[ad_1]

- Ethereum’s exchange reserves hiked over the past week

- Most metrics suggested that ETH might continue to rally

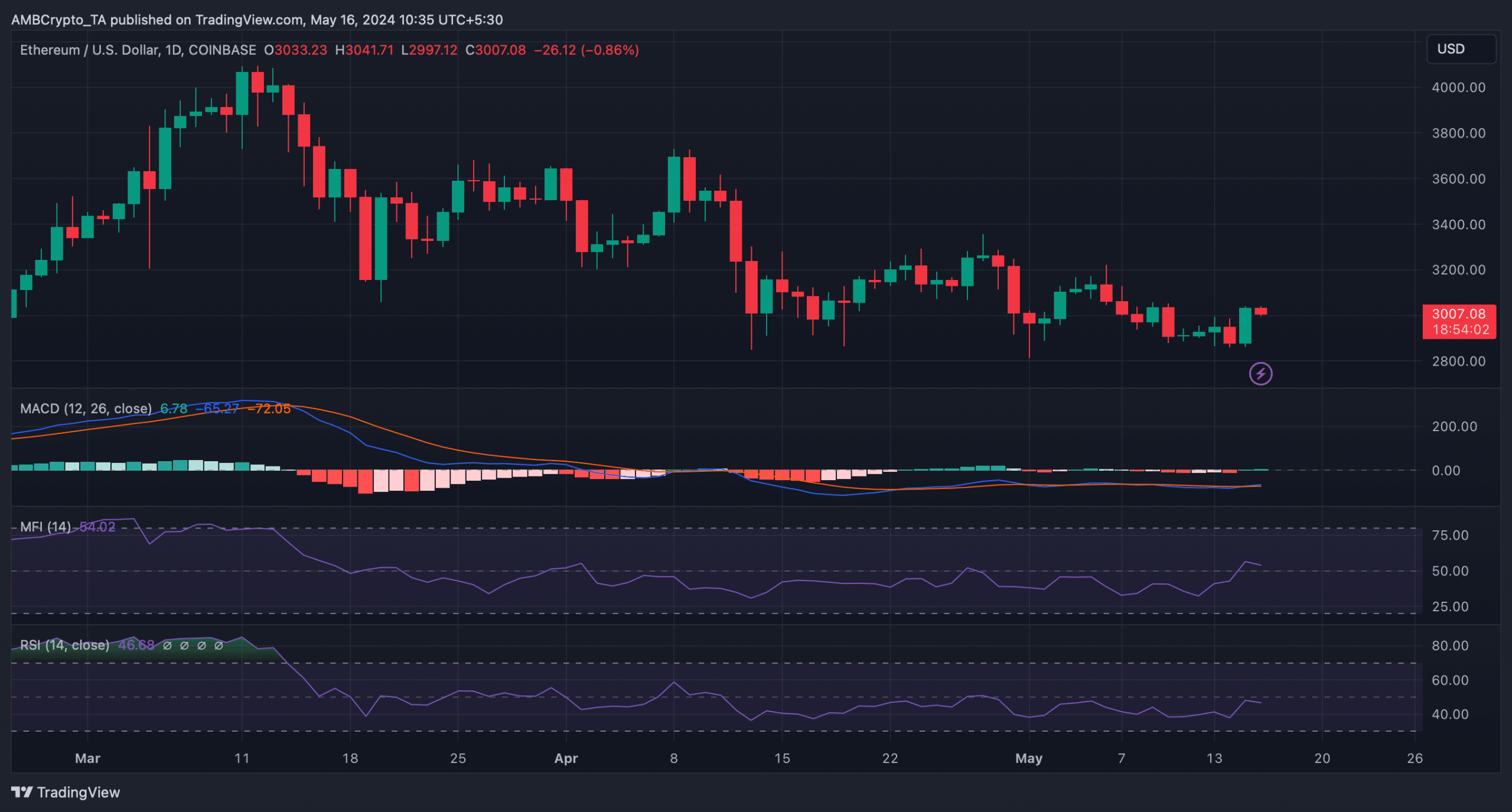

The crypto-market has turned bullish over the last 36 hours, allowing most cryptos to flash green on their charts. Ethereum [ETH] was no different. In fact, while the token’s price moved up, a buy signal flashed on ETH’s price chart, hinting at a further price uptick in the coming days.

