[ad_1]

- ETH short-term holders see profit.

- ETH has broken resistance for the first time in weeks.

Ethereum [ETH] has been highlighted as one of the standout performers over the past week, with its market capitalization increasing by over 14%.

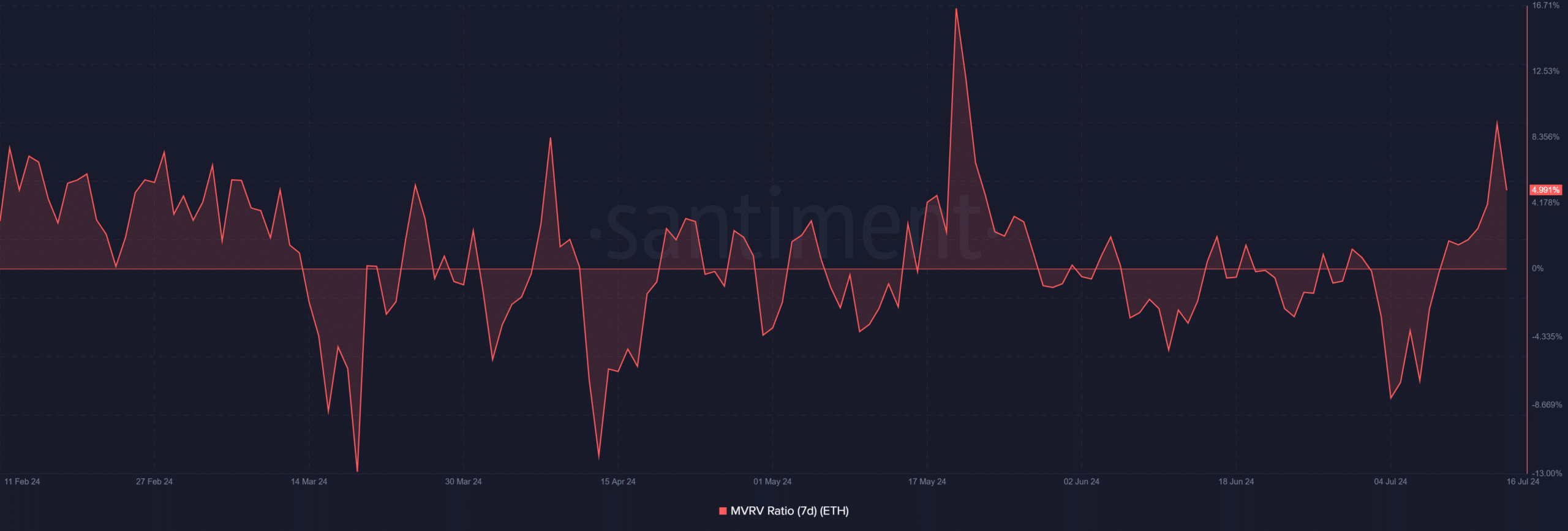

Additionally, the seven-day Market Value to Realized Value (MVRV) ratio indicated that buyers who entered the market during this period now hold their investments profitably.

Ethereum shows attractive trends

Analysis of data from Santiment indicated that investors who purchased Ethereum during its recent dip are now seeing substantial returns. The data revealed that ETH and several other assets experienced a significant increase in market capitalization.

Specifically, ETH’s market cap grew by over 14%, enhancing its value for holders. This increase underscored the profitability for those who bought in at lower prices.

It also highlights its attractiveness as an investment during volatile market phases.

