[ad_1]

- In the last two weeks, investors have pulled out $120 million from ETH-focused investment products.

- Ether spot ETF launch timeline has been moved after the SEC asked issuers to resubmit amended S-1 drafts.

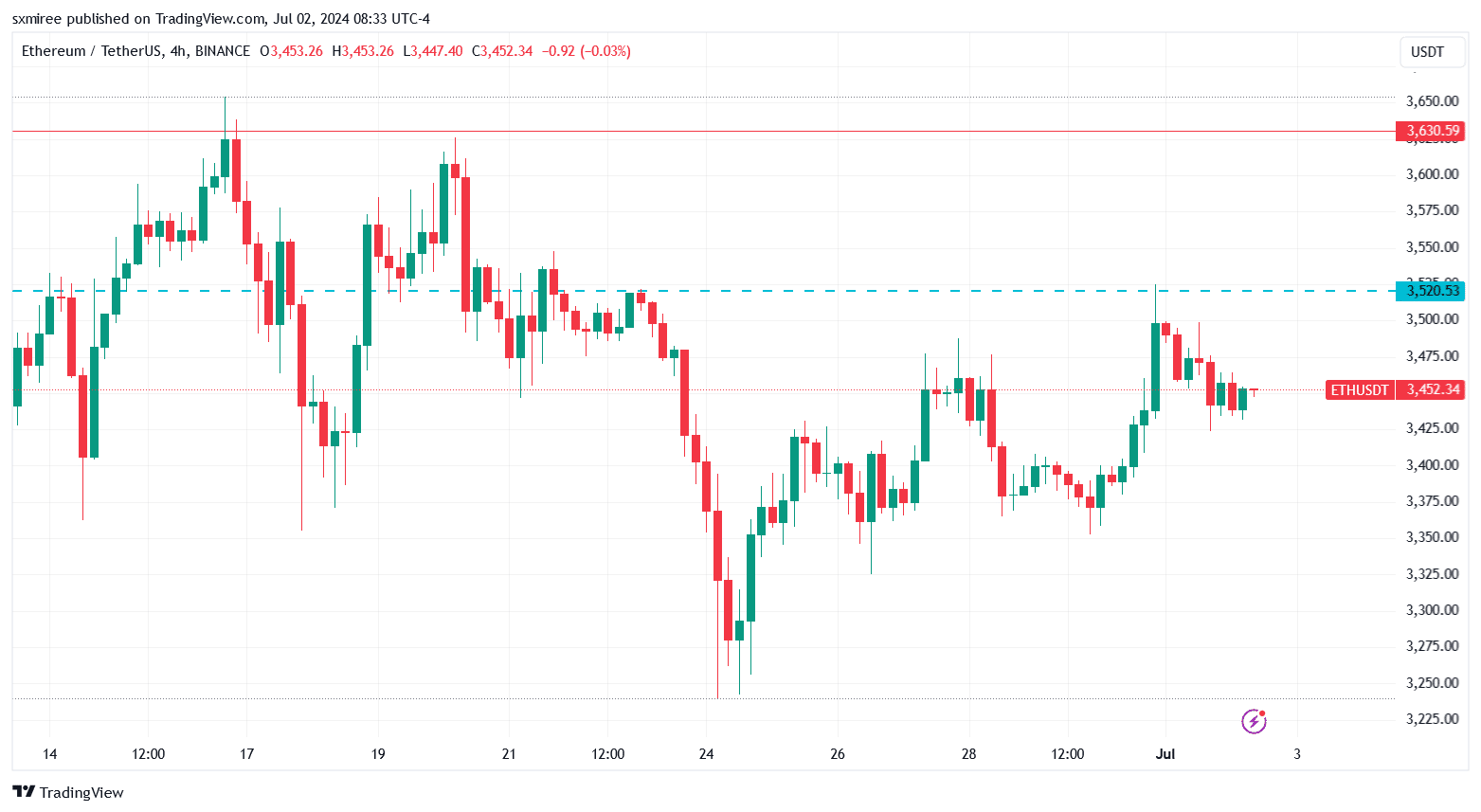

Ethereum [ETH] was trading at around $3,448 on the 2nd of July, barely unchanged in the last few hours but in conformance with the generally positive July narrative.

