[ad_1]

- Are we set to see a demand resurgence for ETH from Ethereum ETFs?

- Sell pressure slows down but weak demand may fuel directional uncertainty.

Ethereum [ETH] ETFs were off to a rocky, yet unsurprising start, with noteworthy outflows registered in the first few days. Conversely, new data indicates that the tides might be about to change.

New reports indicate that Ethereum ETFs just registered their first positive net flows in the last 24 hours. This is the first time that positive flows have been recorded in the last nine days.

Prior to that, the ETF outflows coincided with the sell pressure that prevailed in ETH’s price action since the approvals. Could this new shift pave the way for recovery?

The positive Ethereum ETFs flows alone may not necessarily support a bullish outcome. The cryptocurrency has been experiencing some bullish relief in the last five days of July.

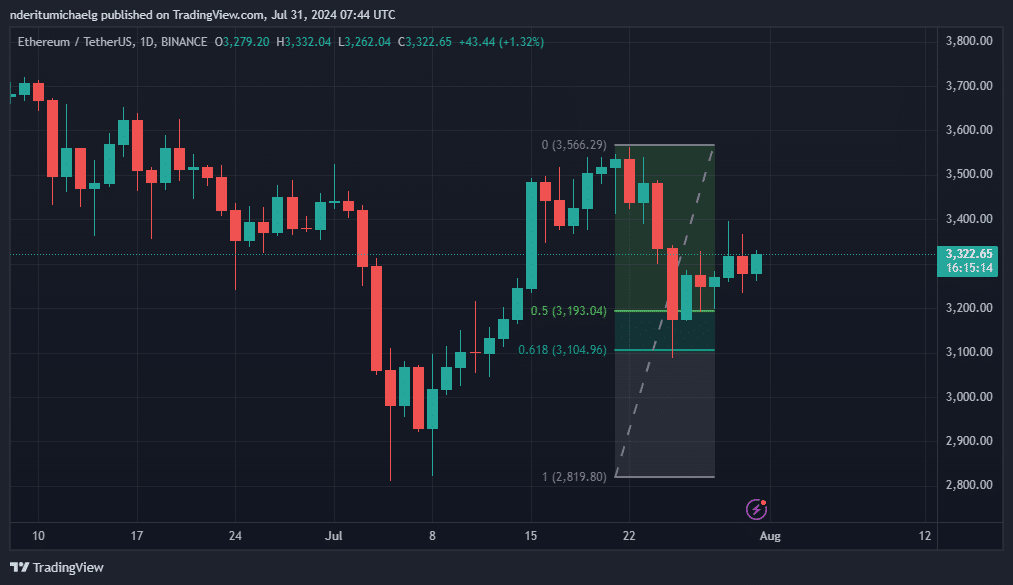

One possible reason could be re-accumulation at key Fibonacci retracement levels. ETH’s latest retracement found a resurgence of demand between the 0.5 and the 0.618 Fibonacci levels.

The observed net positive inflows in Ethereum ETHs could support more upside if sustained buying takes place. However, this is not the only factor that is influencing ETH price action.

ETH’s bullish relief could also be fueled by more optimism as the 20-day Moving Average indicator crosses above the 50-day MA. This crossing is often translated as a bullish sign.

Market data may also have an impact. FOMC data and FED announcement regarding interest rates are expected to have a significant impact in the level of demand in the market. For example, the market anticipates rate cuts sometimes soon and if that happens, it could improve investor sentiment in favor of the bulls.

Assessing Ethereum ETFs influence on ETH’s on-chain data

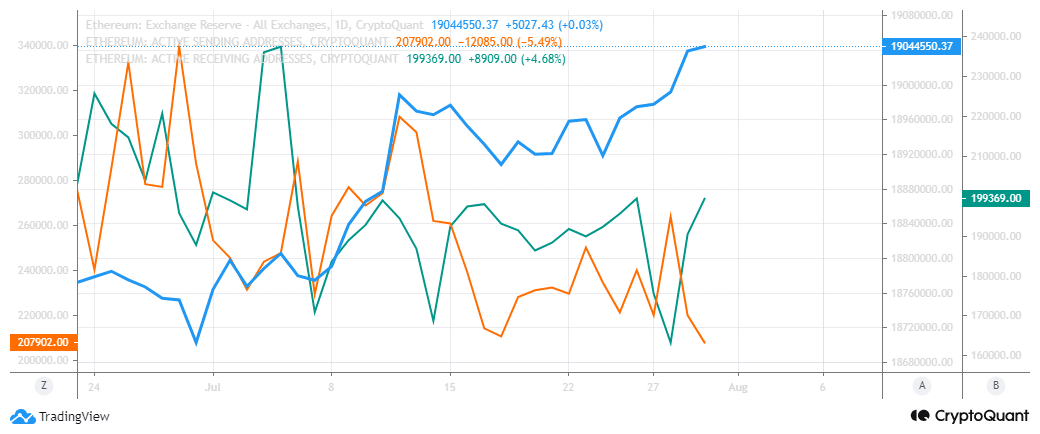

We explored Ethereum’s onchain data to determine the current state of demand. Exchange reserves grew by 341,374 ETH in the last four weeks, which may explain why its bulls have struggled during the same period.

There has also been an overall decline in active addresses.

We observed a surge in active receiving addresses from 28 July and a dip in active sending addresses during the same period. This observation could signal a demand resurgence.

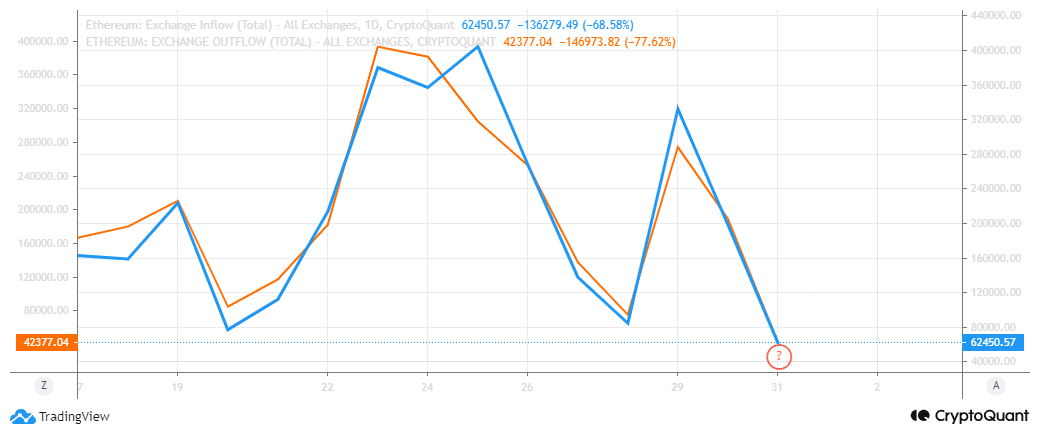

However, exchange reserves are still at a monthly high, hence demand is weak. Exchange flows collaborate this observation.

ETH exchange inflows have dipped over the last five days, explaining the sell pressure slowdown. However, we also observed a similar slowdown in exchange outflows.

Read Ethereum (ETH) Price Prediction 2024-25

One possible reason behind the above observation could be that the market is fearful. Post-ETF approval sell pressure may yet push prices lower and investors are waiting for clear conformation of bearish exhaustion.

Resurgence of strong demand for Ethereum ETFs and an exchange reserve pivot would provide strong confirmation.

[ad_2]

Source link