[ad_1]

- Memorial Day saw crypto thrive, with Bitcoin hitting $70K and Ethereum $4K.

- 2024 defied norms, showing increased crypto activity on Memorial Day.

On the 27th of May, while the United States celebrated Memorial Day, an interesting disparity emerged in the financial markets.

While the U.S. Stock Market, including the Nasdaq and New York Stock Exchange (NYSE), were closed for the holiday, the cryptocurrency market was thriving.

Crypto market surges

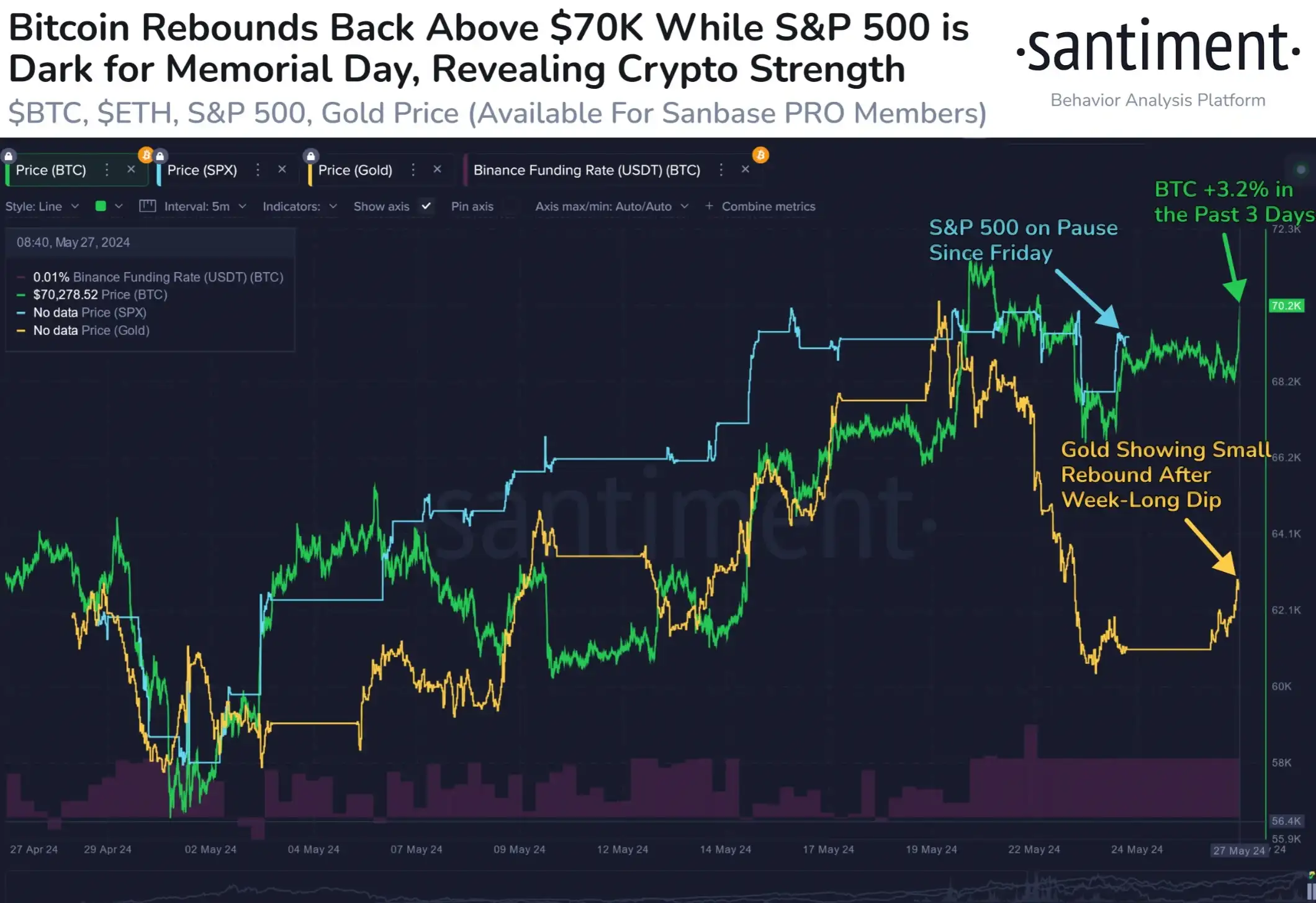

Bitcoin [BTC] surged to the $70,000 mark, and various altcoins displayed significant gains on their daily charts. Ethereum [ETH] also briefly reached the $4,000 level, adding to the overall market excitement.

