[ad_1]

Bitcoin merchants have engaged in a tricky battle as BTC value shoots to $37,000. The Bitcoin futures open curiosity has shot to a seven-month excessive.

Earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) made a robust transfer to $37,000 ranges and is at present hovering round these ranges. After vital in a single day positive factors, Bitcoin value is making a decided push in the direction of the $40,000 threshold. Surging by 6.6% in November and attaining almost a 30% acquire in October, the cryptocurrency’s sturdy efficiency is shocking some market observers.

Bitcoin Worth Actions

Nonetheless, considerations come up round buying and selling quantity, as Materials Indicators, an on-chain monitoring useful resource, highlights a scarcity of robust quantity assist at present ranges. The assist rests across the $33,000 mark, with resistance now positioned within the $42,000 vary, a shift from the earlier $40,000 resistance stage. An accompanying chart illustrates BTC/USDT order guide liquidity on the most important world alternate, Binance. Of their submit, Materials Indicators noted:

“There isn’t a denying the truth that value has been difficult numerous totally different native prime alerts, however there may be additionally no denying that one thing doesn’t appear proper about this transfer. The obvious crimson flag for me is that we’re seeing value admire on declining quantity. That sometimes doesn’t finish effectively, however we’re going to have to look at to see if this time is totally different.”

Bitcoin Open Curiosity at Seven-Month Excessive

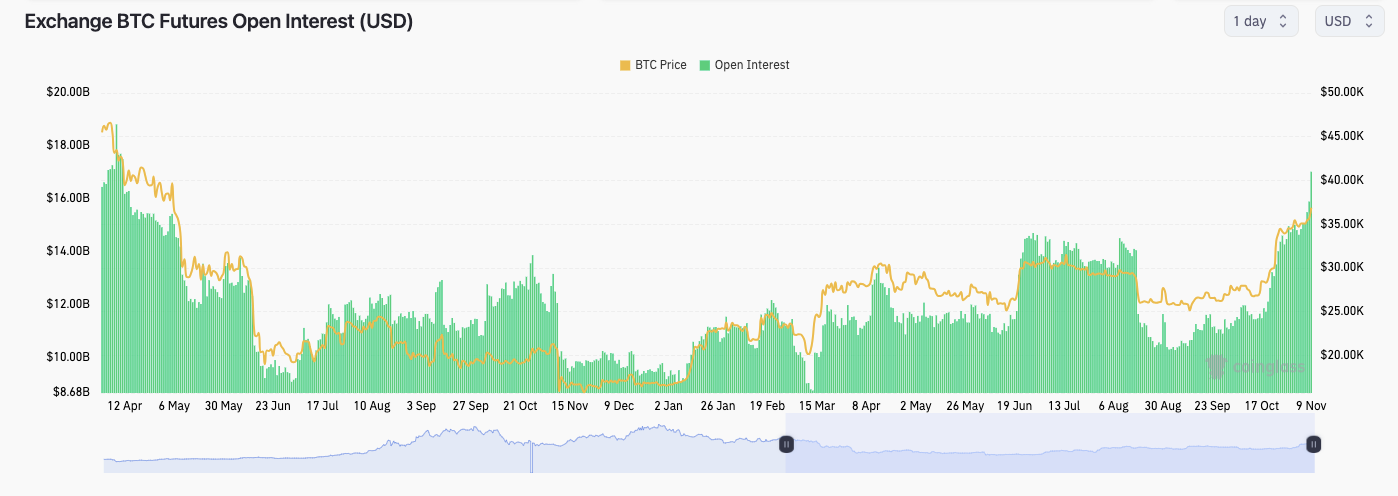

In different developments, monetary commentator Tedtalksmacro highlighted a notable enhance in open curiosity (OI), an element that has been a driving drive behind speedy upward actions in current weeks and months.

In line with information from monitoring useful resource CoinGlass, the full open curiosity in Bitcoin futures has surpassed $17 billion, marking the best worth since mid-April. Tedtalksmacro noticed that in bearish durations, the market tends to withstand these OI impulses, resulting in a predatory and ranging surroundings.

He suggests {that a} full bullish development would emerge when the market begins trending greater regardless of rising OI, indicating a noteworthy facet to observe.

Photograph: CoinGlass

However common crypto analyst Ali Martinez famous that the BTC value flashes a promote sign as per the technical chart. The TD Sequential is signaling a promote on the weekly chart as #BTC nears a vital resistance zone starting from $38,500 to $42,000.

Anticipating the influence of this resistance barrier, I foresee a possible correction in the direction of $33,000, presenting a shopping for alternative for the dip earlier than the upward development resumes. The state of affairs could be invalidated if there’s a weekly candlestick shut above $42,500.

Photograph: Ali / X

Alternatively, amid the current value rally, Bitcoin miners have additionally began offloading their BTC holdings. Following the late October surge that propelled Bitcoin past $34,000, miners of $BTC have been actively promoting. Greater than 5,000 BTC, equal to roughly $175 million, have been divested since that interval.

[ad_2]

Source link