In the meantime, ETH bulls targeted fresh heights above $3,450 and were betting on upside potential from the hype around Ether spot exchange-traded funds (ETFs).

The new products, expected to debut in the U.S. later this month, could help propel ETH/USDT above the $3,630 resistance, where it was rejected on the 17th of June.

Bullish speculators suffered mild losses on the 1st of July after Ethereum failed to sustain momentum above $3,520.

ETH attempted to break out from the descending channel on the 4-hour timeframe chart overnight on the day, but as of press time, has been unable to cement the move.

Markedly, the latest advance toward $3,500 will not amount to triumph for bulls if ETH is unable to sail above the $3,520 — $3,550 resistance zone.

Ethereum institutional uptake

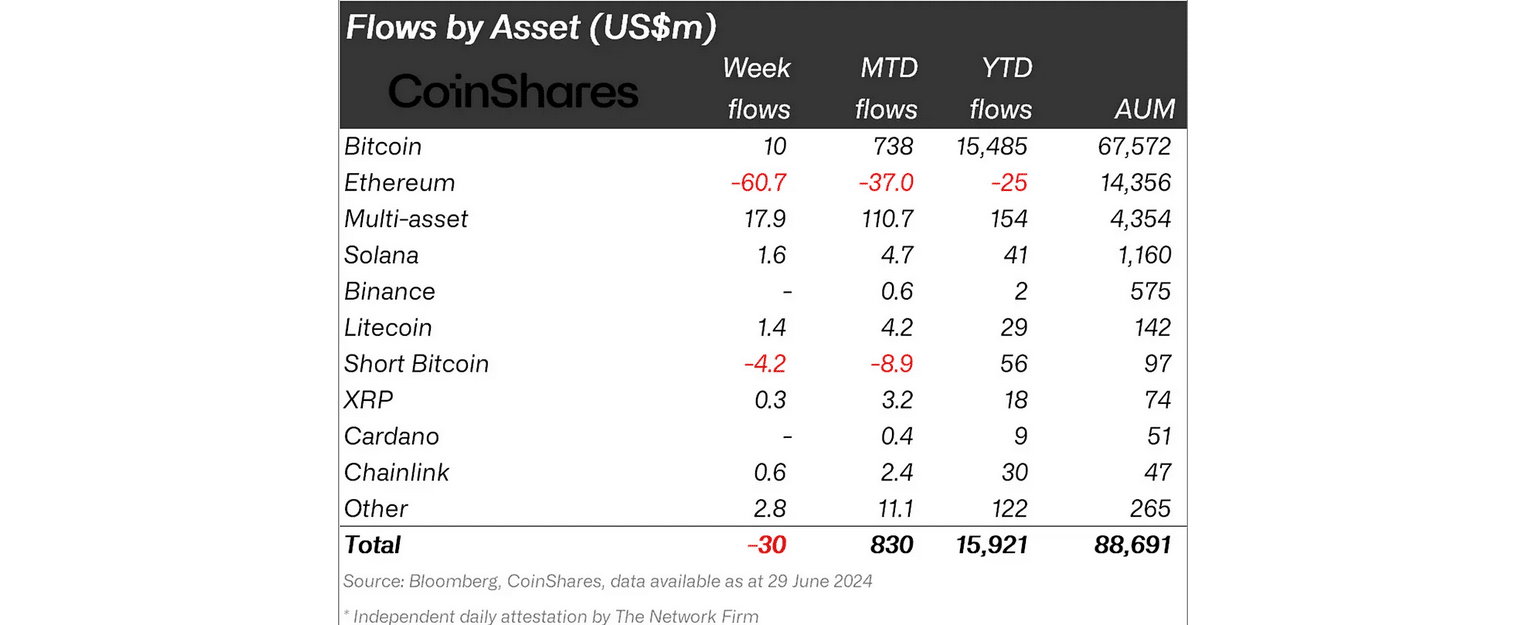

In its digital asset flows report released on Monday, CoinShares observed that Ethereum investment products posted outflows of $60.7 million last week.

