A dealer who nailed the ground worth of Bitcoin (BTC) through the 2018 bull market believes Solana (SOL) and Polygon (MATIC) are about to witness bursts to the upside.

Pseudonymous analyst Bluntz tells his 229,100 followers on the social media platform X that Solana seems able to rally after pulling again to final week’s low of $54.78.

In line with the dealer, final week’s correction set the stage for Solana to print a brand new 2023 excessive.

“SOL trying like a sequence of 1-2s from the lows on low time frames. The following leg up ought to hopefully take us as much as $80 and past.”

Bluntz practices Elliott Wave concept, a sophisticated technical evaluation methodology that makes an attempt to foretell future worth motion by following crowd psychology which tends to manifest in waves. In line with the speculation, a bullish asset goes by means of a five-wave rally with every main wave consisting of its personal 5 sub-waves.

Trying on the dealer’s chart, he appears to foretell that SOL will initially rally to about $70 after which $82.50. At time of writing, SOL is buying and selling for $59.66.

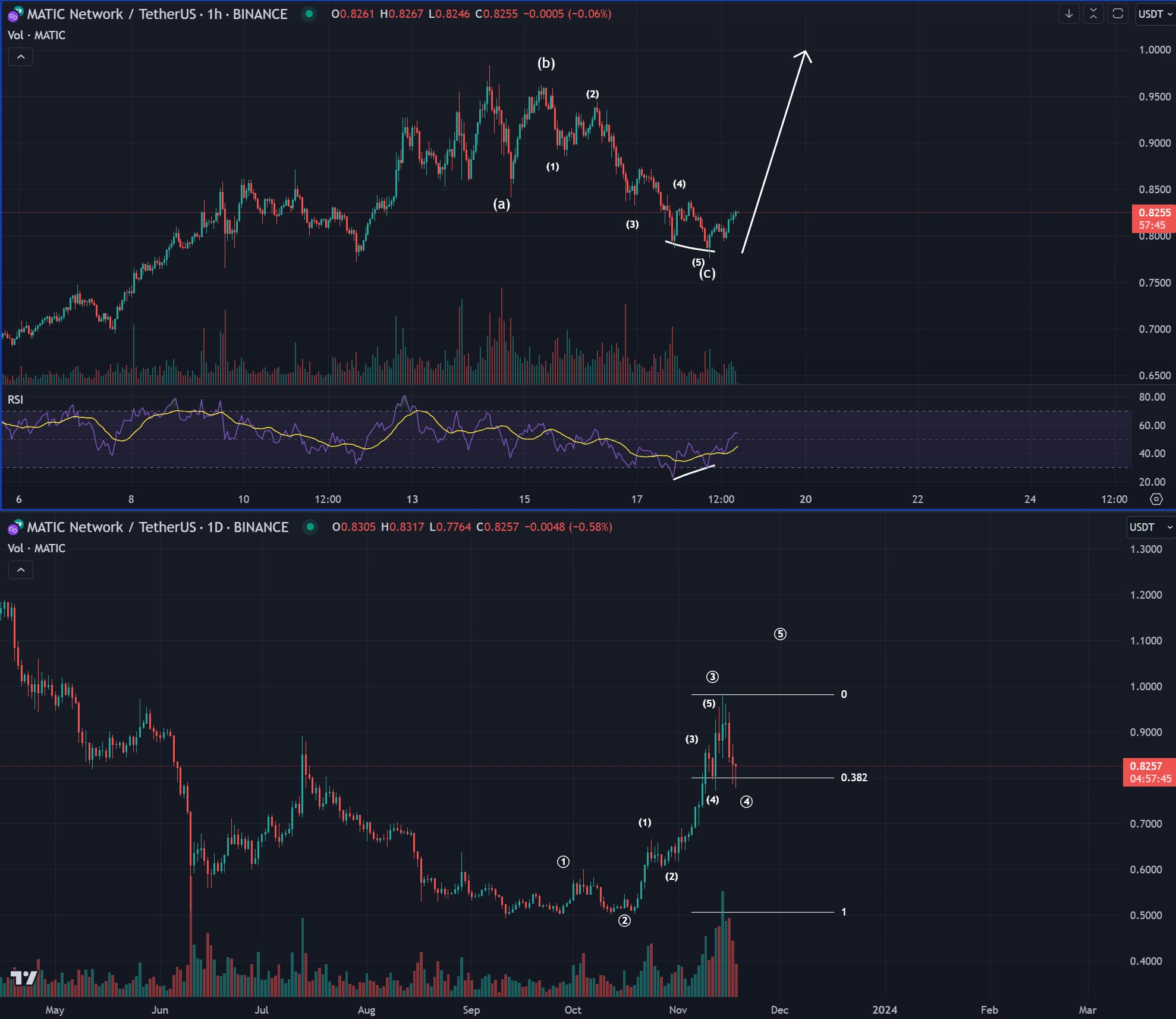

Subsequent up is MATIC, the native asset of the Ethereum (ETH) scaling resolution Polygon. In line with Bluntz, MATIC seems bullish after respecting a key help degree whereas printing a bullish divergence on the hourly timeframe.

A bullish divergence is historically seen as a reversal sign because it means that bulls are gaining momentum regardless that the asset’s worth is making new lows.

Says Bluntz,

“MATIC gearing up for a possible 20% push into new highs in my view.

High chart is the low timeframe. The underside is each day. Had a pleasant 0.38 Fibonacci retest. Appears to be like like a three-wave transfer down and bought some good [bullish] divergence on the lows.”

Trying on the dealer’s chart, he appears to foretell that MATIC will rally to $1. At time of writing, MATIC is value $0.844.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Quardia