[ad_1]

- Ethereum worth over $35M moved to exchanges by institutions.

- Market indicators are still bullish on ETH.

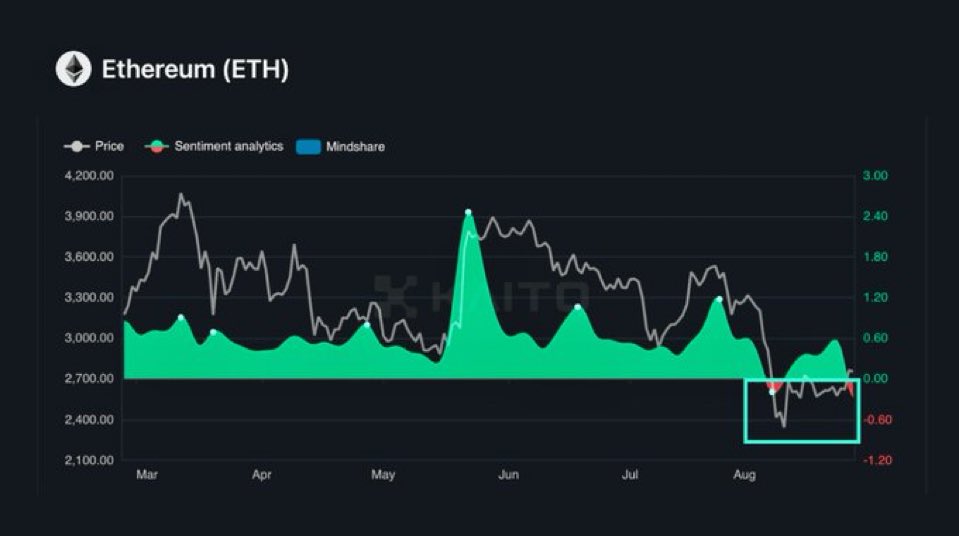

Ethereum [ETH], the second most popular cryptocurrency, has experienced significant fluctuations recently, partly due to a large movement of ETH by institutions to exchanges.

