[ad_1]

- Hong Kong-based Metalpha offloaded over 33,589 ETH worth $77.55 million to Binance in the past four days.

- Based on the historical price momentum, there is a high possibility that ETH could soar by 23% to the $2,700 level.

Despite the ongoing market recovery, it appears that Ethereum [ETH] is poised for a significant price decline. Currently, both investors and institutions are bearish as they continue to dump ETH on exchanges.

Institutional selling spree

On the 10th of September, on-chain analytic firm Lookonchain noted on X (formerly Twitter) that Metalpha, a Hong Kong asset management giant, had dumped 10,000 Ether worth $23.45 million to Binance [BNB].

The firm offloaded over 33,589 ETH worth $77.55 million to Binance in the past four days.

But despite the notable dump, the asset manager still held a significant 51,300 ETH, worth $120 million, at press time.

Are whales moving away from ETH?

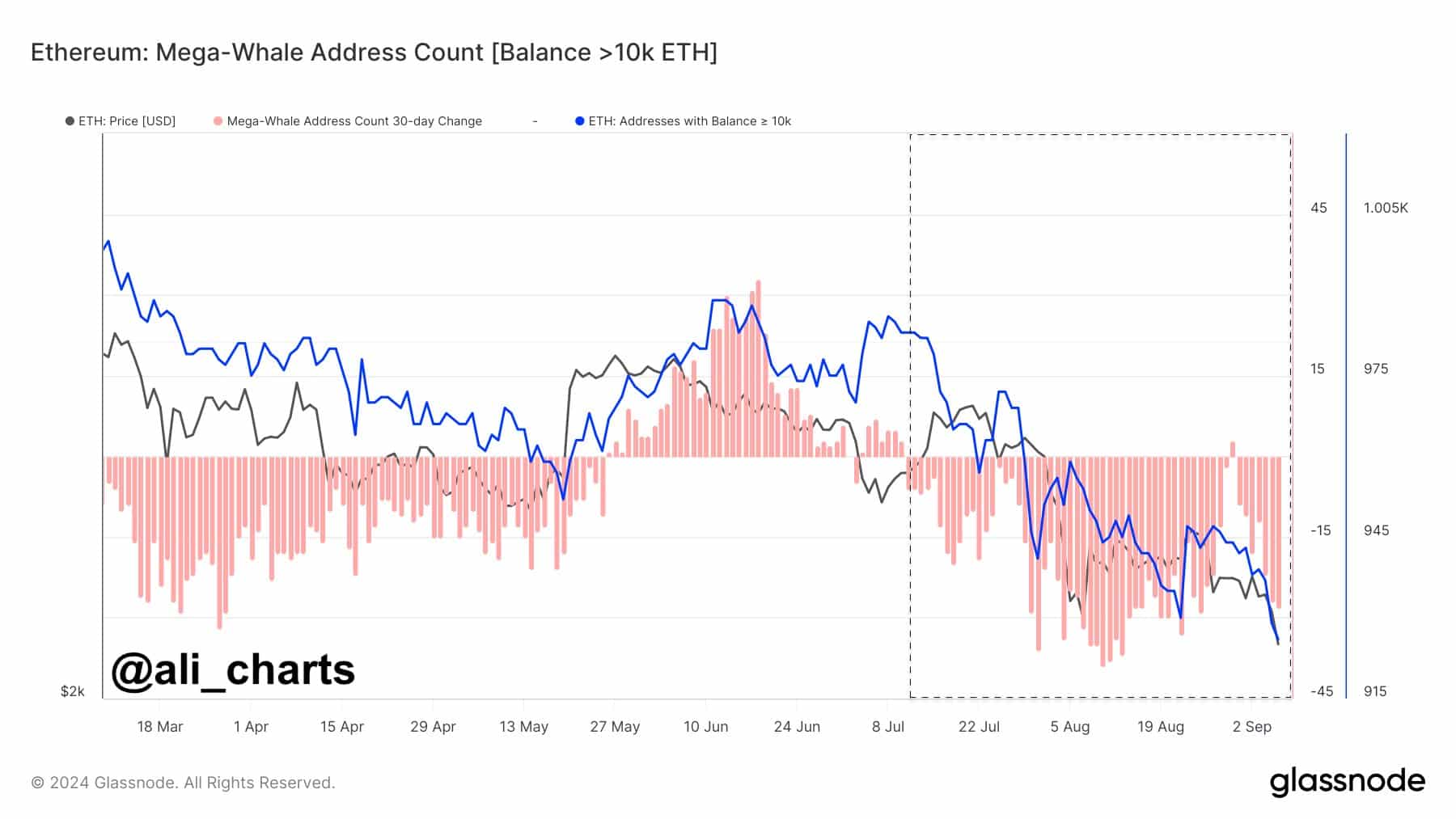

Recently, a prominent crypto expert made a post on X, stating that Ethereum whales have stopped accumulating ETH since early July. Instead, they have either been selling or redistributing their ETH holdings.

This indicates a lack of interest from investors and whales in the past few weeks.

However, if whales and institutions continue with significant ETH dumps, there is a high possibility that it could trigger a massive sell-off in the coming days.