How ETH trended

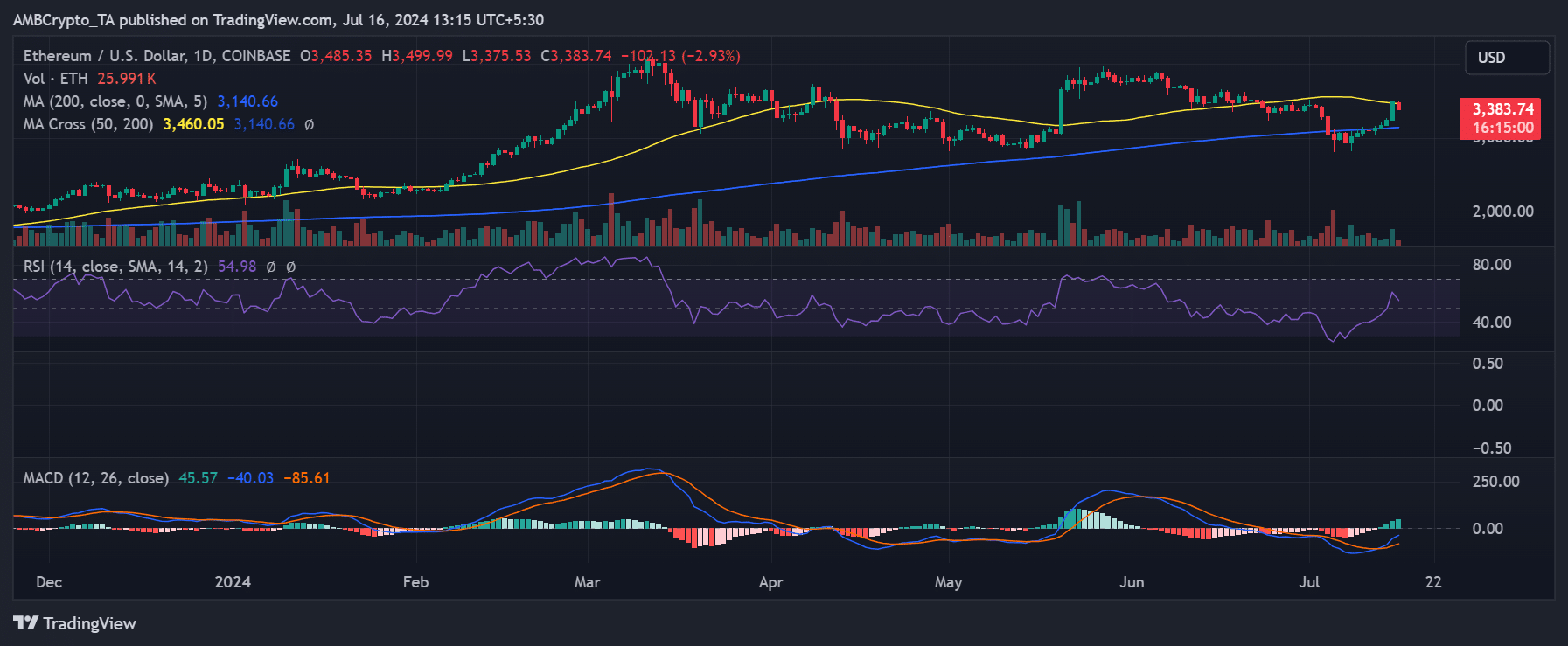

Analysis of Ethereum on a daily timeframe, as reported by AMBCrypto, showed a marked uptrend on 15th July.

The price of ETH increased by 8%, moving from approximately $3,246 to close at around $3,485. This surge pushed its price just above its short-moving average (yellow line), which had previously acted as a resistance level.

The breakthrough above this short-moving average is significant as it indicates Ethereum was able to overcome immediate resistance, suggesting a potential for further gains.

However, as of the latest observations, it was trading with a nearly 3% decline at around $3,380.

Although it remained slightly above the yellow line, a continued decline could push it back below this pivotal resistance-turned-support level. The ongoing trading activity near this critical juncture will determine its short-term price trajectory.

Short-term holders see profit

The analysis of Ethereum’s seven-day Market Value to Realized Value (MVRV) ratio indicated that short-term holders are realizing significant profits.

According to the data from Santiment, the MVRV ratio was around 5.6% as of this writing. This ratio, however, has seen a decline from over 9% noted on 15th July, coinciding with a downturn in ETH’s price.

Despite this recent decline, the MVRV ratio remained profitable for holders. This indicates that those who invested more recently are still profiting even with the price pullback.

Read Ethereum (ETH) Price Prediction 2024-25

The MVRV ratio initially moved into the profit zone around 9th July and continued to rise until the recent drop. This movement suggests a generally bullish sentiment among recent buyers.

However, the current downturn warrants monitoring to gauge the potential for sustained profitability or further corrections.

[ad_2]

Source link