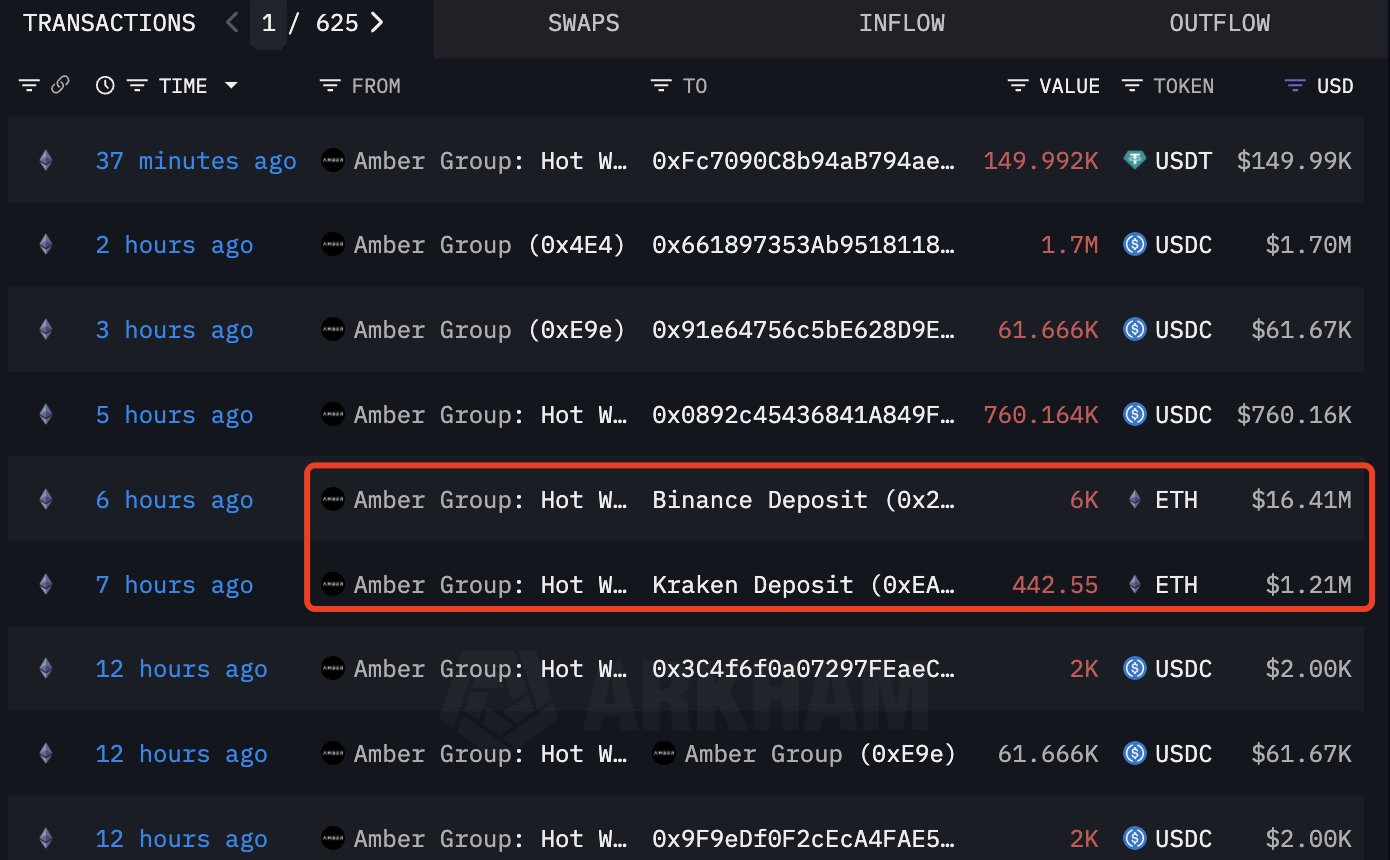

Over the past 24 hours, major players like Amber Group and Cumberland have deposited large amounts of ETH—6,443 and 6,439 ETH respectively—to exchanges that is Binance and Kraken.

This influx has raised concerns about the impact on Ethereum’s price, which has seen both upward and downward movement in response.

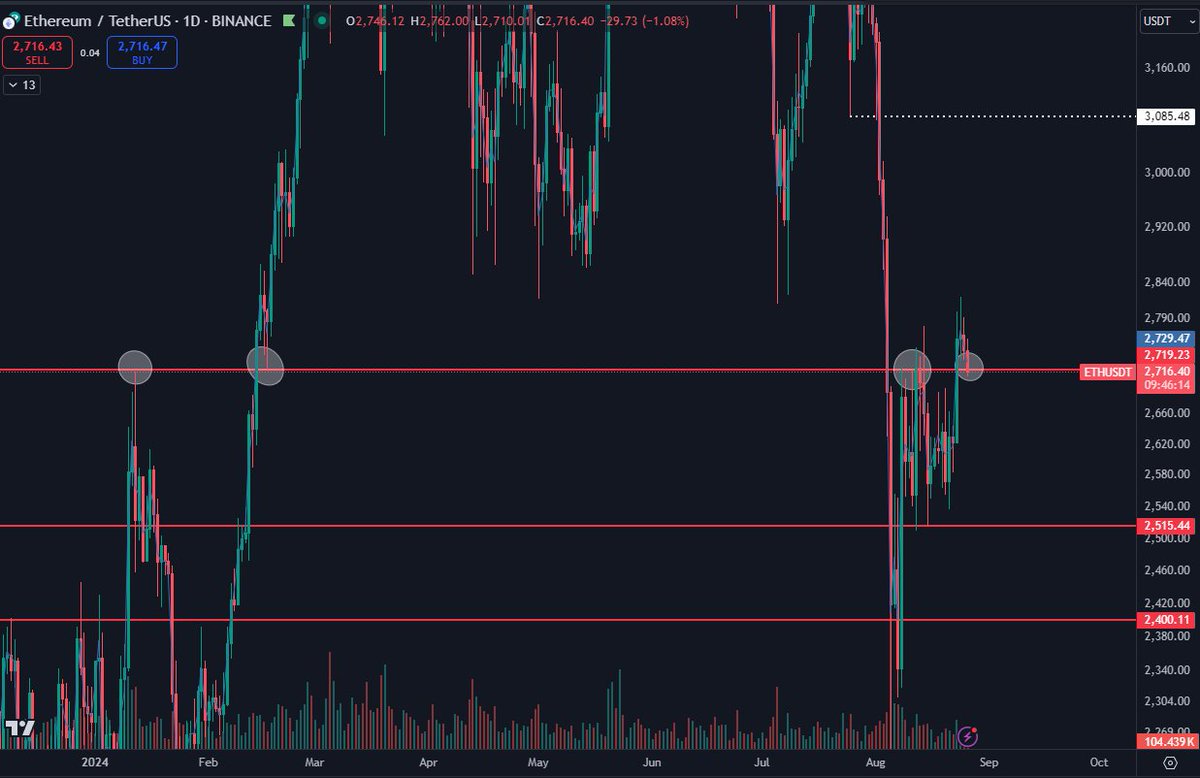

Price action of ETH/USDT

Currently, Ethereum’s key support level on the daily chart is around $2,720. This level has proven to be critical this year, and its ability to hold could pave the way for ETH to target the $3,000 region.

