[ad_1]

- The evidence at hand shows that Bitcoin is likely headed much higher.

- Bitcoin aged 6 months and above saw reduced activity in the past two months.

Bitcoin [BTC] has stalled after the recent breakout past the $67k resistance. The bullish move last week reached $72k on the 21st of May but has receded by 5.7% to trade at $67.8k at press time.

The demand for Bitcoin-backed investment products was explored in a recent report, with most of the inflows coming from the United States.

The recent dip has cut short bullish sentiment, and it appeared that the bulls might not be ready for a move past $71.5k yet.

However, the long-term outlook remains bullish, and according to one metric, we are just halfway through a bull run.

Bitcoin’s bull run still has some fuel left

Source: Axel Adler on X

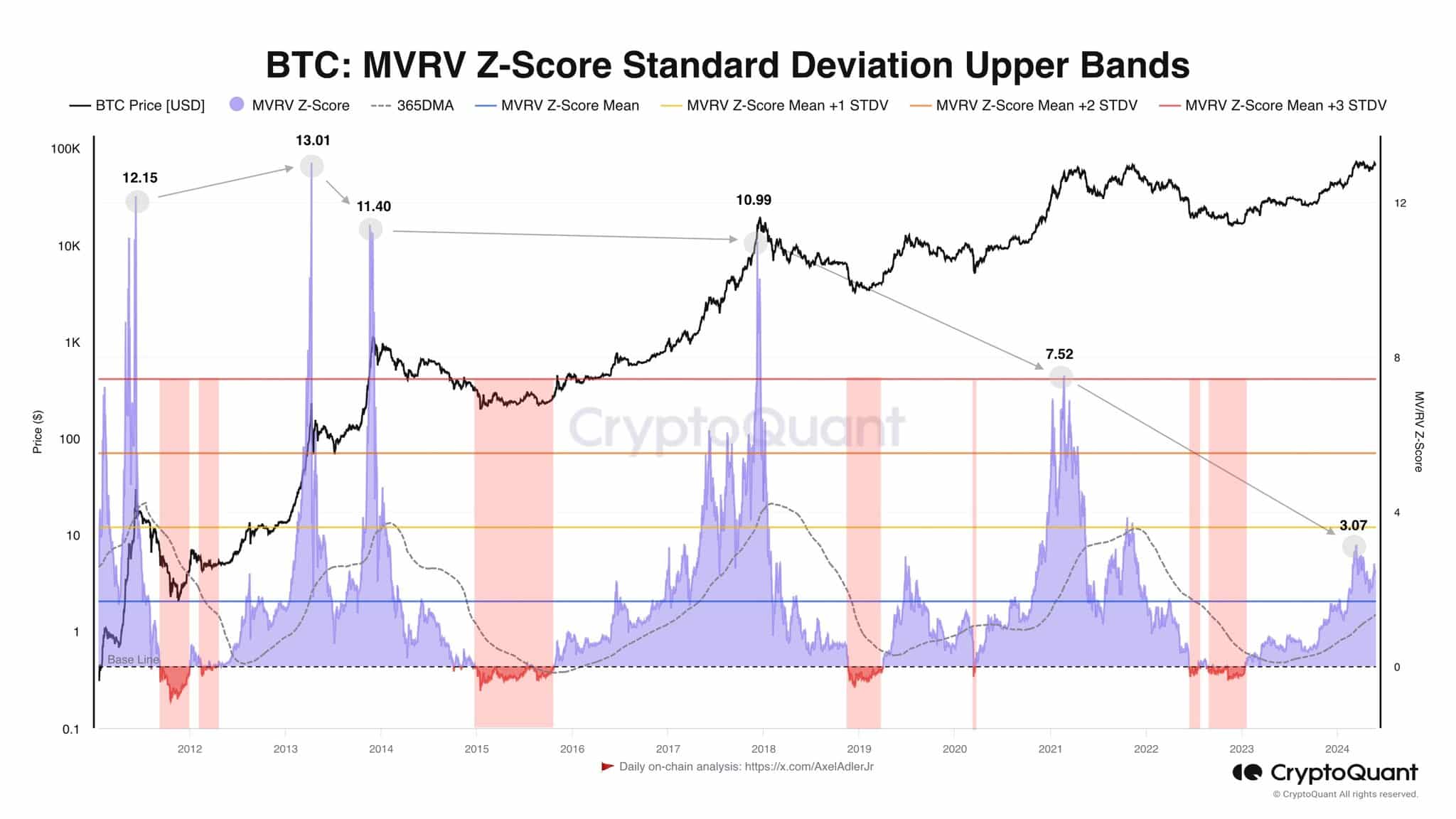

Crypto analyst Axel Adler used the Bitcoin MVRV Z scores to illustrate that the current cycle is only halfway done in a post on X (formerly Twitter).