The figure marked the most significant negative 7-day flow in almost two years, and brought the cumulative two-week outflows to $119 million.

The report further highlighted that Ethereum was the worst-performing crypto asset in 2024, based on net flows, with—$37 million and—$25 million MTD and YTD flows, respectively.

U.S. Ethereum spot ETF

A U.S. Ether spot ETF has been nigh this summer after the Securities and Exchange Commission (SEC) approved 19b-4 filings of eight prospective issuers on the 23rd of May.

Still, the ETF products are yet to be cleared to go live, pending approval of the S-1 registration statements.

The latest setback in the approval process has been laid at the door of the U.S. securities regulator. Last week, the SEC reviewed S-1 forms from issuers and requested resubmissions incorporating its comments by the 8th of July.

Consequently, the timeline for the launch of the spot Ethereum ETFs has been pushed to mid-or end of July.

Market anticipation

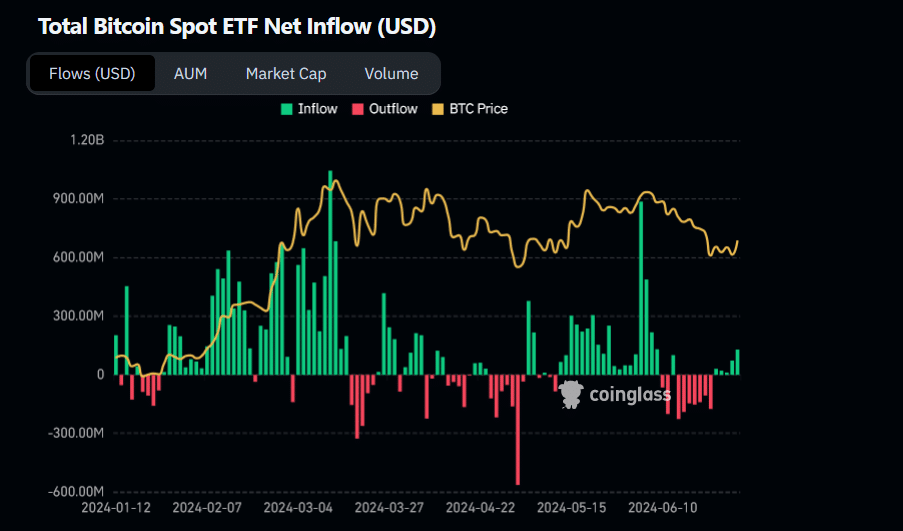

Last week, Bernstein analysts Gautam Chhugani and Mahika Sapra forecasted that Ether spot ETFs will see slightly lower demand when they go live, compared to Bitcoin [BTC] ETFs, since they mostly share the same sources of demand.

The co-authors also cited “the lack of an ETH staking feature” in the approved spot Ether ETFs as a deterrent that could dampen interest in the products.

Bitcoin ETFs have thus far attracted $55 billion since their introduction at the start of the year.

Though inflows have waned from the February highs, analyst projections show that the figure is expected to eclipse $100 billion by the end of 2025.

J.P. Morgan, on the other hand, forecasted that Ether ETFs could see net inflows of about $3 billion ($6 billion if staking is permitted) by the end of the year.

Read Ethereum’s [ETH] Price Prediction 2024-25

J.P. Morgan also expected the market’s immediate reception to be mildly negative, citing possible profit-taking by investors who bought the Grayscale Ethereum Trust (ETHE) in expectation of its conversion to an ETF.

Separately, in the last week, Bitwise CIO Matt Hougan projected that Ether spot exchange-traded funds (ETFs) would draw in $15 billion of net inflows in the first dozen and a half months.

[ad_2]

Source link