Ethereum’s bullish turn

According to CMC, ETH recorded a massive price correction last week as its price fell to $2.86k. However, the bulls stepped in and pushed the token’s price up by more than 3.5% in the last 24 hours. At press time, it was trading at $3,007.64 with a market capitalization of over $361 billion.

Meanwhile, Ali, a popular-crypto analyst, tweeted that a buy signal had appeared on ETH’s chart. According to the same, ETH could see a rebound of one to four candlesticks.

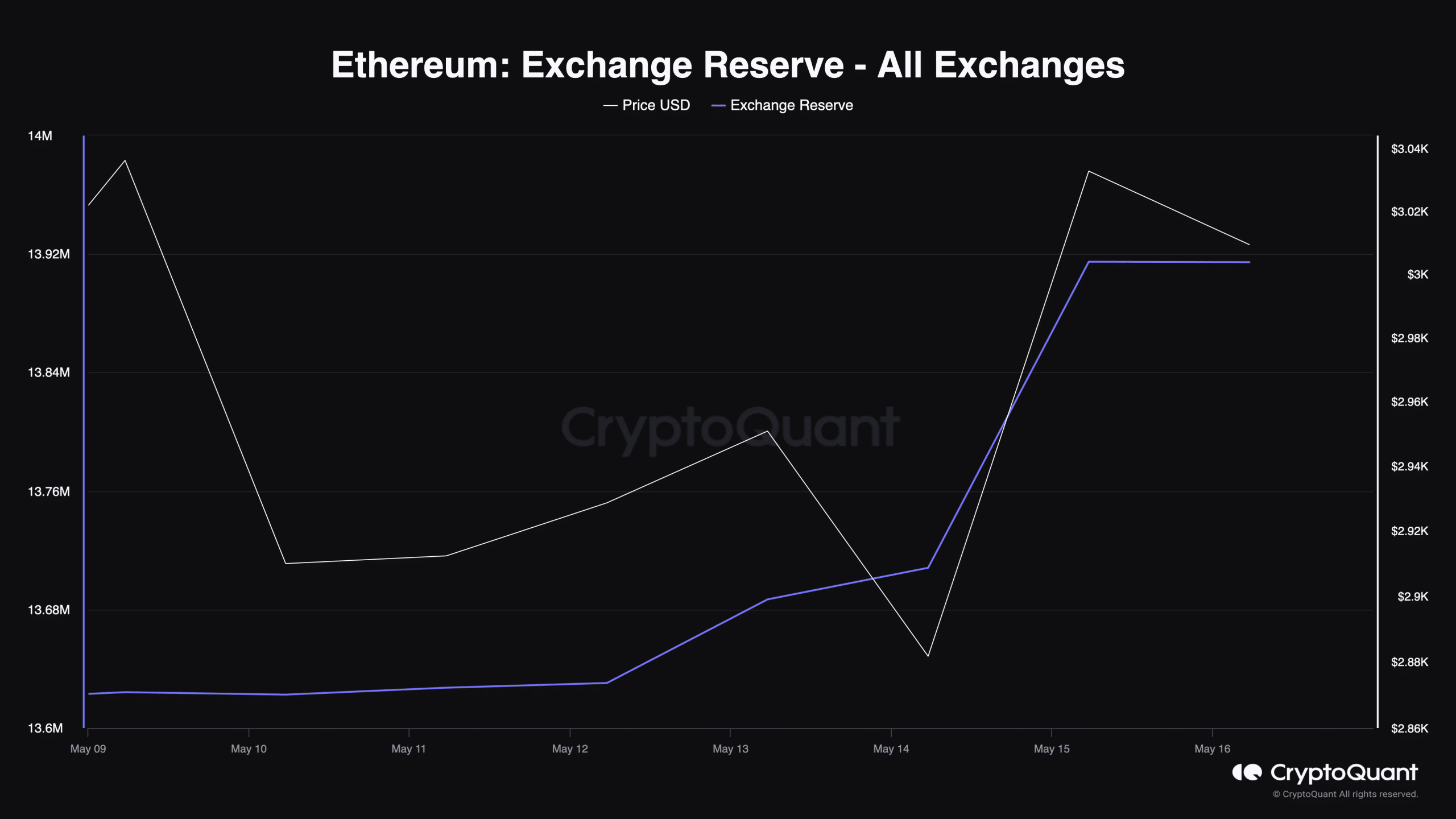

AMBCrypt0 then checked ETH’s metrics to find out whether investors actually used the opportunity to accumulate more ETH. Our look at CryptoQuant’s data revealed that ETH’s exchange reserves rose sharply over the last few days, indicating selling pressure.