Key levels to watch for

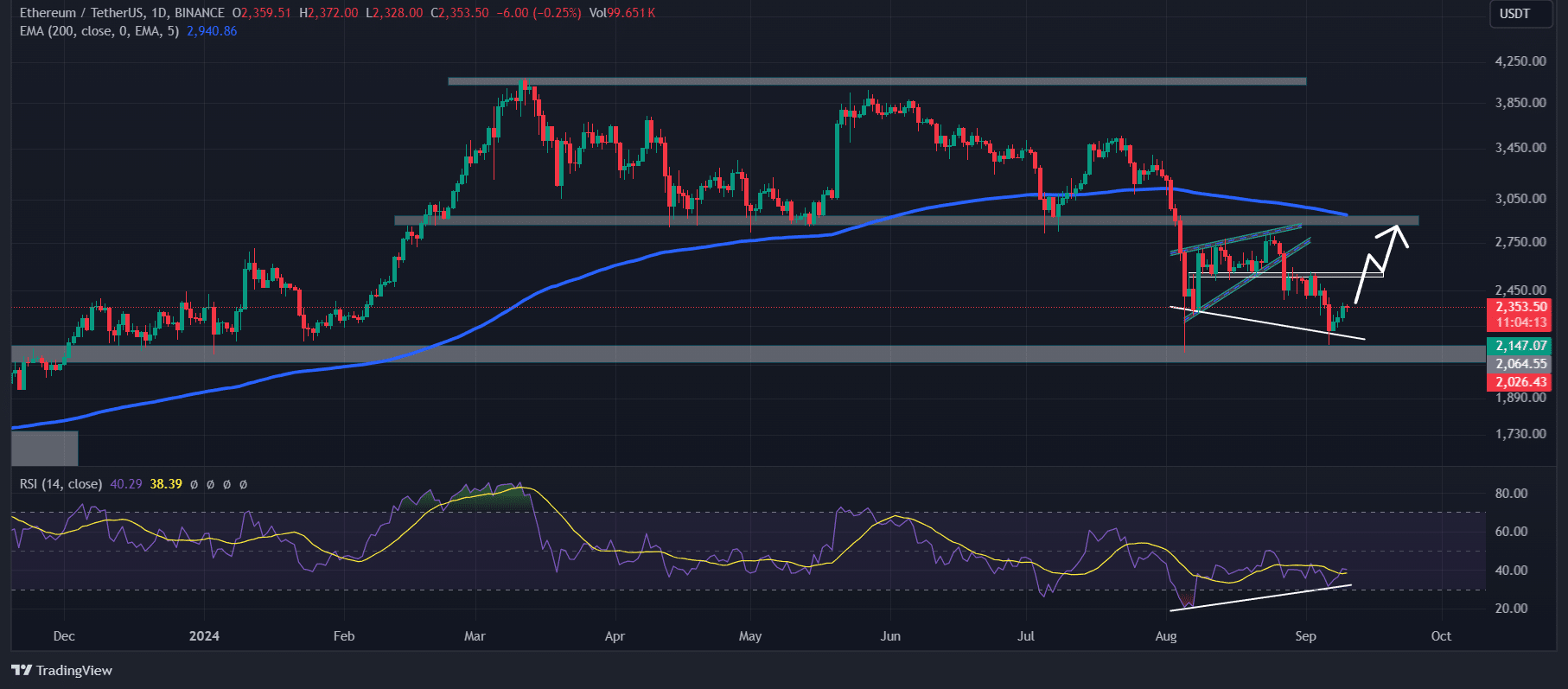

AMBCrypto’s look at Ethereum showed encouraging signs.

Notably, the king of altcoins may experience an upside rally due to the current bullish divergence on its Relative Strength Index (RSI). Additionally, it has found support at the crucial $2,150 level.

Based on the historical price momenta, whenever ETH’s price reaches this support level, it always tends to experience a massive price surge of over 23%. This time, there is a similar expectation is that ETH could soar to $2,700.

However, this bullish outlook thesis will only work until ETH maintains itself above the crucial support level of $2,150 level.

Bullish on-chain data

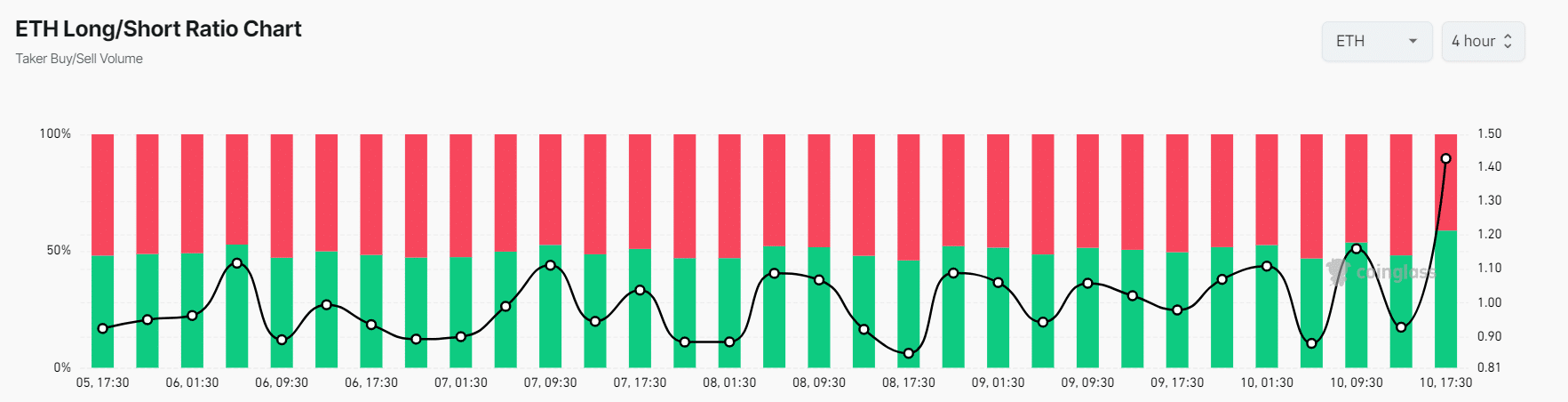

On-chain data also supported the bullish outlook. Coinglass’s ETH Long/Short Ratio Chart stood at +1.424 at press time, the highest level in the past week, indicating traders’ bullish sentiment.

Additionally, ETH’s Futures Open Interest increased by 2.5%, indicating that traders are potentially betting more on long positions.

A positive Long/Short Ratio and increased Open Interest signals potential buying opportunities. At press time, 58.75% of top ETH traders held long positions, while 41.25% held short positions.

This suggested that bulls were dominating the asset, and have the potential to liquidate short positions.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, ETH was trading near the $2,350 level, having experienced a price surge of over 2.35% in the last 24 hours.

Its trading volume increased by a modest 14% during the same period, suggesting higher participation from traders amid the market recovery.

[ad_2]

Source link