[ad_1]

- Ethereum’s price has fallen by nearly 9%, trading at $2,460 after peaking at $2,696 just a day earlier.

- Analysts are divided on ETH’s next move, with some predicting a potential rebound and others warning of further downside.

Ethereum [ETH] has mirrored Bitcoin’s [BTC] recent sharp decline, shedding nearly 9% of its value in the past 24 hours.

This downturn has pushed ETH’s price down to $2,460, a notable drop from the $2,696 peak seen just a day earlier.

This market performance has sparked a flurry of analysis and speculation among cryptocurrency experts, with varied opinions on what might come next for the second-largest cryptocurrency by market capitalization.

Major rebound or further downside next?

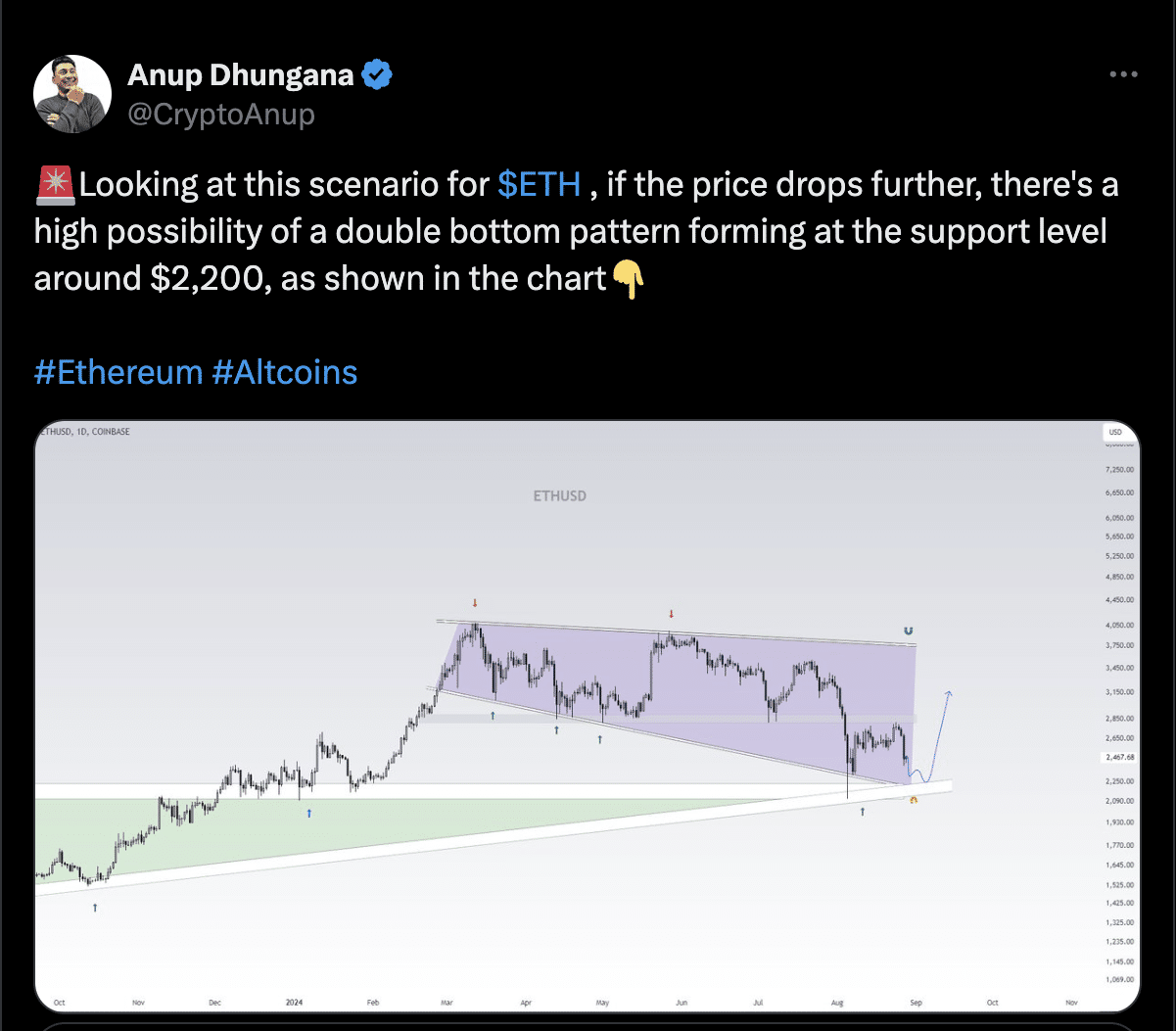

One prominent crypto analyst, Anup Dhungana, highlighted the potential for further downside in Ethereum’s price.