This metric evaluates whether Bitcoin is overvalued or undervalued by comparing it with its fair value.

MVRV stands for market value to realized value to compare the asset’s market capitalization to the cumulative capital inflow into the asset. When the former is much higher, it signals a potential top.

Source: Glassnode

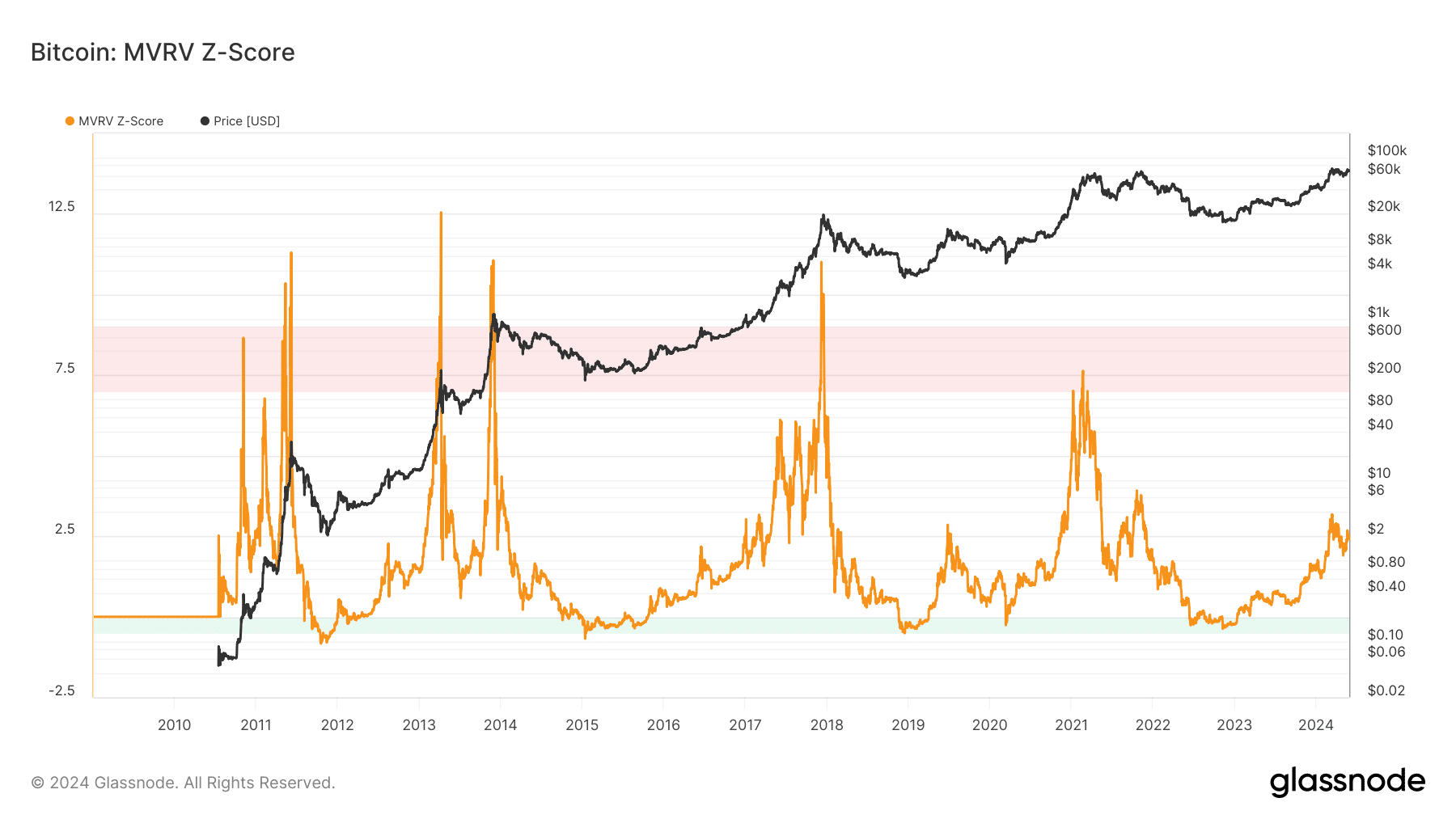

The MVRV Z-score compares the MVRV difference with the standard deviation of the market cap of Bitcoin. In the previous cycles, an MVRV-Z score of 7 or above has marked the cycle tops.

This run saw the metric climb as high as 3.07, which means it is highly likely that we see further price gains in the coming months.

