[ad_1]

- Sentiment appeared bullish ahead of the ETH ETF launch, with 40% of the total Ethereum supply now locked.

- Bulls have kept bears at bay, suggesting that ETH might inch toward $3,500.

On the 11th of July, an unknown market participant transferred 6,400 Ethereum [ETH] to the Beacon depositor wallet. The Beacon Chain is the system responsible for validating new blocks on the Ethereum network.

Therefore, sending coins to this wallet implies that holders would rather lock the supply than engage in trading them.

Locking a lot of coins could reduce selling pressure, and in ETH’s case, it could prevent it from declining below $3,000.

ETH supply continues to fall

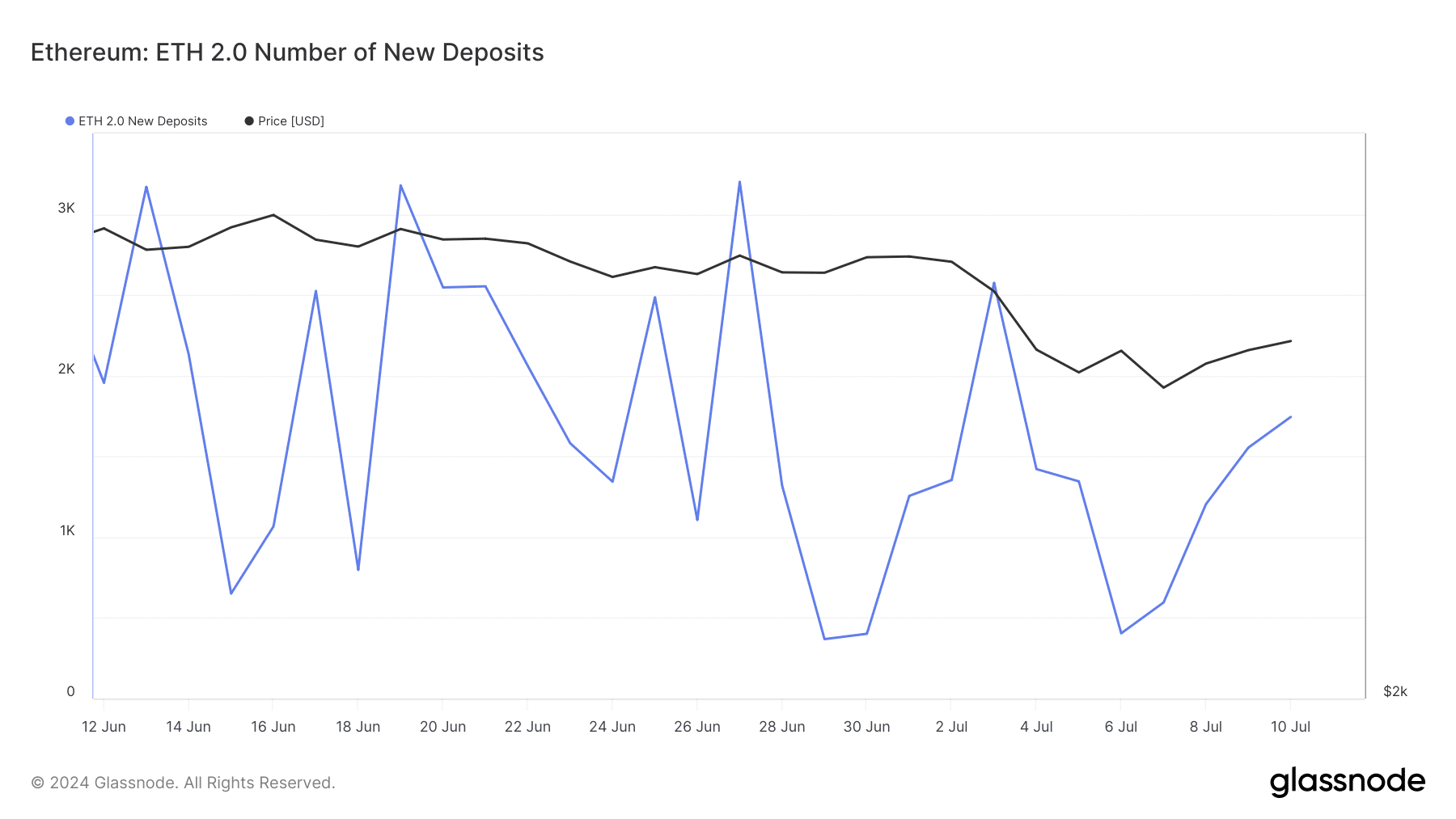

However, that was not the only thing. According to Glassnode, the ETH 2.0 New Deposits have been increasing.

