[ad_1]

- Solana outperformed Ethereum in terms of fees paid out to validators.

- Usage on the Ethereum network declined, as the price of ETH fell.

The popularity of the Solana [SOL] network has helped it attract a large number of users, due to which an increase in activity on the network was observed.

Gas is paid

Due to the rising activity on the network, the fees paid out to validators on the Solana network had grown.

Ethereum [ETH] has long been the dominant player in the smart contract platform space. Solana’s rise in popularity, especially if its fees remain competitive with Ethereum’s, could chip away at Ethereum’s market share.

This weakens Ethereum’s position as the go-to blockchain for developers and users.

The state of the Ethereum network has also been dire. Over the last month, the number of daily active addresses on the Ethereum network had declined significantly.

According to Token Terminal, the number of daily active users on the network fell by 2.9% in the last 30 days.

Moreover, the average revenue generated by the network also declined significantly by 81.6% during this period.

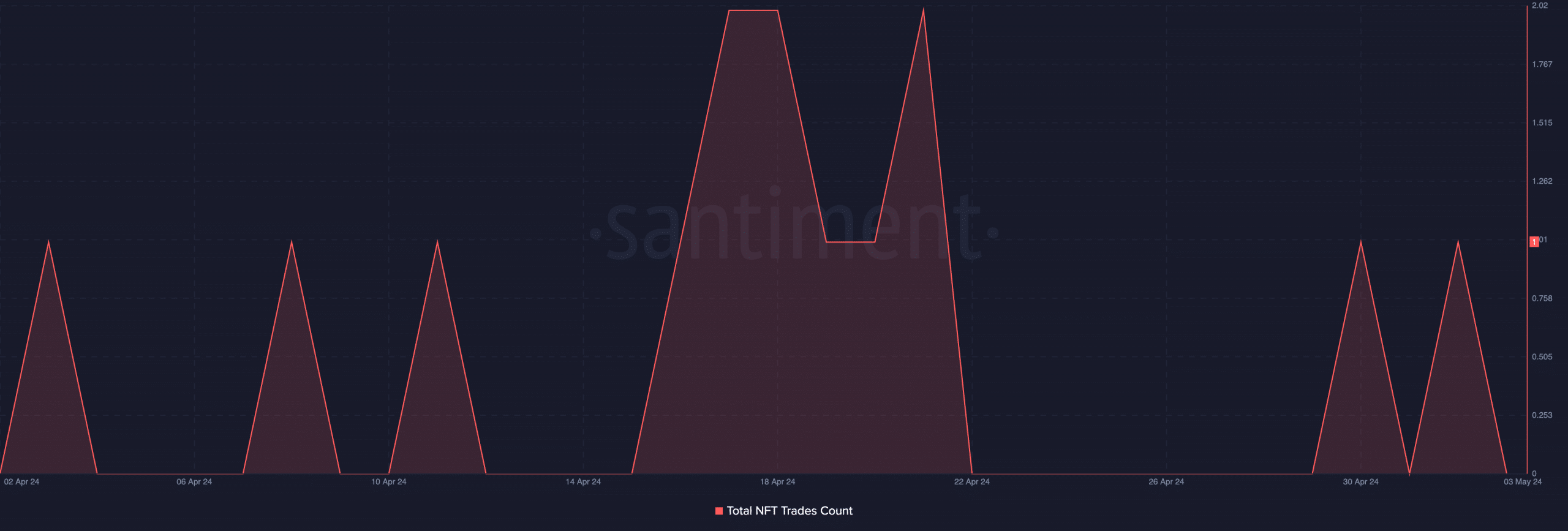

The NFT trades on the Ethereum network also declined significantly over the last month.

The popularity of NFTs from alternative chains such as Bitcoin [BTC] and Solana [SOL] may be grabbing a good chunk of the Ethereum network.