However, if this support fails, ETH might drop to the next significant level at $2,500.

Despite recent declines, the $3,085 level is within reach, particularly if ETH can recover from its recent losses and close the gap caused by five consecutive down days.

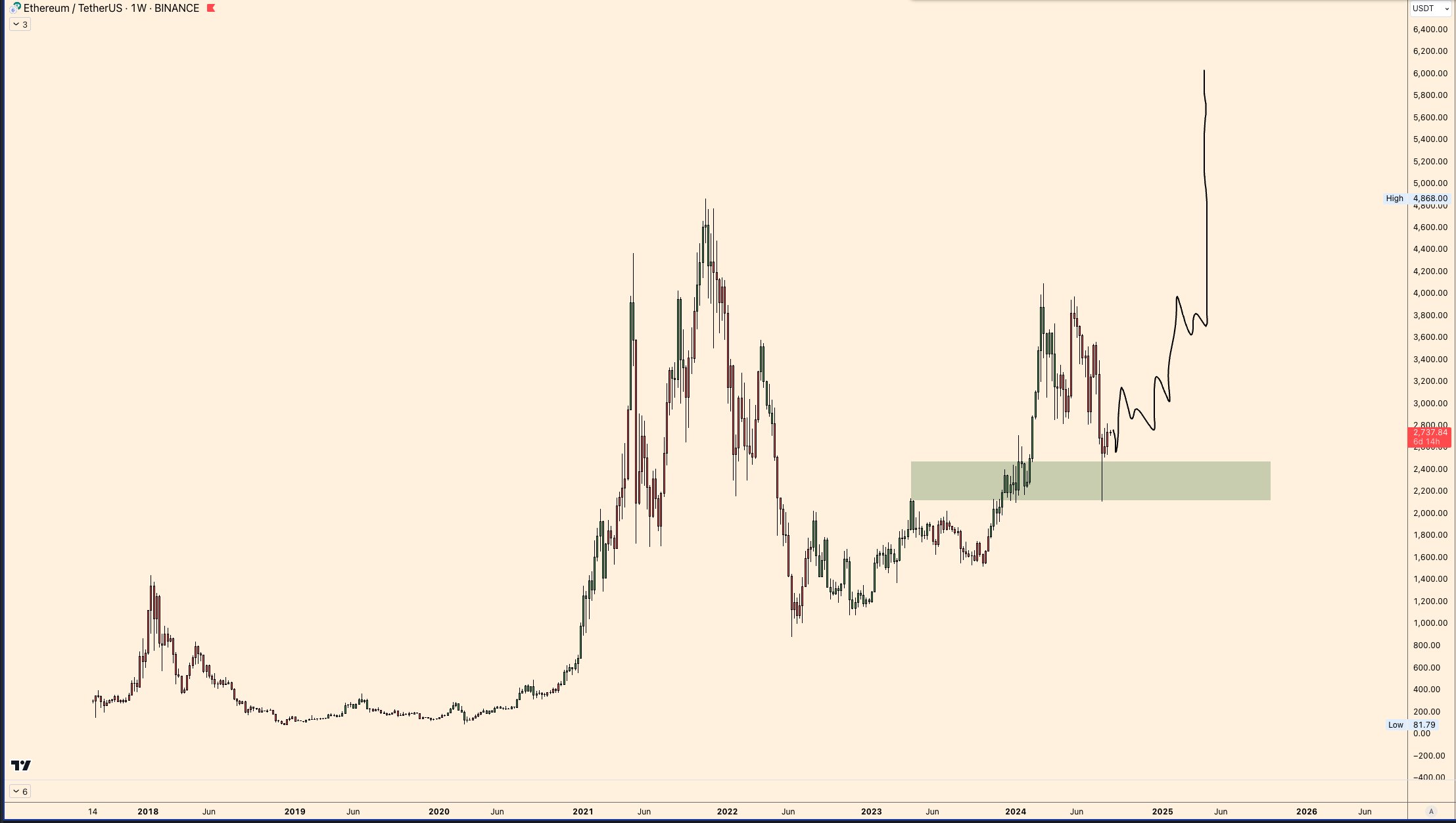

The weekly timeframe has also retested the breaker area, suggesting a strong potential for an ETH bottom. Patience over the next 10 days will be crucial to confirm the expected upward price movement.