When this metric increases, it means that holders of the altcoins are socking away at least 32 ETH in expectation of rewards.

Coincidentally, this is happening at a time when the spot Ethereum ETF launch is approaching. Going by this development, the drop in circulation suggest that the Ethereum community seem bullish on the event.

Should more ETH get locked, the price of the cryptocurrency might increase. In total, the total Ethereum supply locked was 40%. Out of this, 28% has been staked and 12% — bridged via smart contracts.

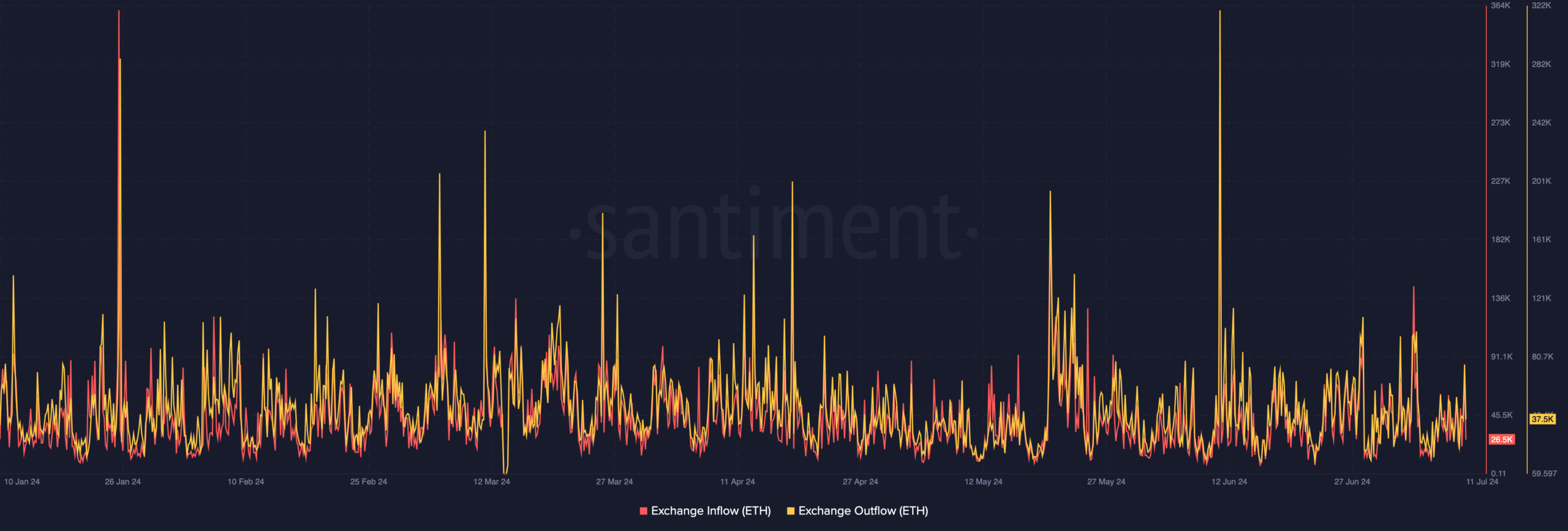

But for the price to increase, the number of coins on exchanges has to reduce. To check if this was the situation, AMBCrypto assessed Ethereum’s exchange inflow and outflow.

Exchange inflow tracks the number of crypto sent into exchange via external sources. Exchange outflow, on the other hand, is the number of ETH withdrawn.

If the exchange inflow outpaces the outflow, then the price risks correction. However, a rise in the outflow gives credence to a potential price increase.