Long-term holders have been diamond hands in the past two months

Source: CryptoQuant

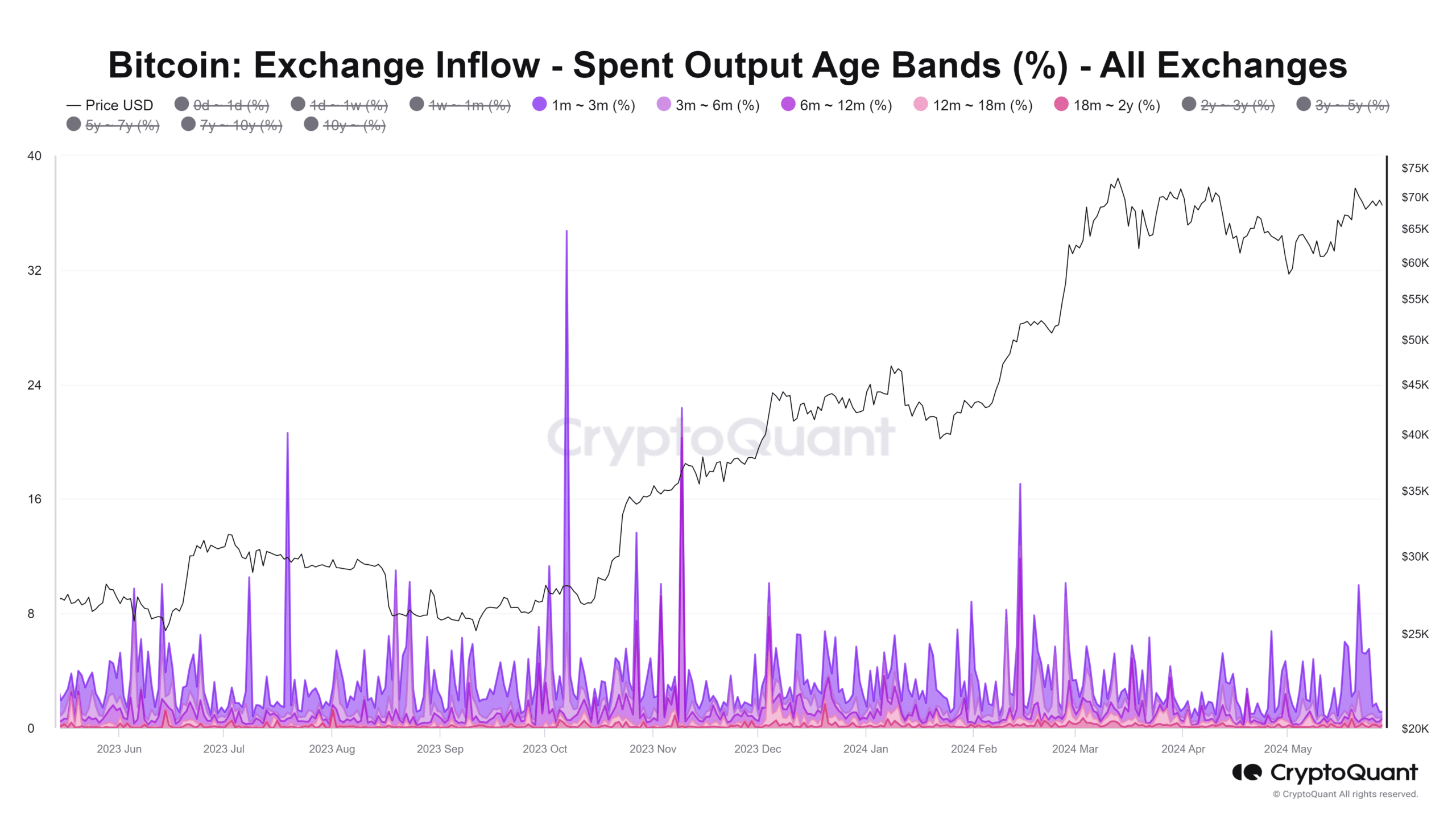

The cohort of BTC holders aged six months and above saw a flurry of activity on the 28th of February. The 3-6 month age band was particularly active and illustrated the profit-taking activity from that group.

Is your portfolio green? Check out the BTC Profit Calculator

Similarly, over the past two months, it has been the 1-3 month-long holders who have been relatively active in the market and registered a spurt of selling on the 21st of May when prices climbed above $70k.

However, most of the older holder groups did not see intense selling activity to exchanges in April and May. This was likely due to expectations of a price rally post halving, and this expectation has not worn out yet.

[ad_2]

Source link