[ad_1]

- Ethereum showed signs of recovery after testing the $2,400 zone and surged by 4%, outpacing Bitcoin.

- Does this mean the altcoin could challenge BTC’s dominance?

Ethereum [ETH] showed signs of strength, outpacing Bitcoin with a gain of over 4% in the last 24 hours.

Historically, a bullish divergence between Ethereum and Bitcoin has been a strong indicator of a price trend reversal for ETH.

Put simply, such divergences have frequently led to significant surges in Ethereum’s price, with ETH often outperforming Bitcoin during market volatility.

So, is history repeating itself? AMBCrypto investigates.

History shows ETH outperforms in September

AMBCrypto’s analysis of the ETH/BTC weekly chart revealed that Ethereum experienced significant rallies in September 2016 and 2019, peaking around mid-September.

Coincidentally, this year, the Federal Reserve is set to cut interest rates on the 18th of September.

Given these past patterns, the timing of the Fed’s rate cut might be more than just coincidence.

Historical data suggests that ETH often performs well around this time of year, and a rate cut could provide additional market momentum, potentially causing the price to reach the $2,800 resistance level.

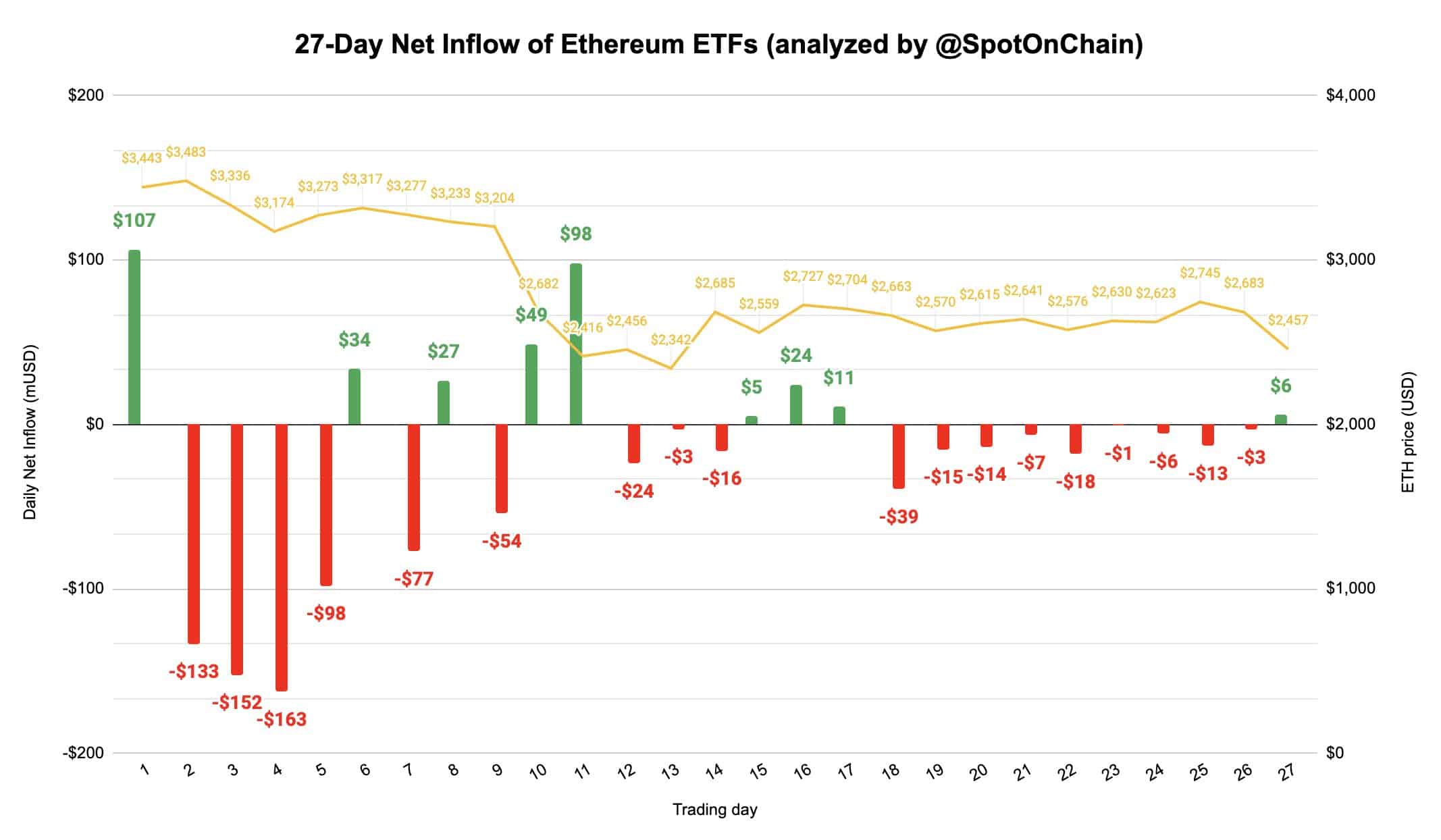

Adding to the optimism, ETH’s net inflow yesterday ended a 9-day outflow streak. Additionally, BlackRock’s ETHA saw an inflow of $8.4M after 5 trading days with zero net flows.

