- Ethereum outperformed Bitcoin in terms of year to date growth.

- Overall interest in Ethereum NFTs and its ecosystems fell significantly.

Ethereum [ETH] has had a tumultuous time in 2024, with prices seeing massive fluctuations during this period. Despite the volatile trajectory of ETH’s price movement, it has still managed to outperform BTC.

Ethereum comes out on top

According to Artemis’ data, Ethereum not only outperformed Bitcoin in 2024, but also managed to outpace tokens in other sectors such as AI, Data Services and RWA (Real World Assets).

Interestingly, the surge in Ethereum’s price over the last year was driven by retail investors.

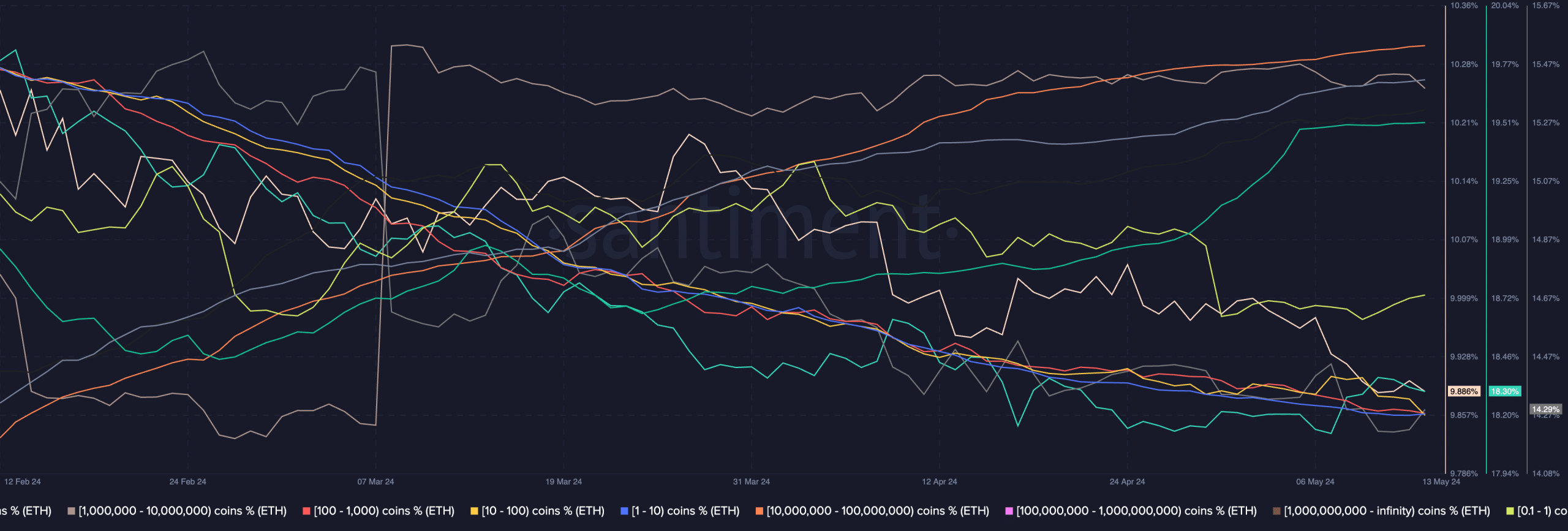

AMBCrypto’s analysis of Santiment’s data revealed that addresses holding anywhere between 0.1 to 10 ETH had accumulated large amounts of ETH over the last few months.

In contrast to that, whale investors were observed to be selling their holdings and were not showing any interest in accumulation.

This could be positive for Ethereum in the long run, as a presence of a large number of retail investors could make the Ethereum network much more decentralized.

However, large sell-offs from whales may impact the price movement of ETH negatively in the short term.

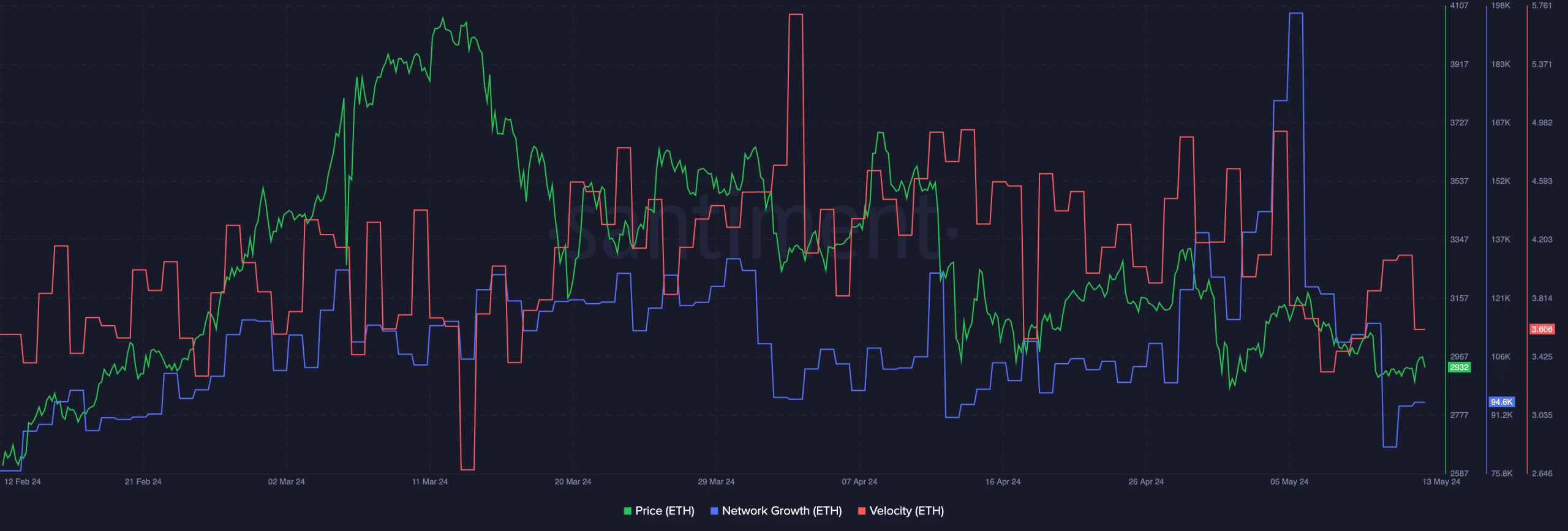

At press time, ETH was trading at $3,765.89 and its price had surged by 0.21% in the last 24 hours. Despite the surge in price, the Network Growth had plummeted over the last few days.

A decline in Network Growth indicates that the frequency with which new addresses were trading ETH had fallen significantly.

If new addresses continue to lose interest in ETH, it could impact ETH’s price negatively in the long run.

Moreover, the velocity at which ETH was trading at had also fallen, implying a decline in ETH’s overall trades.

Activity on the network

Another factor is the overall health of the Ethereum ecosystem.

Read Ethereum’s [ETH] Price Prediction 2024-25

Per AMBCrypto’s analysis of Santiment’s data, Daily Active Addresses on the Ethereum network had declined from 630,000 to 430,000 over the past few weeks.

This indicated that users were moving to other networks and platforms.