fall below $3056 will flip the market structure bearishly on the 12-hour chart.

Ethereum was undervalued, but should you rush to buy it now?

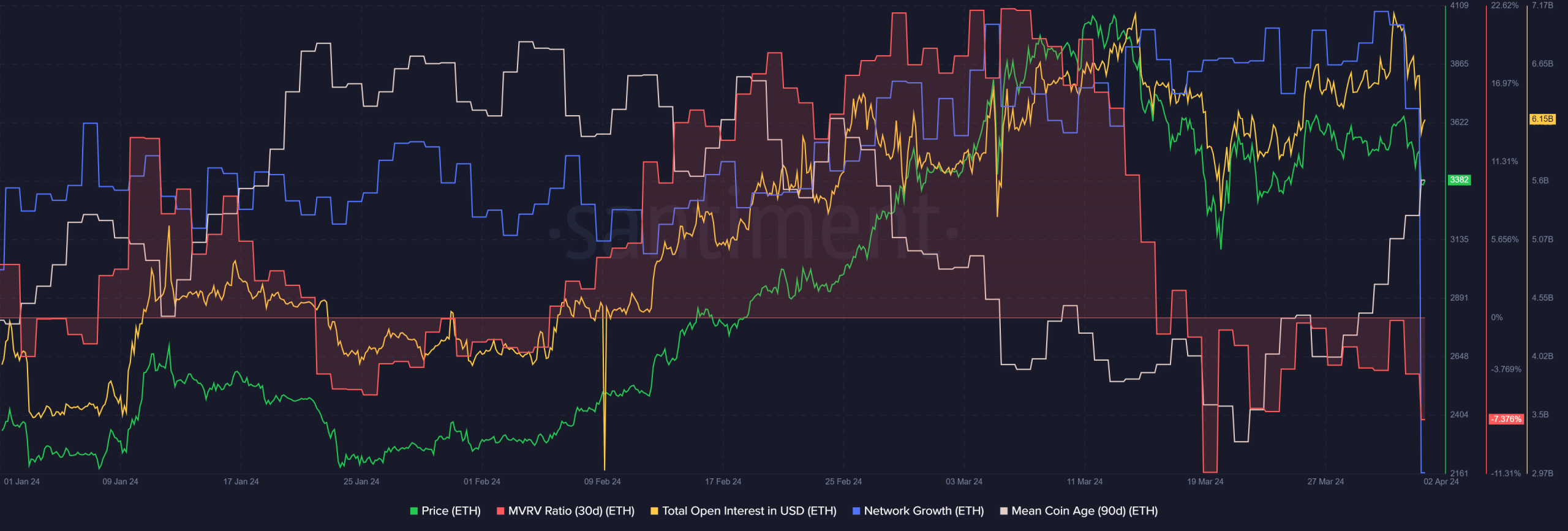

Source: Santiment

AMBCrypto’s analysis of some of Ethereum’s on-chain metrics noted positive findings for investors. The 30-day MVRV ratio has been below zero since 18th March, showing an undervalued asset.

Yet, the mean coin age, which had trended downward since the 9th of February, began to trend higher.

Together, it was a strong buy signal. However, this signal is not a short-term one. Risk management needs to be formulated based on technical analysis as well, and at press time, the bears have the advantage.

Is your portfolio green? Check the Ethereum Profit Calculator

Comparing the network growth in March to January, it showed that an increasing number of new addresses were created on the network.

The total Open Interest fell alongside the price to indicate short-term bearish sentiment. However, the evidence at hand showed that a drop to $3.1k or $2.6k would still present a buying opportunity for long-term holders.