To check whether investors sold ETH, AMBCrypto then analyzed Santiment’s data. We found that ETH’s supply on exchanges rose over the past week.

In fact, Ethereum’s supply held by top addresses also remained somewhat flat, suggesting that whales also didn’t make large moves. A possible reason behind this behavior could be that investors were expecting a market top. That’s why they might have opted to sell their holdings and take profits.

Will Ethereum’s bull rally continue?

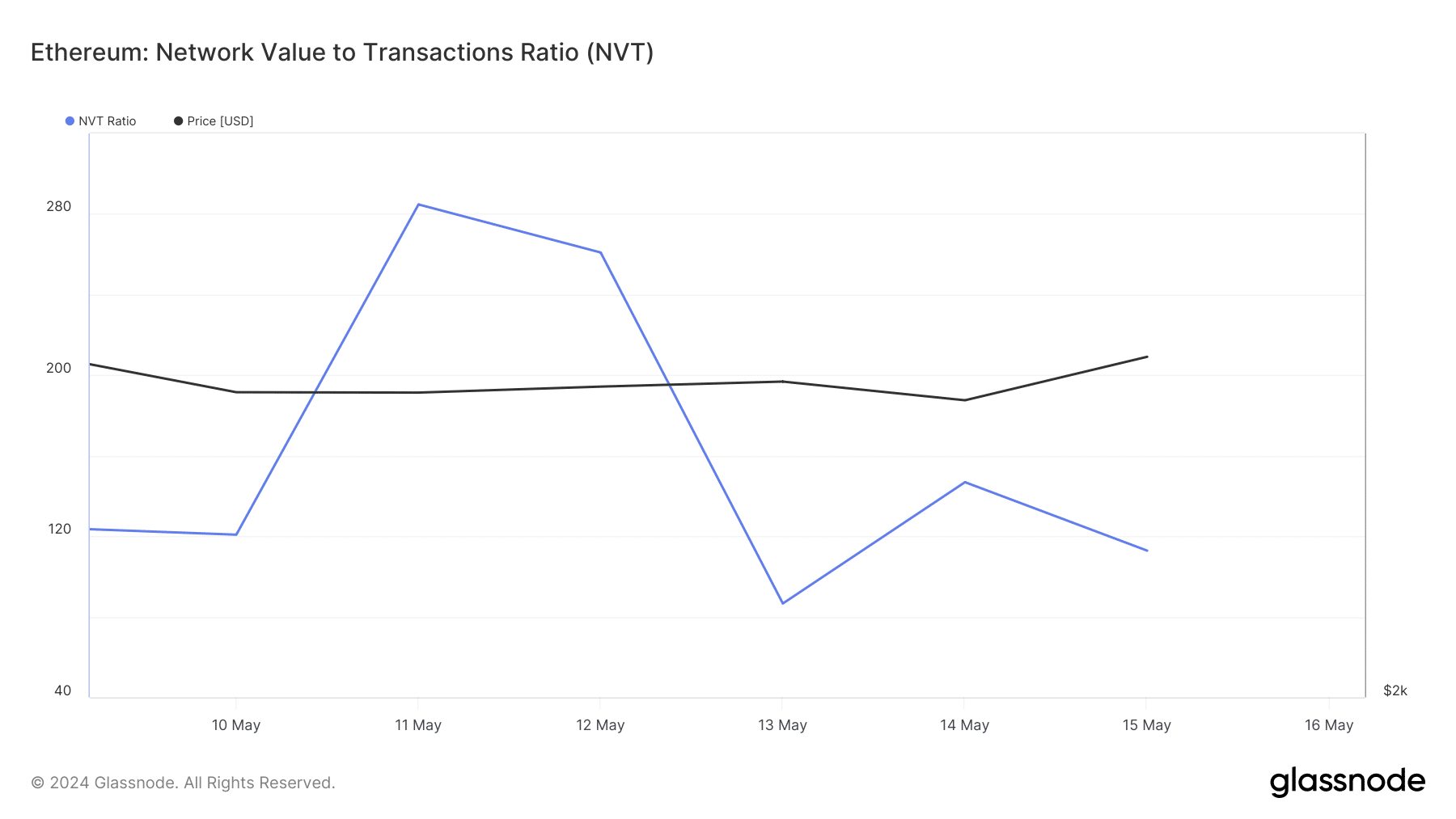

To see whether this bull rally would last longer, AMBCrypto then analyzed Glassnode’s data.

As per our analysis, ETH’s Network To Value (NVT) ratio registered a decline over the past week. A drop in this metric means that an asset is undervalued, indicating that the chances of a price hike are high.

