[ad_1]

- Bitcoin consolidated at $68K, possibly needing to touch $65K before aiming for its all-time high.

- On-chain metrics and bullish trader activity show stabilization, with potential for a surge post-consolidation.

Bitcoin [BTC] has been experiencing a period of consolidation after hitting $70K last week, thanks to the Ethereum [ETH] ETF hype. With the market showing signs of a potential slowdown, Bitcoin might consolidate further before making its way back to the all-time high.

On-chain metrics and investor behavior

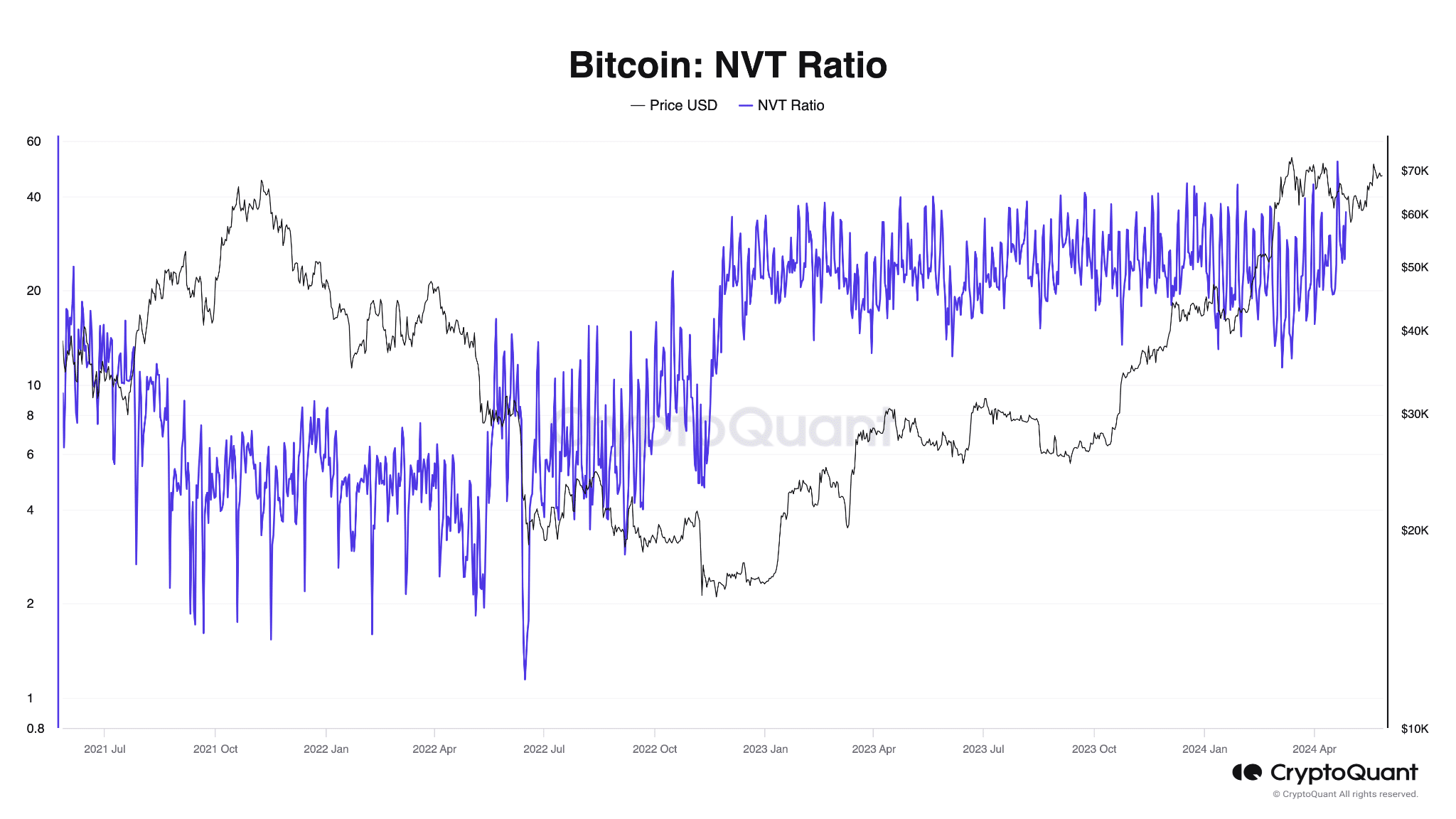

Currently, the NVT ratio appears elevated, which could indicate that Bitcoin’s price is somewhat overvalued compared to the economic activity on its blockchain.

This mismatch usually leads to more consolidation as the market seeks equilibrium between price levels and transaction volumes.

