[ad_1]

- Grayscale’s ETHE saw $1.51 billion outflows in the first week of trading

- Coinbase analysts believe outflows could ease after two weeks

Ethereum’s [ETH] price depreciated by over 7% due to a massive exodus of investors from Grayscale’s ETHE. Shortly after U.S spot ETH ETFs began trading, Grayscale saw weekly outflows totaling $1.51 billion, pushing ETH to $3k from $3.5k.

However, at press time, the world’s largest altcoin had bounced back above $3.2k. Hence, the question – Can extra Grayscale outflows still subdue ETH’s price into the new week?

When will Grayscale outflows ease?

Well, on the bright side, Coinbase analysts believe that relief from the ETHE bleedout could happen after next week. Comparing GBTC and ETHE’s outflows, they noted,

“On its first two trading days, ETHE saw outflows of -$484M and -$327M respectively. In contrast, GBTC saw outflows of -$95M and -$484M, while having nearly three times the AUM ($28B vs $8.6B).”

The analysts, David Duong and David Han, added that the heavy outflows from ETHE mean that the trend could be ‘short-lived,’ compared to GBTC’s three-month-long outflow streak.

If ETHE follows the GBTC trend, as per Duong and Han, then it could see its first net inflows when its AUM (assets under management) drops by 53%.

“If ETH price remains constant and ETHE outflows continue to average $400M, ETHE would reach 53% of its July 24 AUM in approximately two weeks due to its smaller size.”

On Friday, ETHE saw more outflows worth $356 million, bringing total weekly outflows to $1.51 billion.

To put it simply, the aforementioned projection means that Grayscale’s bleeding could ease after next week.

By extension, that means the ETH ETF could repeat the U.S spot BTC ETF’s playbook. In fact, according to some market observers, ETH could bounce back with a potential 90% rally to $6.5k in such a scenario.

Mixed views from QCP Capital analysts

However, QCP Capital analysts aren’t as bullish on ETH as they were before the spot ETF launch. According to him, the lack of a staking feature makes the ETF products less interesting to investors.

On Grayscale’s outflows, QCP Capital analysts blamed its hefty 2.5% fee charges as the reason for the outflows. Even Grayscale’s Mini ETF version hasn’t helped ease the bleed out as some initially expected.

As a result, the ETH ETF has turned out to be a ‘buy the hype, sell the news’ event.

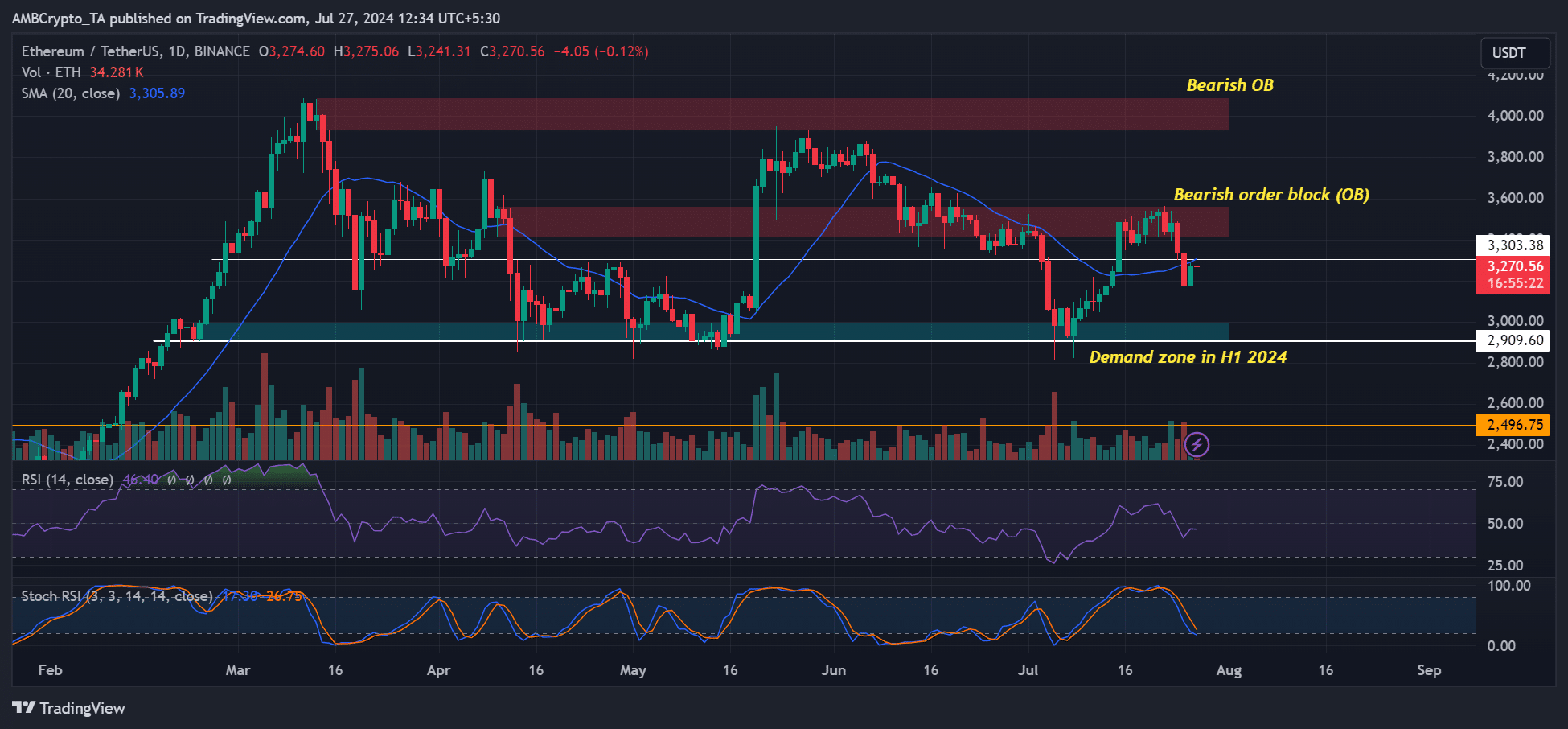

Meanwhile, ETH could be closer to a price reversal, as denoted by the Stochastic RSI (Relative Strength Index), easing into oversold territory.

However, the RSI’s recent dip below the average indicated that a convincing rebound could be delayed. If so, a retest of $3.0k can’t be overruled before ETH bulls attempt to rebound to clear the overhead resistance levels at $3.5k and $4k.

[ad_2]

Source link