- Daily fees on Ethereum have dropped by four times since Dencun.

- Lower fees reduced deflationary pressure on Ether.

The recently-activated Dencun Upgrade made Ethereum [ETH] scaling solutions much more affordable to use, in some cases slashing transaction fees by as much as 90%.

But while much of the hype has centered around cost advantages on layer-2 (L2s) as they are popularly called, the base layer was also seemed to be reaping the benefits of the critical technological change.

Ethereum daily fee revenue declines sharply

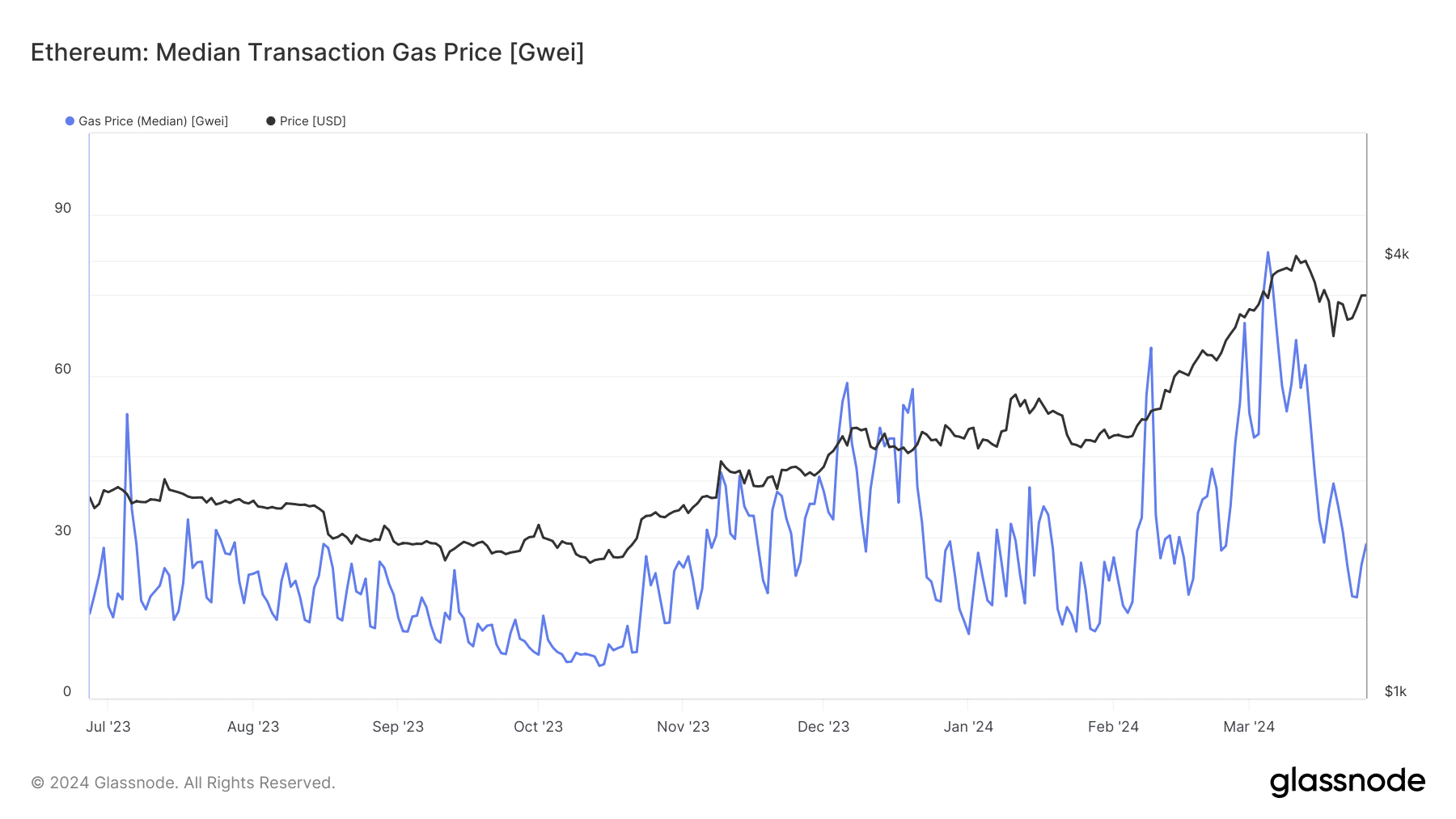

According to X (formerly Twitter) user David Alexander II, gas fees on the mainnet have sharply dipped since Dencun’s execution on the 14th of March, with the daily transaction count remaining roughly the same.

Notably, Ethereum handled an average of 1.23 million daily transactions prior to Dencun, collecting an average daily fees around $28.7 million.

Currently, the transaction count remains the same, but the fees have tumbled to as low as $7.7 million.

AMBCrypto investigated further using Glassnode data and spotted a sharp drop in average fees paid per transaction on Ethereum in the past two weeks.

