[ad_1]

- Ethereum shows potential for a bullish reversal, with a rare daily bullish divergence and narrowing Bollinger Bands.

- Macroeconomic shifts and on-chain data could propel Ethereum’s price upward, despite recent bearish momentum.

Ethereum [ETH] was exhibiting signs of a price reversal at press time, with a bullish divergence emerging on the daily timeframe. This marks the first bullish divergence for ETH in over two years.

Michaël van de Poppe, a crypto analyst, recently noted,

“These are great signs on the markets, as $ETH has made its first bullish divergence in the daily timeframe in more than two years.”

However, he also posed the critical question:

“Will this be the actual reversal signal?”

Technical indicators signal possible price movement

Ethereum traded at $2,514.53 at press time, reflecting a 0.89% decline in the past 24 hours and a 4.94% drop over the last week. Despite this recent downturn, technical indicators are hinting at a potential shift.

The Bollinger Bands are narrowing, which often indicates that a significant price movement could be on the horizon.

ETH was trading below the middle Bollinger Band at press time, suggesting that the asset was still under bearish momentum.

The Moving Average Convergence Divergence (MACD) indicator showed that the MACD line remained below the signal line, with both trending in negative territory.

While this suggested ongoing bearish pressure, the histogram revealed a slight weakening, which could indicate the early stages of a possible reversal or consolidation.

At press time, the Relative Strength Index (RSI) was at 39.7, placing it in the oversold territory.

Thus, while selling pressure remains, there may be an opportunity for buyers to re-enter the market, potentially leading to a short-term bounce.

Macroeconomic influences

Macroeconomic factors could also play a crucial role in Ethereum’s potential price surge.

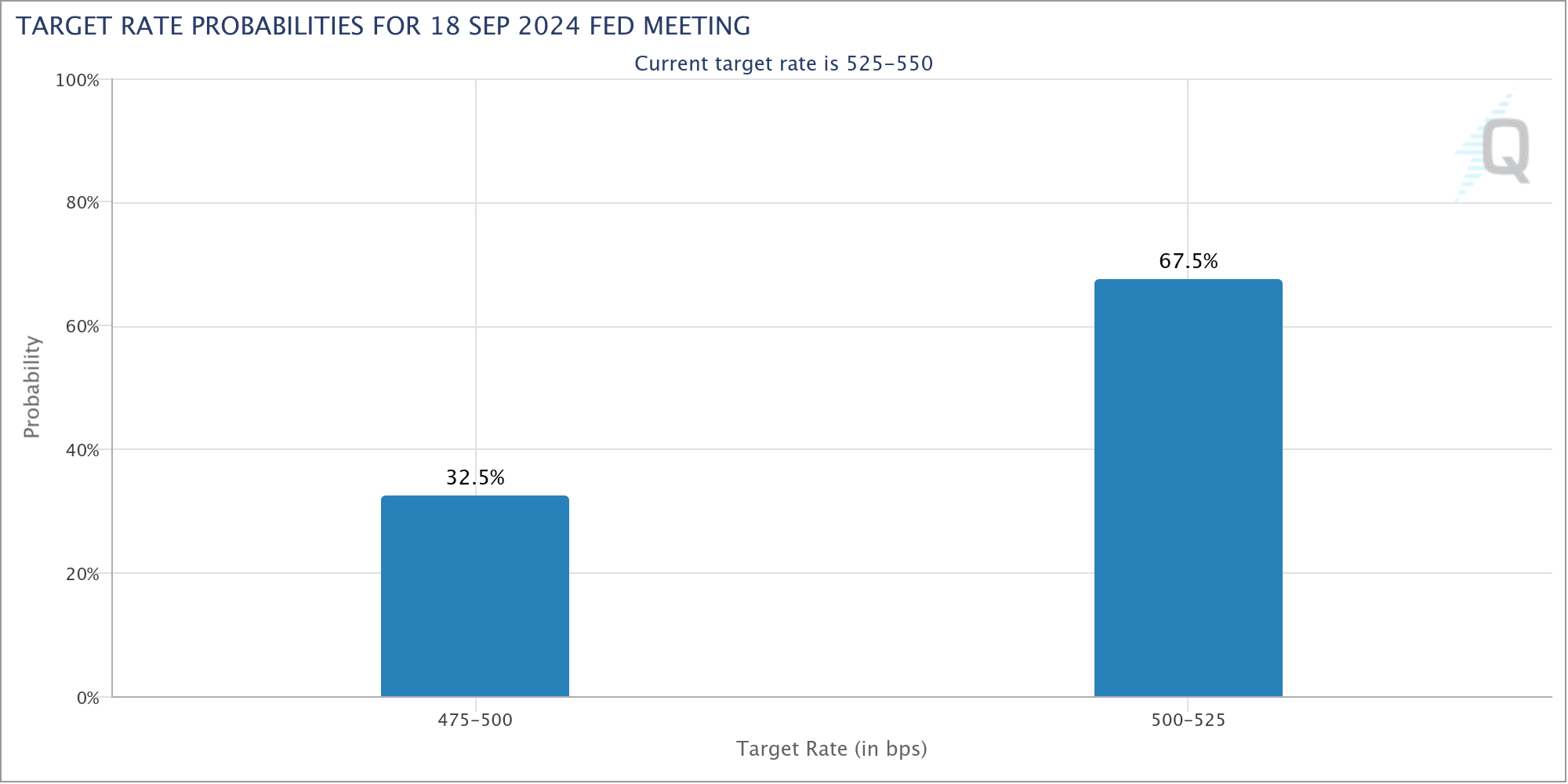

The Federal Reserve is expected to cut interest rates in September and possibly continue with further reductions, driven by slowing inflation and economic uncertainty.

A reduction in interest rates typically makes riskier assets like cryptocurrencies more attractive, as the appeal of safe-haven assets such as the U.S. dollar diminishes.

Historically, rate cuts have led to increased capital inflows into the crypto market, as investors seek higher returns in alternative assets.

Given Ethereum’s established ecosystem and its growing adoption, the crypto could be a prime beneficiary of this shift in investor sentiment.

A dovish stance from the Federal Reserve could weaken the U.S. dollar, providing further upward pressure on ETH’s price.

Ethereum’s growth prospects

On-chain data also supported a positive outlook for Ethereum. According to DefiLlama, the Total Value Locked (TVL) in Ethereum-based decentralized finance (DeFi) protocols was $46.966 billion at press time.

Additionally, the network saw a 24-hour transaction volume of $1.13 billion, with inflows of $2.44 million.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The number of active addresses in the last 24 hours was 390,291, alongside 64,793 new addresses, highlighting continued user engagement and network activity.

So, there is sustained interest in the Ethereum network, which could support the asset’s price in the coming months.

[ad_2]

Source link