Dhungana suggested that if the current downturn continues, Ethereum could form a double bottom pattern at the $2,200 support level.

This pattern, often seen as a bullish reversal signal, would suggest that Ethereum might find a strong support level at this price before potentially rebounding.

However, this scenario is contingent on Ethereum not breaking through the $2,200 support, which could lead to further losses.

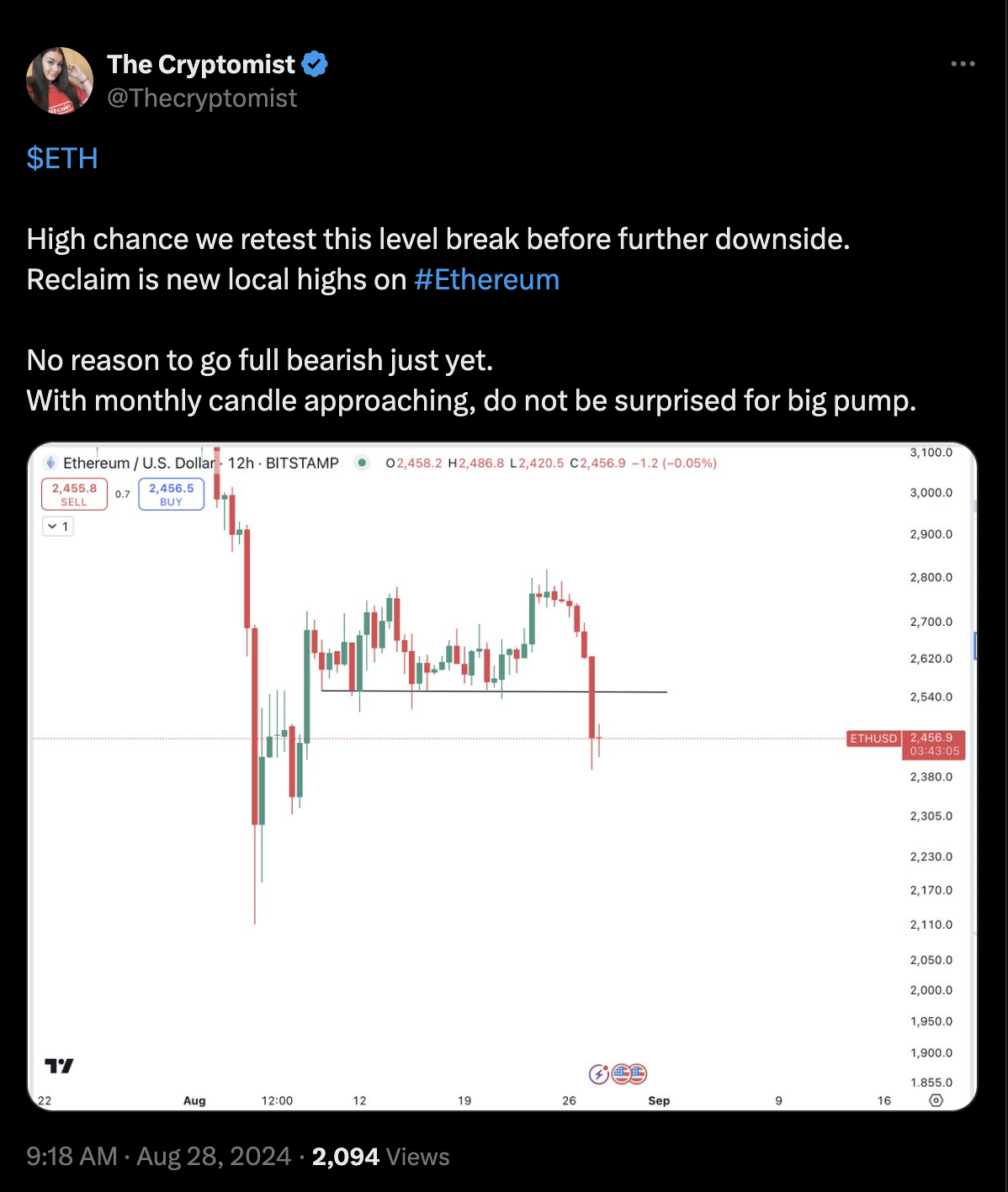

Another well-known analyst, known as ‘The Cryptomist’ on X (formerly Twitter), offered a different perspective, cautioning against turning overly bearish just yet.

