[ad_1]

- Shiba Inu has a bearish short-term market structure.

- The lack of demand at a key support zone was concerning.

A recent AMBCrypto analysis of Shiba Inu [SHIB] noted that an 18% move higher was expected. Since then, the bullish momentum has slowed, but a support zone could hold off the sellers.

Bitcoin [BTC] traded at $63.7k at press time and could sink toward liquidity at $59.4k again. This could hurt the meme coin prices in the short term.

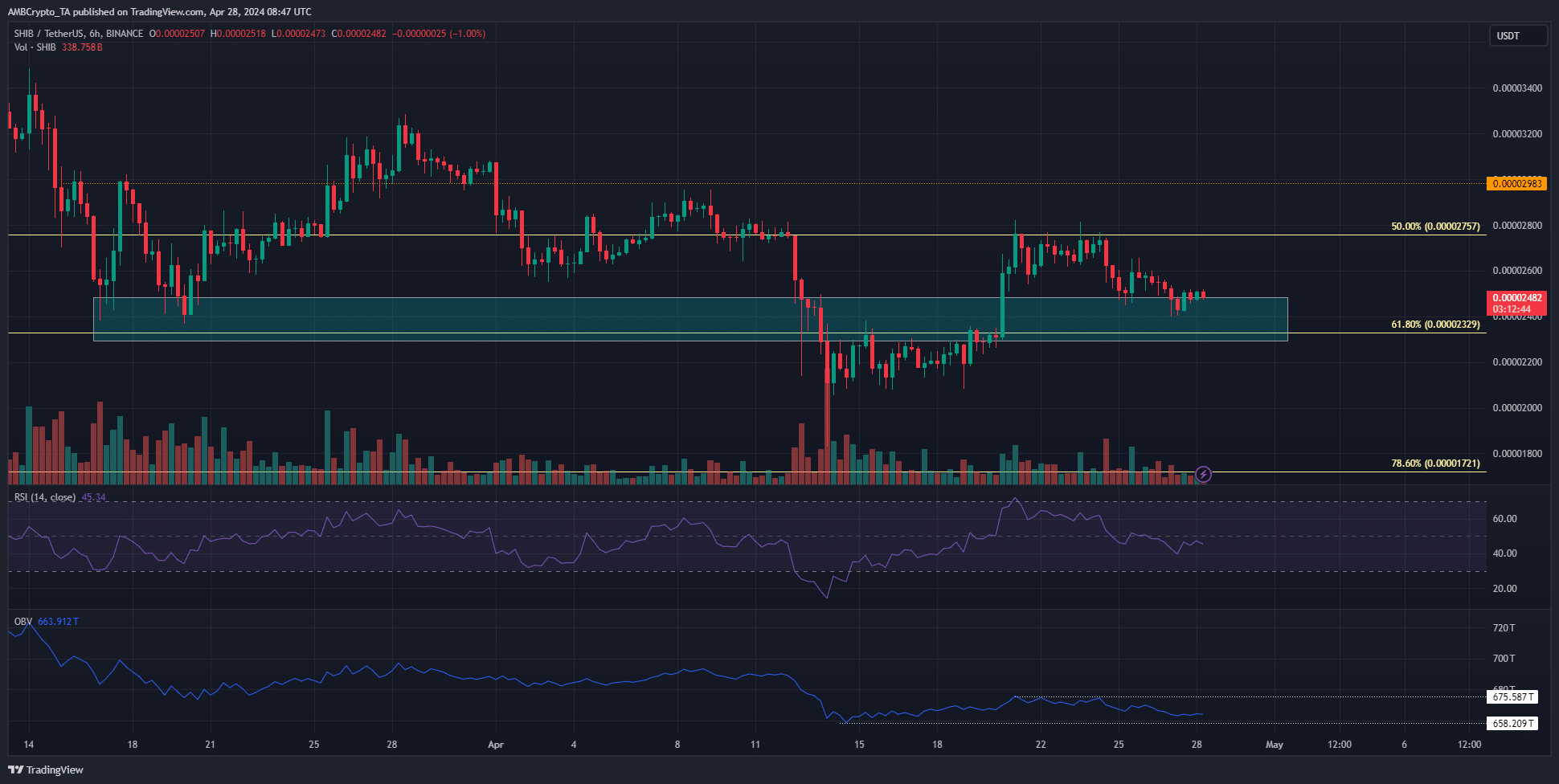

The support zone saw SHIB momentum falter

The encouraging sign for Shiba Inu bulls in the past two weeks was the $0.0000235 region (cyan) being flipped to support. However, the RSI was at 45 and showed bearish momentum had a slight advantage.

