[ad_1]

It’s been a disastrous week for Mila Kunis and Ashton Kutcher, and it’s solely Wednesday. The SEC has charged the Hollywood energy couple’s NFT-based net collection, “Stoner Cats,” calling the NFTs unregistered securities.

Per the SEC, “Stoner Cats is an grownup animated tv present about home cats that develop into sentient after being uncovered to their proprietor’s medical marijuana.” By shopping for one in every of 10,000 NFTs price round $800 every, followers might get unique entry to the six-episode animated collection, which options celebrities like Jane Fonda, Chris Rock and Seth MacFarlane. Even Ethereum co-founder Vitalik Buterin was within the present.

Each time one in every of these NFTs was resold, the unique proprietor would earn a 2.5% royalty. In advertising the NFTs, Stoner Cats emphasised that “the extra profitable the present, the extra profitable your NFT shall be.”

The Stoner Cats’ social media accounts continued to advertise the resale of those NFTs, and since they strongly advised a return on funding, the SEC declared the Stoner Cats NFTs to be unregistered securities.

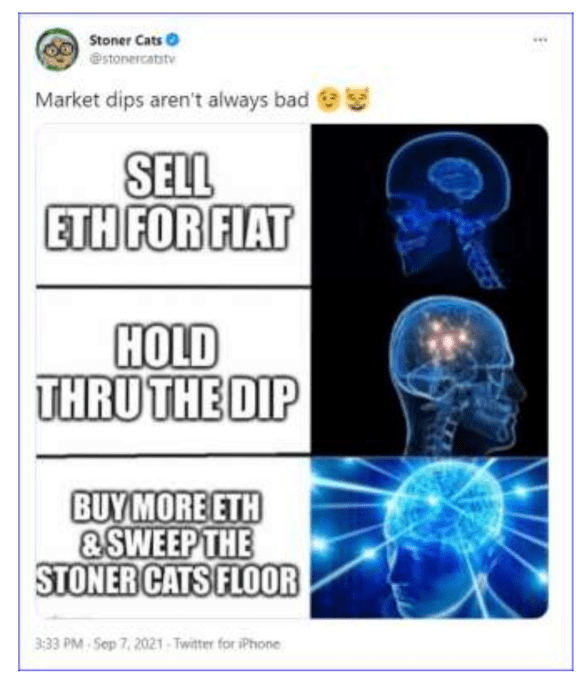

One other nice quote from this formal SEC document: “@StonerCatsTV tweeted on September 7, 2021 a meme suggesting that the neatest factor to do throughout a dip within the crypto markets can be to ‘Purchase extra ETH & sweep the Stoner Cats flooring.’”

The order cites the next meme:

Picture Credit: Stoner Cats on Twitter

Stoner Cats settled with the SEC and can pay a $1 million wonderful. There may even be a Truthful Fund that may return cash to individuals who have been financially harmed by buying the NFTs. The corporate should additionally destroy all NFTs in its possession.

The SEC has been cracking down on celebrity-endorsed crypto tasks. Final yr, Kim Kardashian reached a $1.26 million settlement with the SEC over failing to correctly disclose that she was being paid to advertise a crypto asset safety offered by EthereumMax.

“No matter whether or not your providing entails beavers, chinchillas or animal-based NFTs, beneath the federal securities legal guidelines, it’s the financial actuality of the providing – not the labels you placed on it or the underlying objects – that guides the willpower of what’s an funding contract and due to this fact a safety,” stated Gurbir S. Grewal, director of the SEC’s Division of Enforcement, in a press release.

[ad_2]

Source link