The Cryptomist noted that while there was a high chance of Ethereum retesting its recent low, the upcoming monthly candle could bring about a significant pump in price.

This viewpoint suggests that Ethereum might experience a temporary rebound before any further declines, particularly as the market anticipates the close of the monthly trading period.

What do Ethereum’s fundamentals suggest?

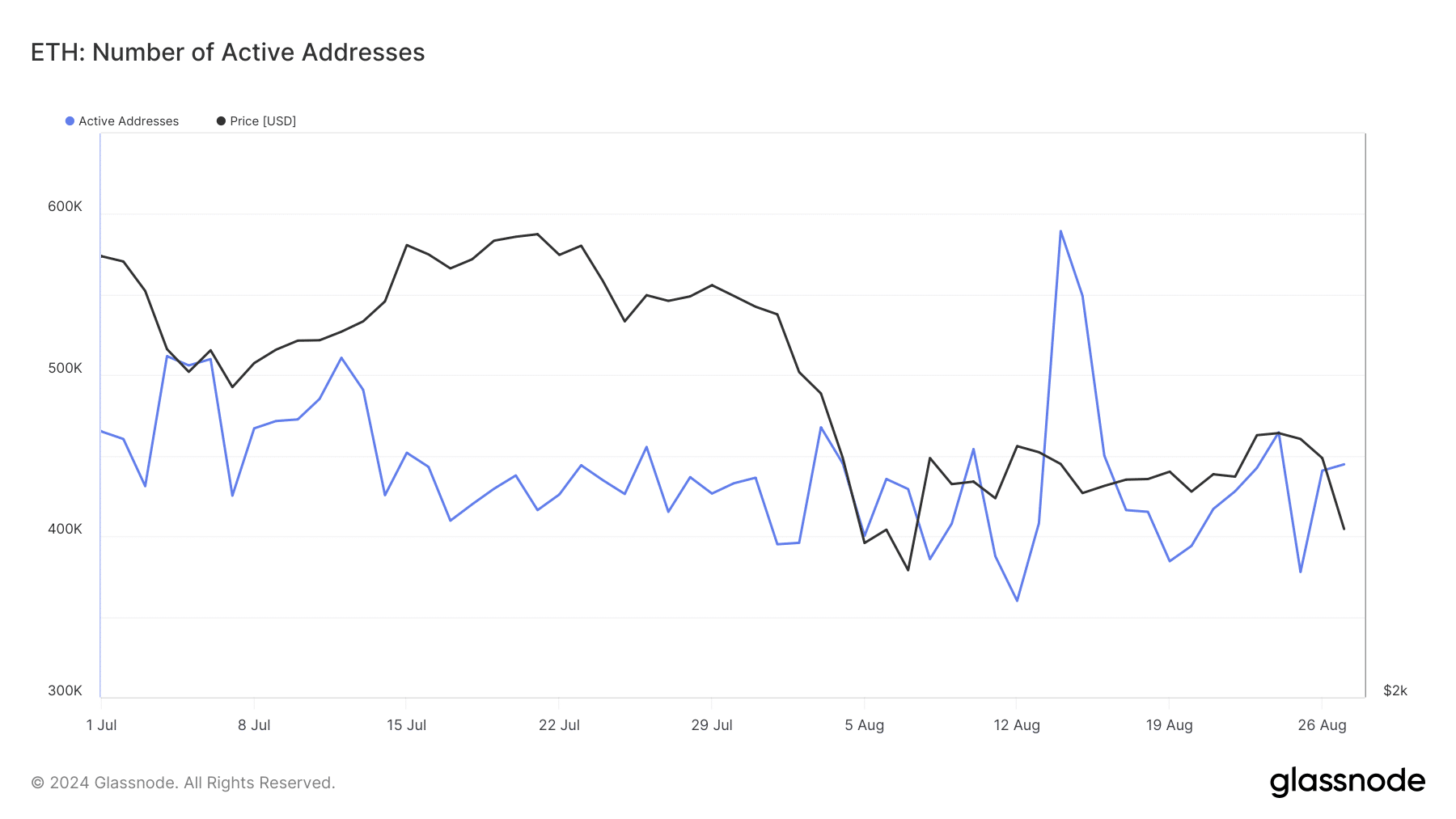

Beyond technical analysis, Ethereum’s fundamentals have shown mixed signals. According to data from Glassnode, Ethereum’s number of active addresses has fluctuated over the past month.

After a period of consolidation, this metric spiked to 589,000 on the 14th of August.

However, since then, the number of active addresses has gradually declined, sitting at 444,000 at press time.

This decrease in active addresses might indicate a weakening in network activity, which could exert downward pressure on Ethereum’s price as fewer participants are engaging with the network.