Incoming altcoins dominance

Ethereum also stands to benefit from a potential resurgence in altcoin dominance. Historically, altcoins have seen significant rallies following periods of support at key levels, and ETH, as a leading altcoin, is poised to capitalize on this trend.

Source: TradingView

Market cycles suggest that altcoins, including Ethereum, could experience a major bull run in the next 6-9 months, providing further upward momentum.

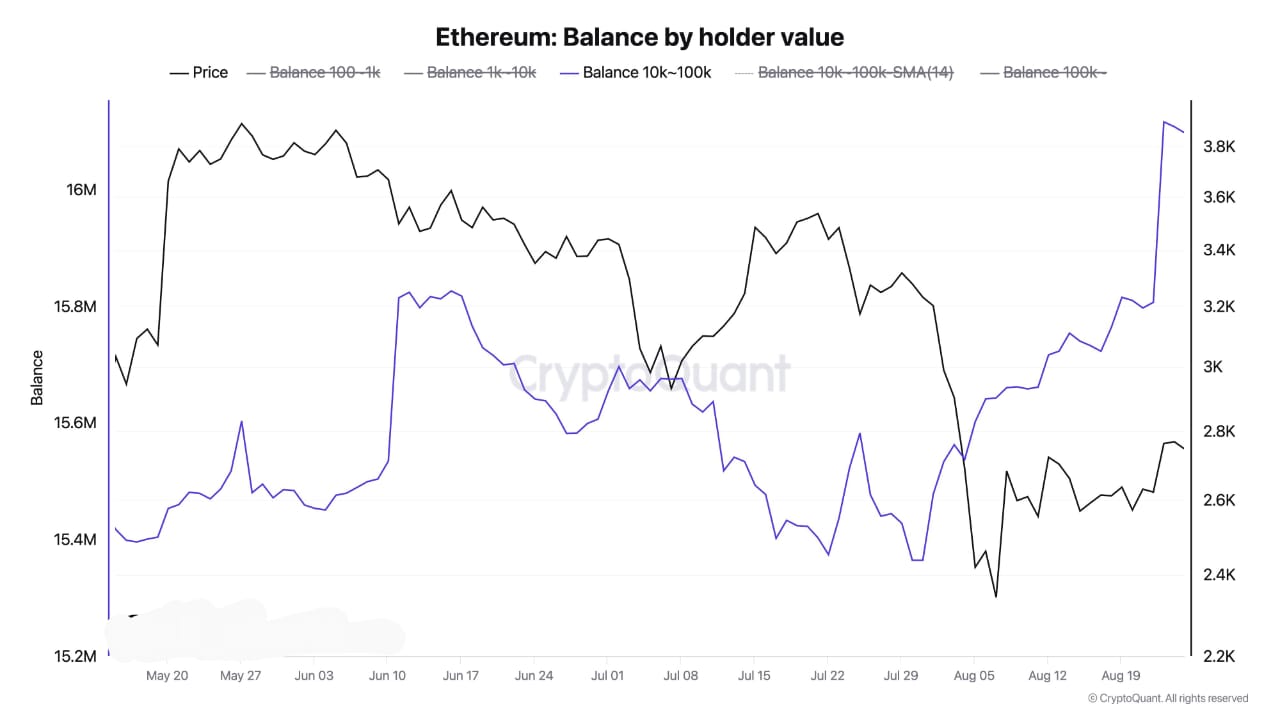

Increasing whale activity

Whale activity offers another bullish indicator for Ethereum. Despite the institutions move, whales have been accumulating ETH, with over 200,000 ETH added to their holdings in the past three days alone.

This accumulation suggests confidence in Ethereum’s long-term prospects and could counterbalance the short-term selling pressure from institutions.

Perfect setup for breakout

Additionally, Ethereum’s fundamentals remain strong, despite low market sentiment. The growing adoption of L 2 solutions and the increasing interest from whales alike make ETH well-positioned for a breakout.

Read Ethereum (ETH) Price Prediction 2024-25

The combination of strong fundamentals, significant whale accumulation, and the potential for a broader altcoin rally creates a perfect setup for Ethereum to move higher in the near future.

While the recent sell-off by institutions has created some short-term uncertainty, the underlying factors suggest that Ethereum’s price is poised to move higher, potentially breaking out as market conditions improve.

[ad_2]

Source link