Echoing similar sentiments, Santiment’s X (formerly Twitter) post noted,

“Bitcoin has eclipsed a $70K market value once again, while #MemorialDay has put US #equities markets on pause. This climb is particularly encouraging, as the positive movement reveals how #crypto markets can perform on the rare weekdays when it is not reliant on the stock market that it has been correlated with since 2022.

Reiterating the same, TheoTrader noted,

“Based on seasonality data, we tend to rally the week post memorial day, expect a bullish week ahead.”

The past isn’t a blueprint for the present

However, as exciting as it is, this trend is quite unusual.

According to Bloomberg’s report, the crypto market volume dropped by 43% in 2020 and 35% in 2021 during the Memorial Day period, suggesting that activity is typically low during this holiday.

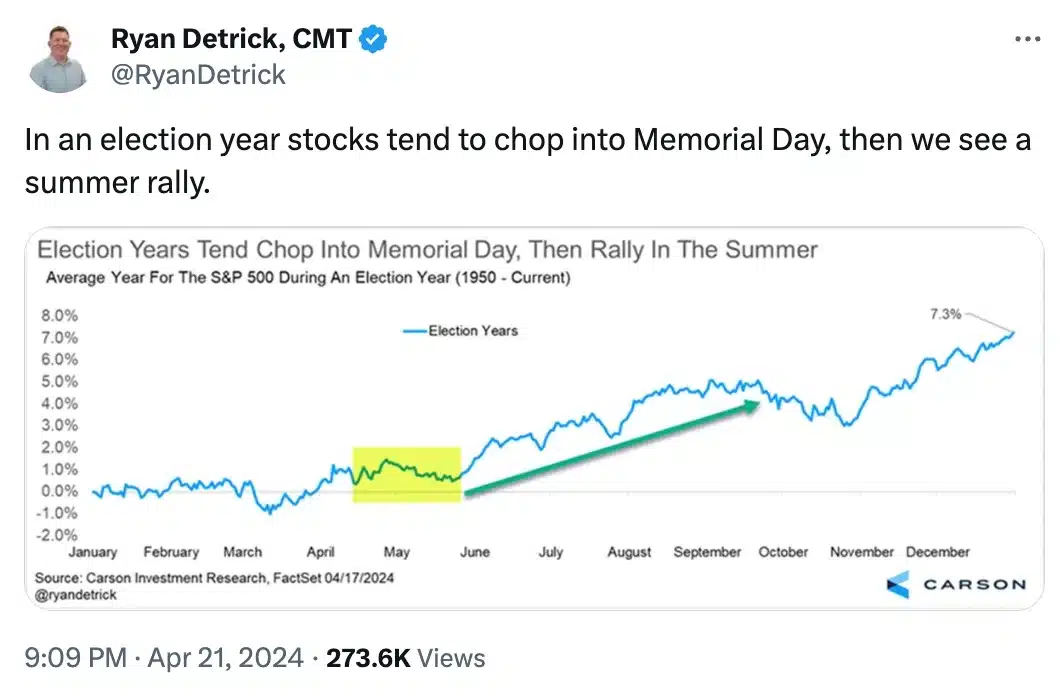

But 2024 has been marked by new events and atypical market trends, and this was one of them. Remarking on the same, Ryan Detrick, Chief Market Strategist at CarsonGroupLLC said,

Historically, during election years, stock prices have fluctuated without a clear trend in the lead up to Memorial Day. After Memorial Day, however, stocks often shoot up, often known as a summer rally.

What lies ahead?

Since the stock market is closed on Memorial Day, it remains to be seen whether Ryan’s prediction will come true or not.

But, in the crypto realm where markets are always open, we’re already starting to get hints of where things might go in the near future.

As traditional assets continue to exhibit seasonal patterns, the cryptocurrency market’s independence and volatility present both opportunities and challenges for investors.

[ad_2]

Source link