Fading meme coin mania to also be blamed

While Dencun may have indirectly aided in lowering fees on Ethereum, it was important to acknowledge that one of the main reasons behind the slump was the waning memecoin frenzy, as AMBCrypto reported previously.

The fees remained high in early March, when Ethereum-based meme tokens like Pepe [PEPE] and Shiba Inu [SHIB] surged in value.

However, as the month progressed, traders turned to Solana [SOL] in search of higher returns from the swarm of meme coins issued via pre-sales.

Is your portfolio green? Check out the ETH Profit Calculator

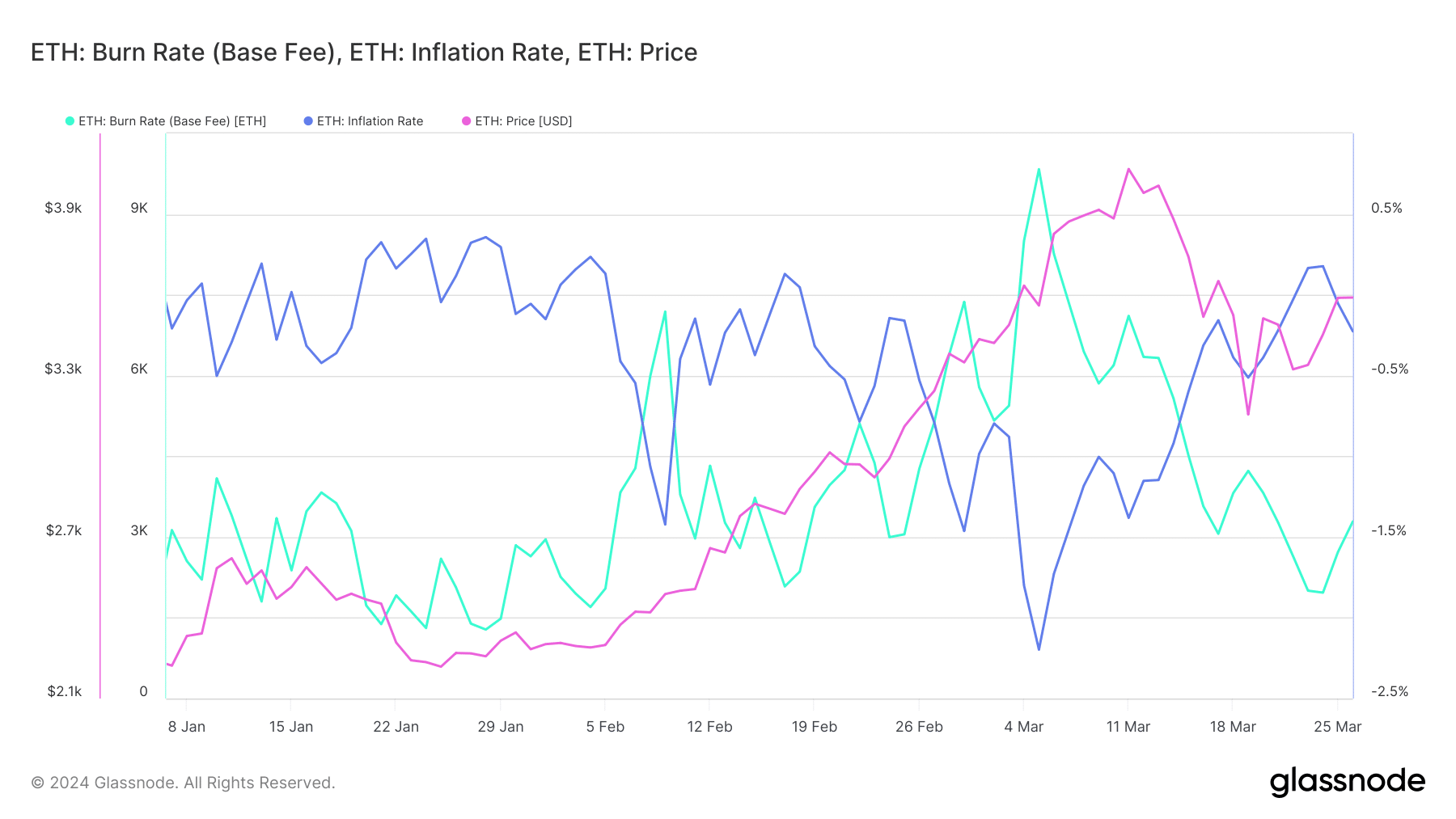

ETH’s deflation rate slows down

As fees on Ethereum mainnet dipped, the rate at which ETH coins were exiting supply slowed down.

Note that a set amount of ETH is burned for each transaction. This corresponds to the minimum amount required for a transaction to be considered valid, i.e., base fee.

As evident, the burn rate dropped sharply in recent weeks, pushing the inflation rate up. The drop in deflationary pressure likely had a role to play in ETH’s 12% drop since Dencun.