[ad_1]

Crypto whales are positioning themselves for the next market expansion in altcoins, according to the CEO of CryptoQuant.

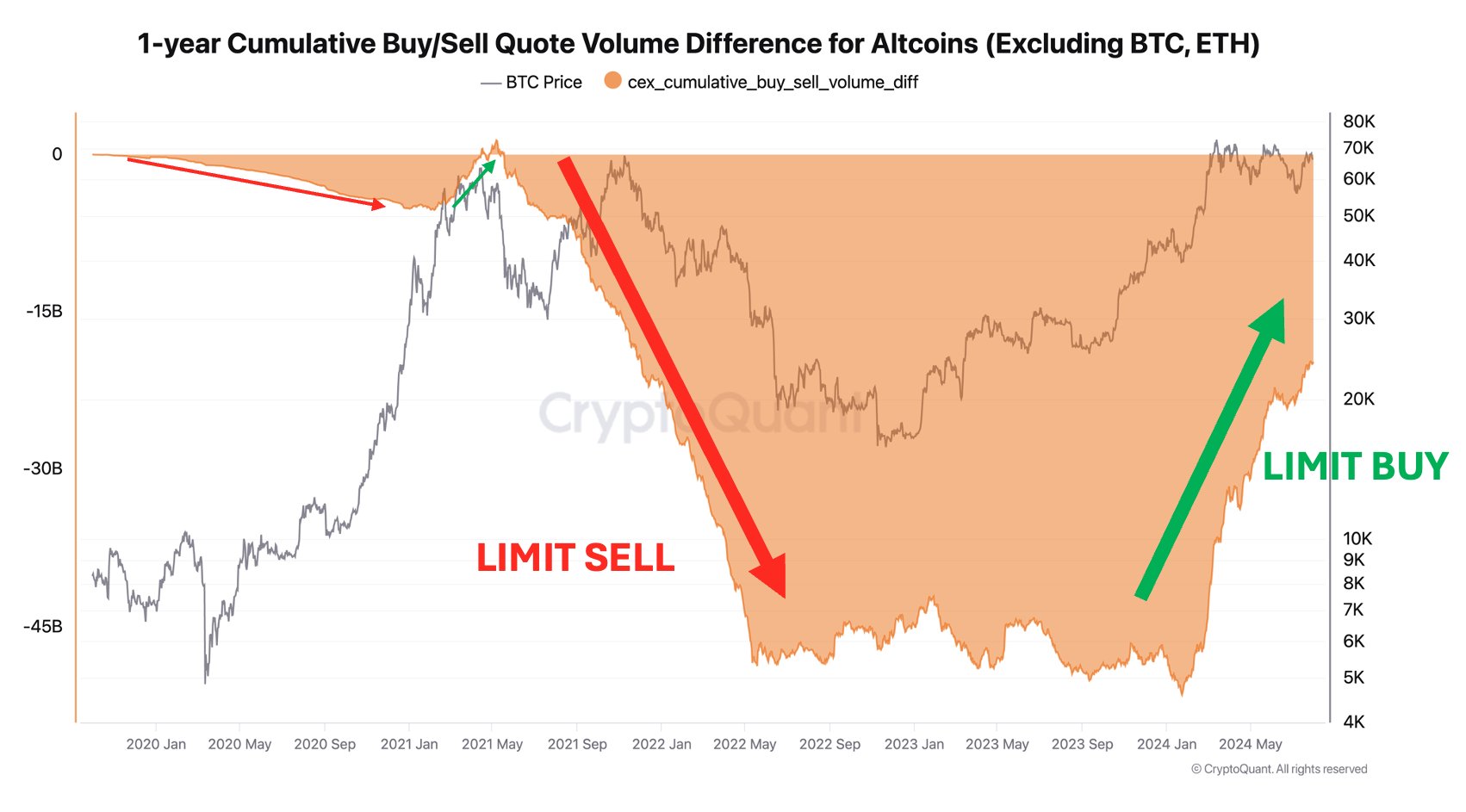

Ki Young Ju tells his 358,000 followers on the social media platform X that whales are now setting up limit orders for altcoins on centralized exchanges (CEXes).

Ju explains whales, institutions, and other large entities prefer using limit orders – as opposed to market orders – to avoid slippage and to get the best possible price.

A limit order is used to buy an asset at a pre-determined price. It will not push through until the asset reaches the desired level. Meanwhile, a market order is used to buy or sell an asset instantly at current prices.

Ju notes that keeping an eye on the volume of limit order quotes can be an indicator of rising buy walls on the market.

“Whales are preparing for the next altcoin rally.

Limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being set up.”

Ju says time will start to run out for market participants looking for altcoin discounts once Bitcoin (BTC) breaks its all-time high (ATH).

“Buy walls are forming for altcoins with both stablecoin and Bitcoin pairs, but volumes are still low.

If alt season means a surge in volume, it’s not here yet.

Now’s the time to research promising alts for the next bull run – time might be short once Bitcoin hits a new ATH.”

According to Ju, Bitcoin’s current state is reminiscent of mid-2020 when it was trading in a sideways manner, void of any retail-driven euphoria.

“Bitcoin data resembles mid-2020 sideways.

Older whales transfer holdings to newer whales on-chain, but retail investors haven’t overheated the market yet. No significant price surge post-halving.

In my experience, bull runs are short but powerful and sudden. Patience is key.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

[ad_2]

Source link