According to Santiment, ETH’s exchange inflow was 26,500 while the outflow was 37,500. Considering the difference, there is a high chance ETH’s price might jump days or weeks after official trading of the ETFs begin.

A rally will begin sooner or later

Following the development, Benjamin Cowen, founder of Into The Cryptoverse, commented on the potential price action.

According to Cowen, ETH might begin to outperform Bitcoin (BTC) by the fourth quarter of the year. He said,

“If it follows last cycle, it means ALT /BTC pairs begin their final drop in August, ETH/BTC begins its final drop in late September, and then BTC dominance tops sometime in Q4.”

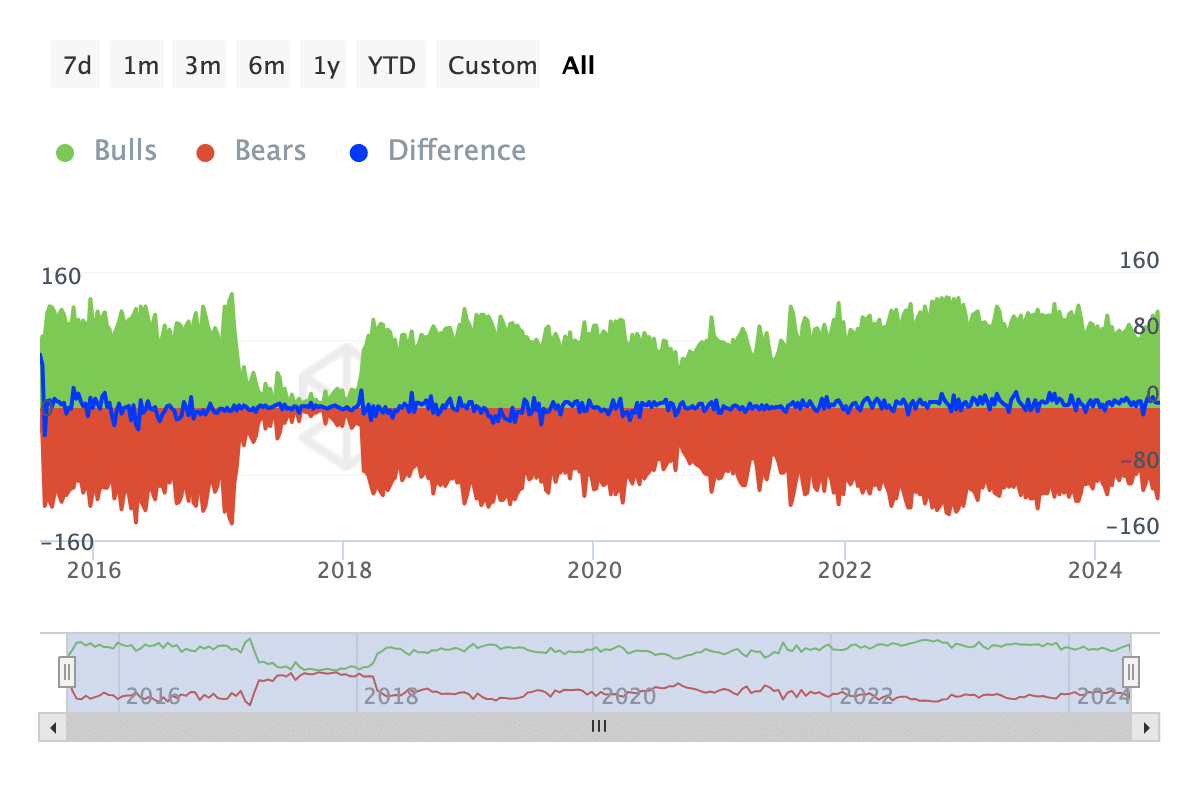

Meanwhile, data from IntoTheBlock showed that Ethereum might not wait till then before it starts doing well. This was because of the state of the Bulls and Bears indicator.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Bulls refers to those who bought about 1% of the total trading volume. Bears are those who sold the same ratio of the volume.

At press time, bulls dominated ETH bears, indicating that buying pressure was more. If this remains the case going forward, ETH’s price might revisit $3,300 and might approach $3,500.

[ad_2]

Source link