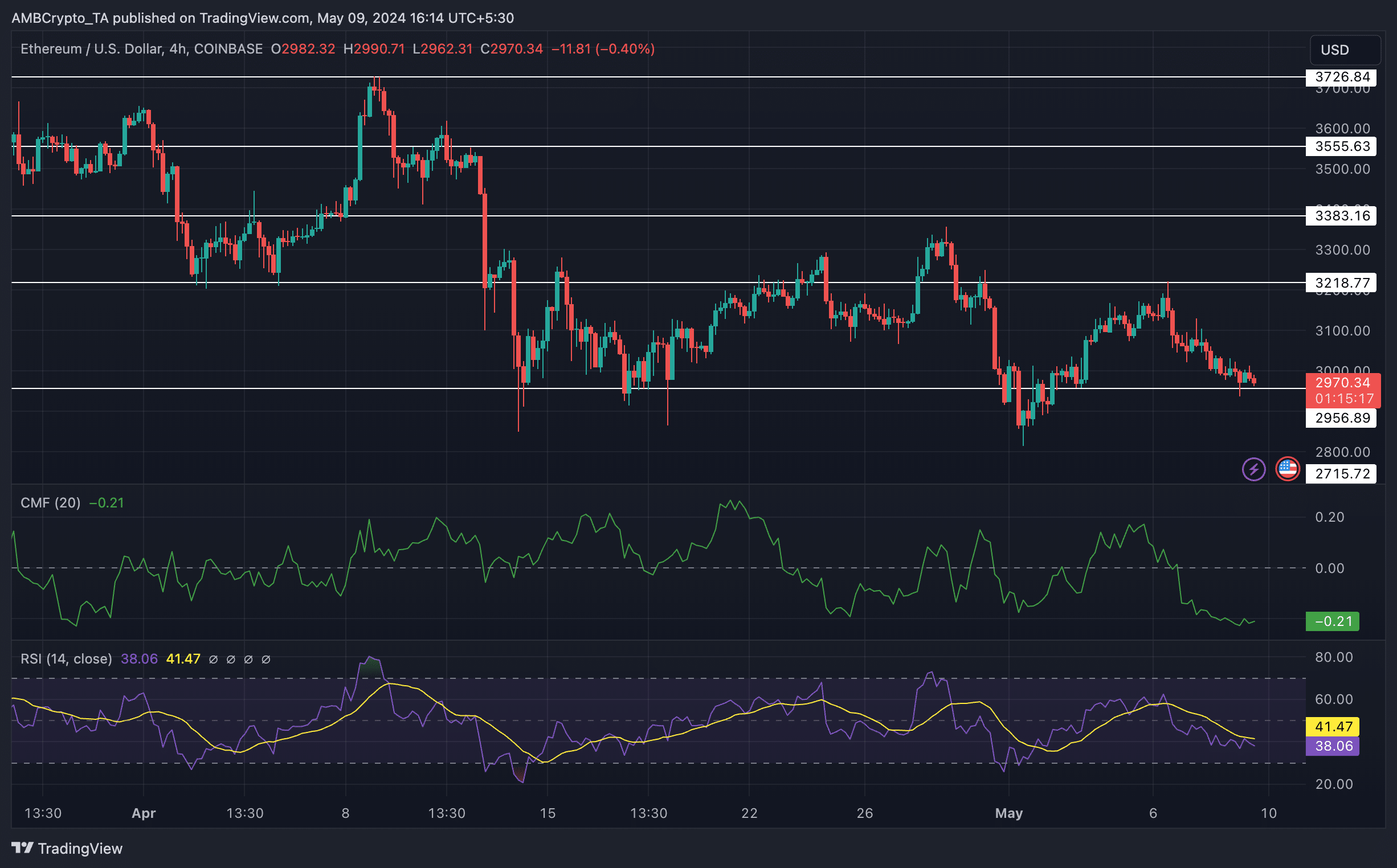

ETH failed to fare well in terms of price as well. Since the 8th of April, its price fell considerably, exhibiting multiple lower lows and lower highs, indicative of a bearish trend.

Coupled with that, the CMF (Chaikin Money Flow) for Ethereum fell significantly to -0.21 during this period. This meant that the money flowing into ETH had declined significantly in the last few days.

The RSI (Relative Strength Index) for Ethereum also declined during this period, implying that momentum was with the bears at the time of writing.

Read Ethereum’s [ETH] Price Prediction 2024-25

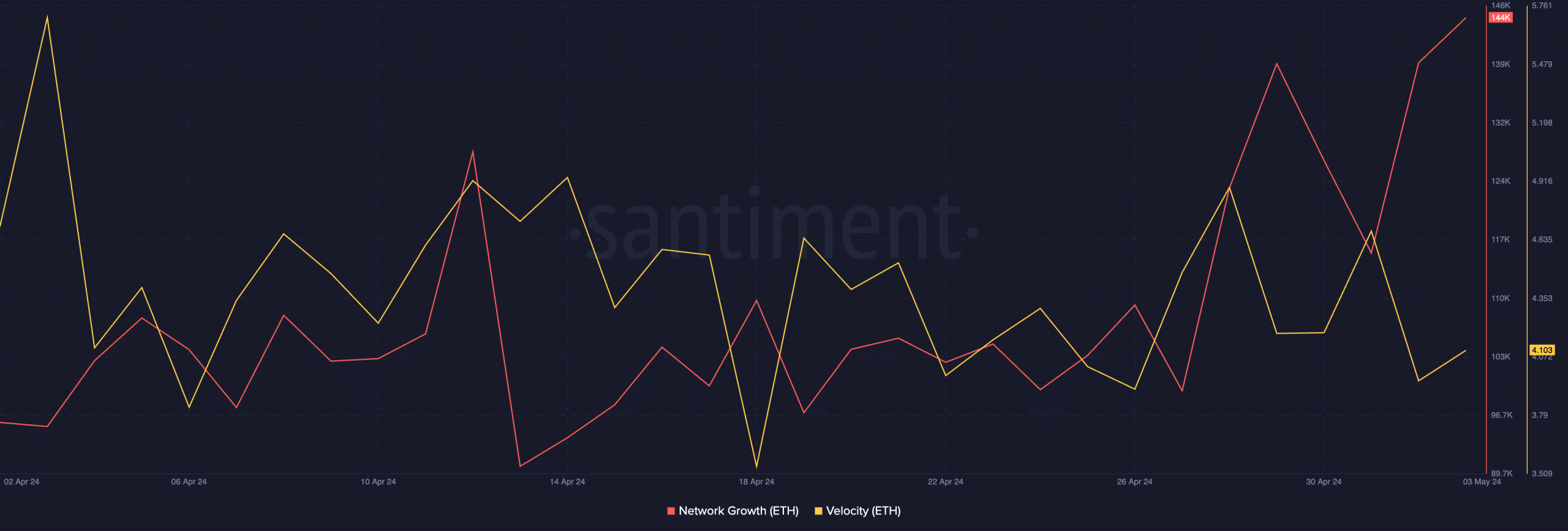

New addresses grow

Coupled with that, the velocity of ETH had fallen, indicating a reduced frequency of trades. In contrast to this, the overall network growth of ETH grew significantly.

This meant that new addresses continued to show interest in the ETH token.

[ad_2]

Source link