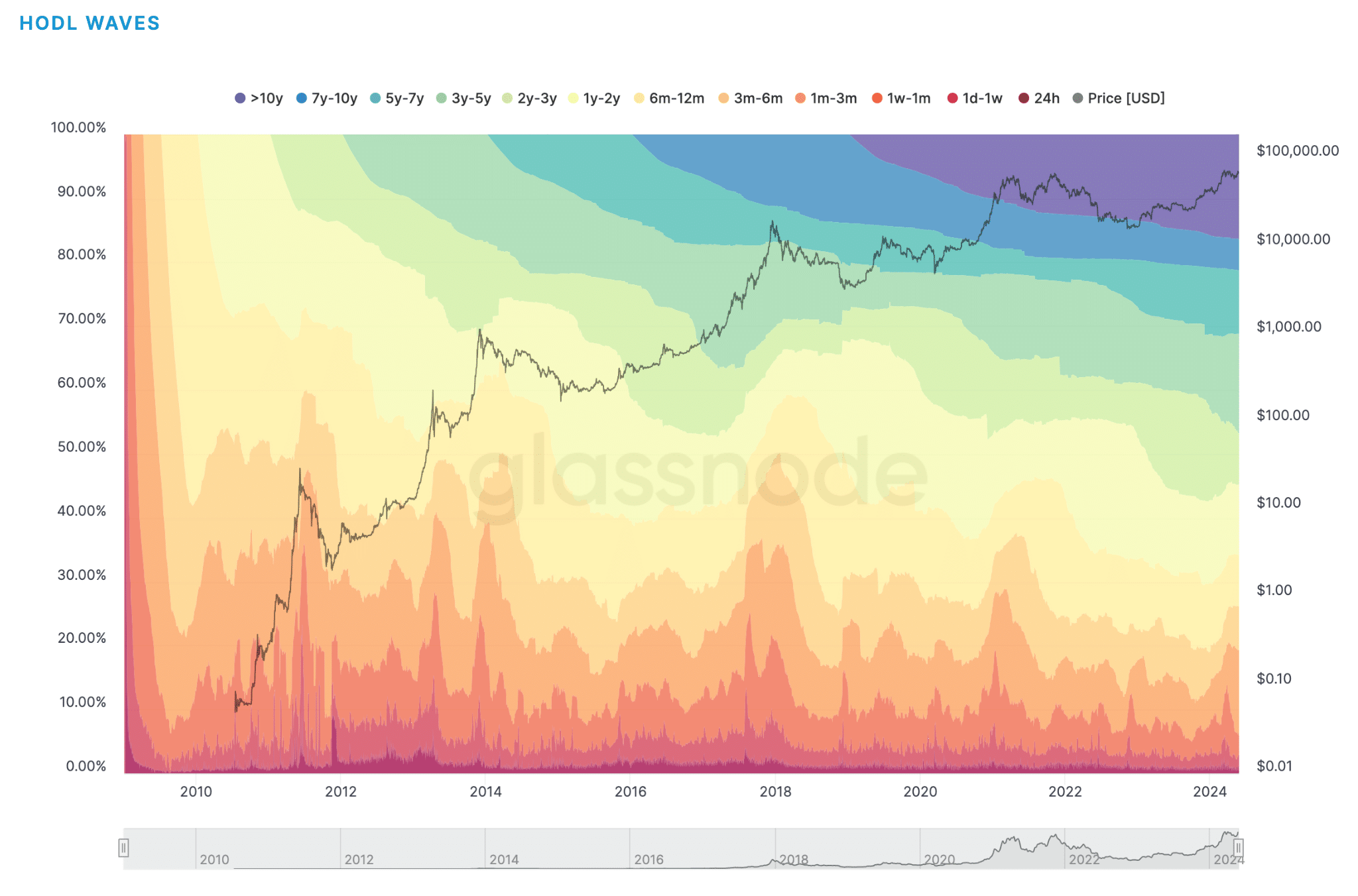

The HODL waves chart showed a historical holding pattern that clearly suggests that Bitcoin would continue to see price consolidation as long-term holders choose to hold through this cycle, awaiting higher valuations.