Compared to this, data showed that BTC’s net flow remained strongly negative for the second day.

Additionally, no U.S. Bitcoin ETFs saw an inflow yesterday, and Grayscale Mini (BTC) recorded its first-ever outflow.

In short, this comparison reveals a stark contrast in market sentiment between ETH and BTC.

While Bitcoin struggles to break above the $60K resistance, Ethereum has surged approximately 4% since yesterday.

However, AMBCrypto notes that to solidify this thesis, on-chain data must align with Ethereum’s dominance. So, does it?

Ethereum remains inferior in dominance

At the moment, Ethereum has shown signs of recovery after testing the $2,400 zone. Analysts believe that ETH needs to break through the $2,600 resistance levels for a potential rebound.

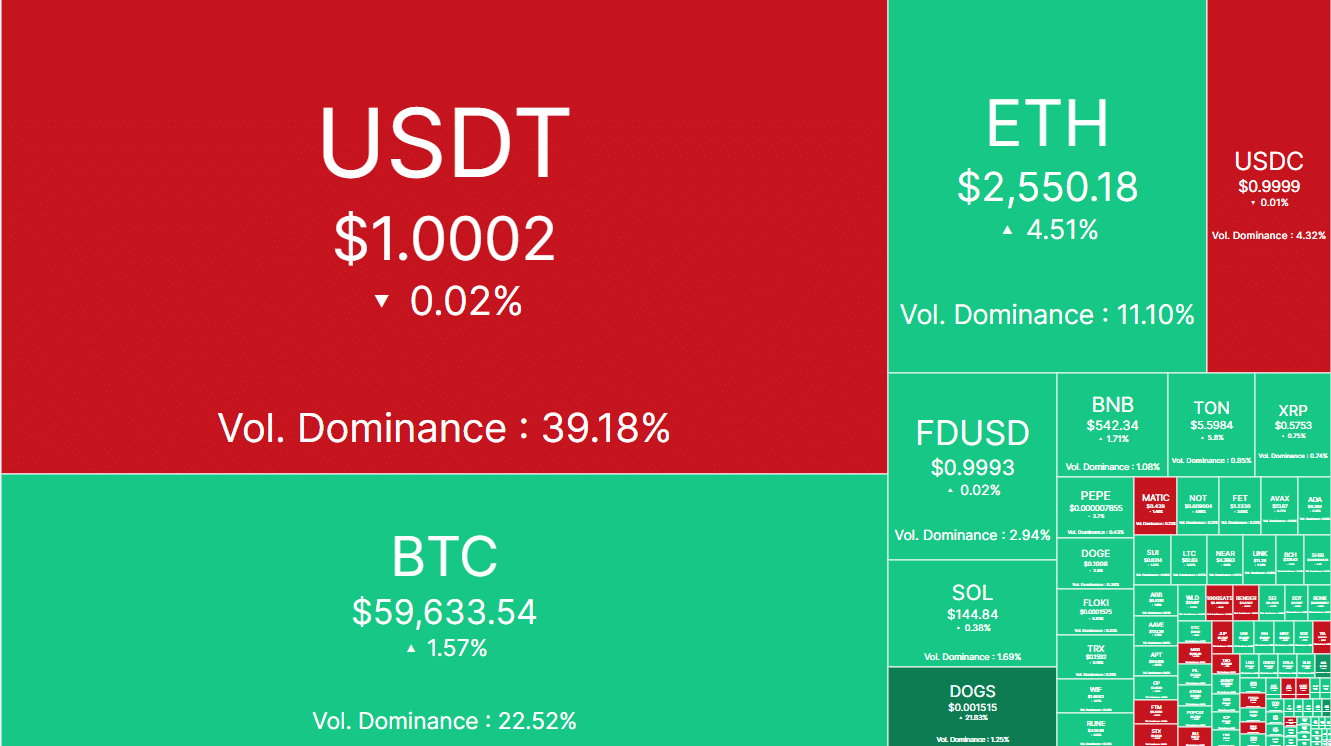

At press time, the altcoin was trading at $2,550. Despite this, ETH trails behind BTC in volume dominance.

A higher volume dominance for Bitcoin suggests it is more actively traded and has greater liquidity in the market. Consequently, despite periods of bearish downturn, Bitcoin tends to rebound more reliably.

Read Ethereum (ETH) Price Prediction 2024-25

In contrast, Ethereum’s chances of recovery are more dependent on Bitcoin’s performance.

In other words, ETH market sentiment is influenced by BTC’s overall performance. If Bitcoin declines, Ethereum is likely to follow suit, reinforcing BTC’s dominance over its counterpart.

[ad_2]

Source link