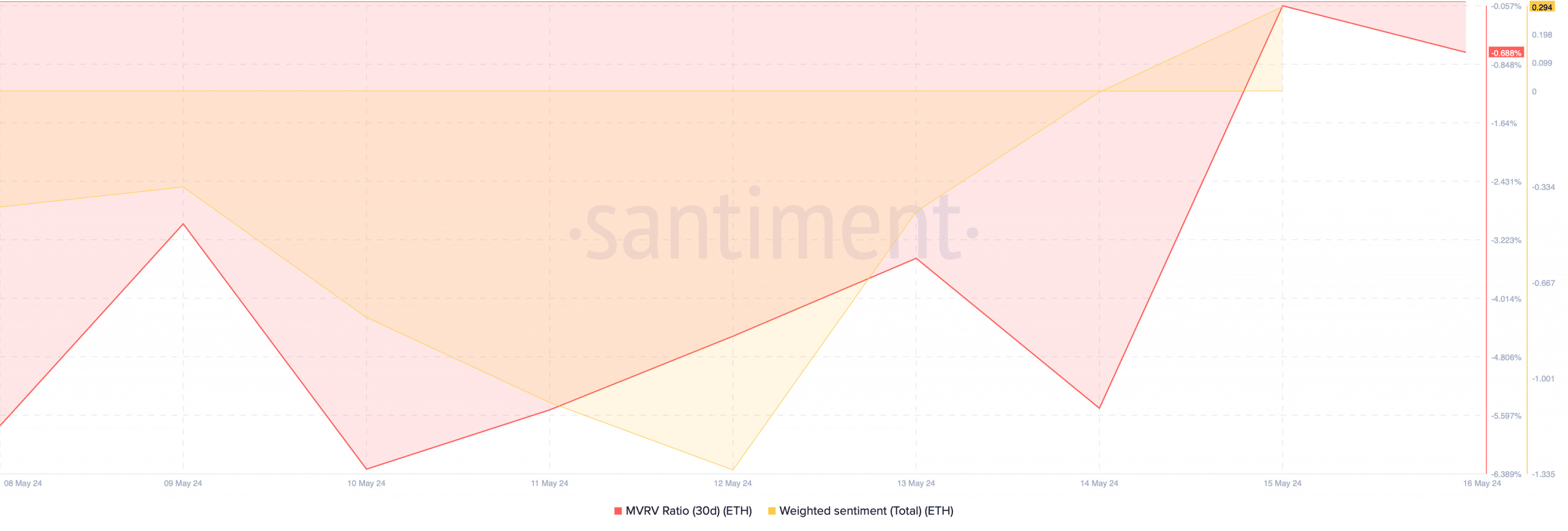

The token’s MVRV ratio improved sharply over the last few days too, which can be inferred as a bullish signal.

At press time, ETH’s MVRV ratio had a value of -0.68%. Additionally, the market sentiment around ETH also turned bullish, with the same evidenced by the rise in its weighted sentiment.

Read Ethereum (ETH) Price Prediction 2024-25

Finally, ETH’s technical indicator MACD projected a bullish crossover, further hinting at a sustained bull rally.

On the contrary, a few of the other indicators suggested otherwise. For example, the Relative Strength Index (RSI) noted a downtick. The Money Flow Index (MFI) also followed a similar declining trend.

[ad_2]

Source link