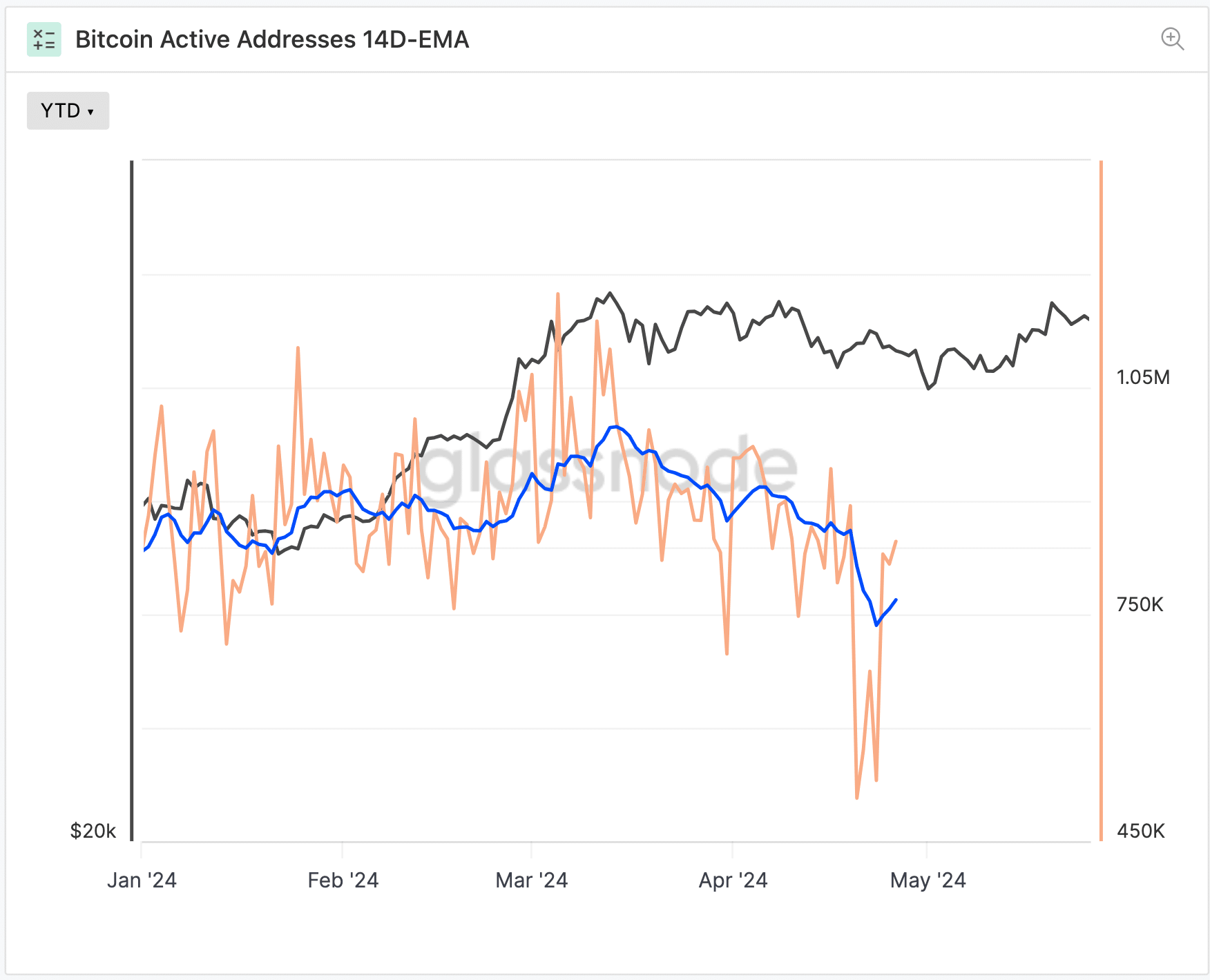

Despite the decline in active addresses, Bitcoin’s price line remains relatively stable, suggesting a consolidation phase where the price is not heavily affected by the change in active users. This pattern often precedes a bull run.

Technical analysis and resistance levels

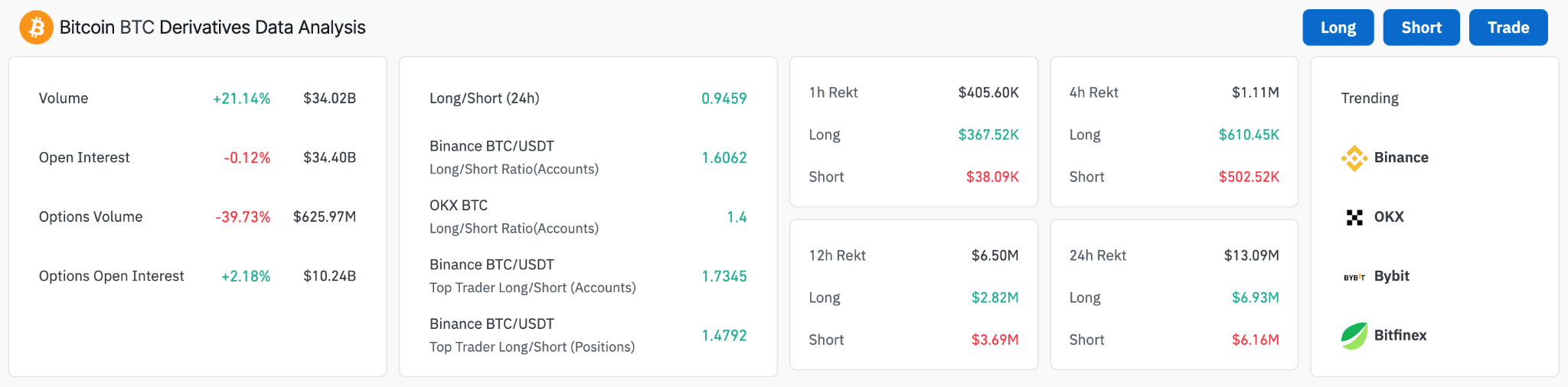

Bitcoin’s trading volume has increased by 21.14%, indicating a spike in trader activity and a strong bullish sentiment. However, the slight decrease in open interest by 0.12% suggests some hesitancy among traders.

A contrast is seen in the options market, where trading volume decreased 39.73% despite a slight increase in open interest of 2.18%.

The long/short ratios across major platforms like Binance and OKX show a predominance of long positions, reinforcing a generally bullish outlook among traders.

However, the higher liquidation values on long positions in the short term caution about potential volatility and price corrections that could affect the market sentiment moving forward.