Similarly, the OBV was also unable to break the two key levels of the past two weeks. It suggested that buying and selling pressure were balanced, and neither side had a clear advantage.

Therefore, the BTC trend could be the deciding factor for SHIB in the coming week. To the north, the $0.00003 level is the short-term bullish target.

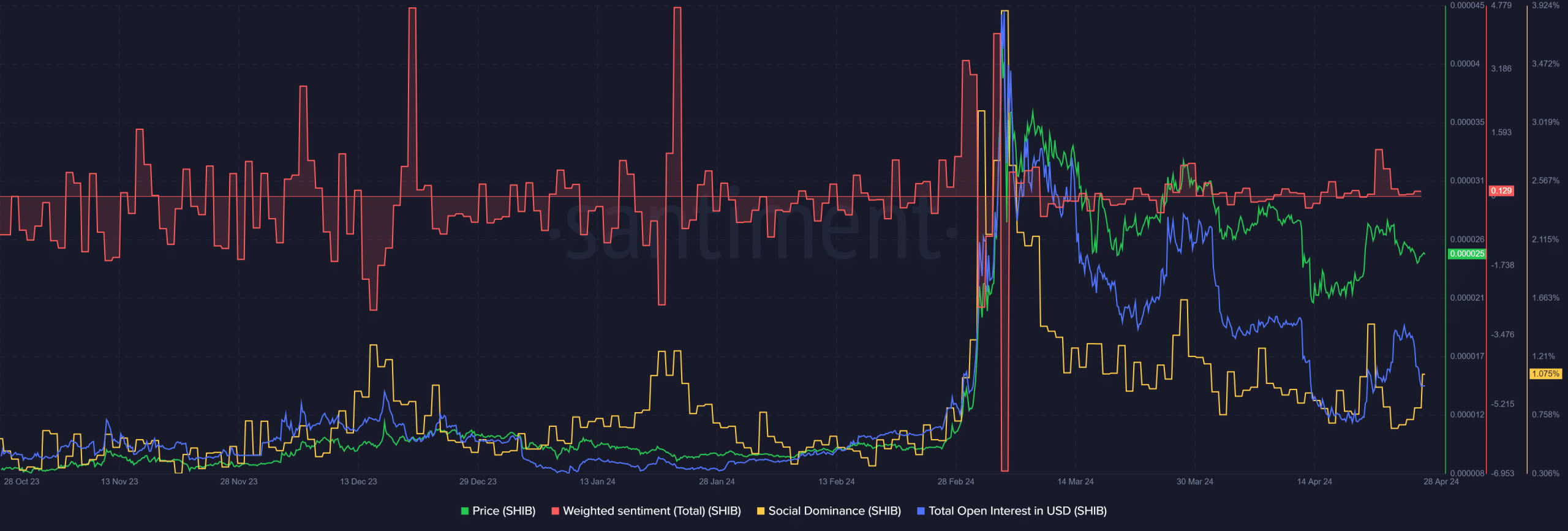

Weakened social sentiment highlighted the bullish struggle

Source: Santiment

The Weighted Sentiment behind Shiba Inu was slightly positive. Yet, the other metrics have been in decline alongside the price.

The Social Dominance has been on the wane in the past six months, reflecting reduced social media engagement around SHIB.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The Open Interest also saw a decline in the past three days as the meme token lost its lower timeframe bullish momentum.

These metrics likely swing upward if the prices do, which could be dictated by Bitcoin’s trends.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

[ad_2]

Source link