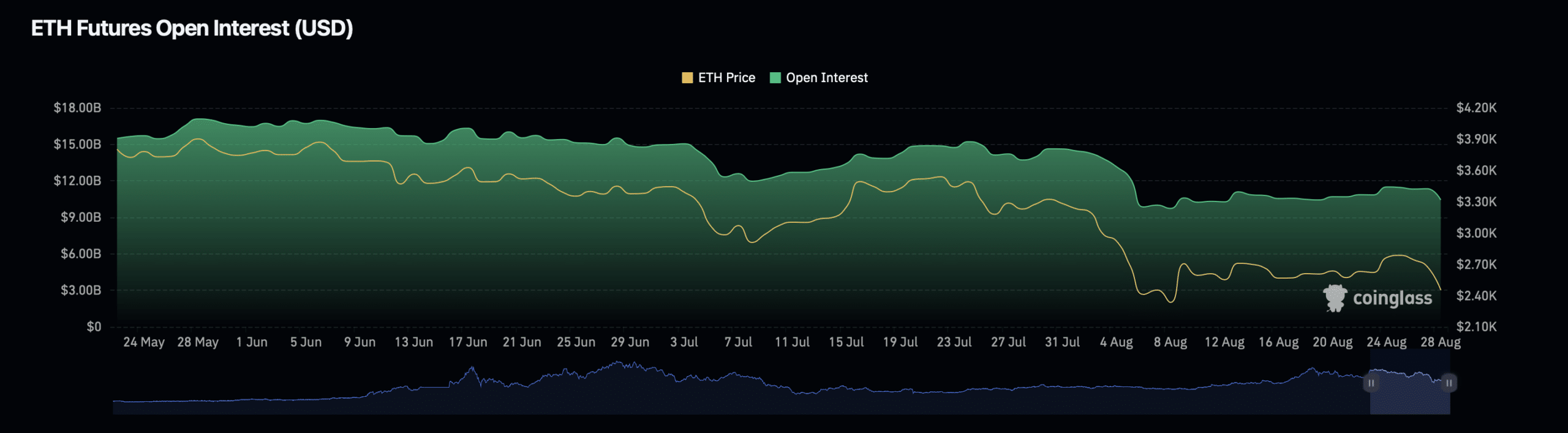

In contrast, Ethereum’s Open Interest data presented a more complex picture.

Coinglass’ data revealed that Ethereum’s Open Interest—a measure of the total number of outstanding derivative contracts on the asset—has decreased by 7.42% over the past day, bringing the press time valuation to $10.60 billion.

This decline in Open Interest typically suggests that traders are closing positions, potentially due to uncertainty or a lack of confidence in the short-term price direction.

However, Ethereum’s Open Interest volume has seen a significant increase, rising by over 100% to reach $38.97 billion.

Read Ethereum’s [ETH] Price Prediction 2024 – 2025

This surge in volume, despite the decrease in Open Interest, indicated a heightened level of trading activity, possibly driven by speculative moves in response to the recent price drop.

High trading volumes often lead to increased price volatility, meaning Ethereum could experience further sharp movements in the near term.

[ad_2]

Source link