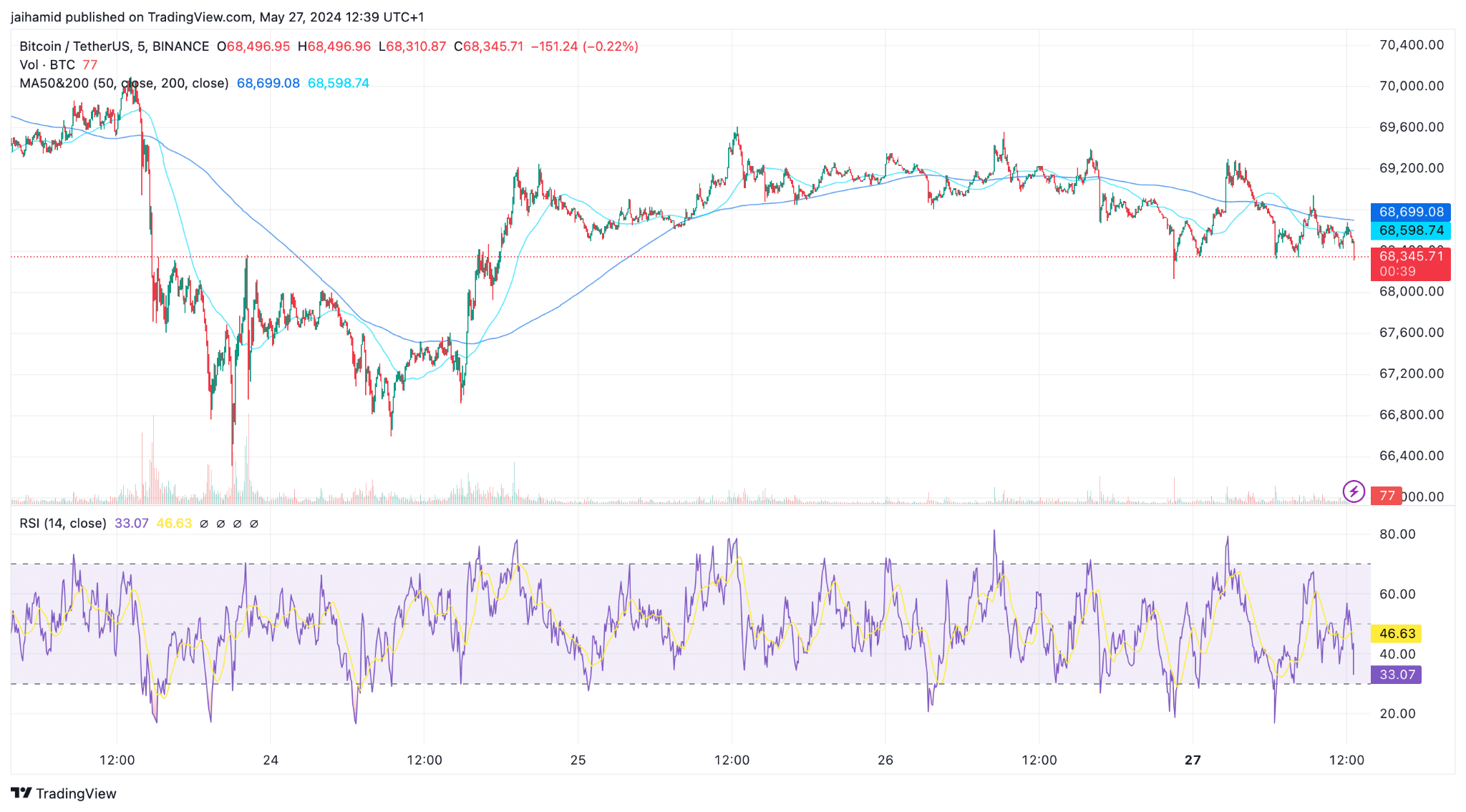

Speaking of price, if the $66,800 support is broken, a potential retracement towards $65,000 might occur, but it would also provide a stronger base for the next leg up.

Is your portfolio green? Check out the BTC Profit Calculator

The RSI is around 46, which indicates neither overbought nor oversold conditions, supporting the consolidation phase.

Once Bitcoin successfully breaches the $70,000 mark, it is expected to attempt to reach its all-time high of around $73.8K

[ad_2]

Source link