[ad_1]

- The Bitcoin halving has sparked short-term unpredictability.

- Debate over holding Bitcoin vs. taking profits emerged amid market fluctuations.

Just four days ago, Bitcoin [BTC] experienced its much-anticipated halving event, yet its post-halving price performance continues to make headlines with its unpredictability.

According to CoinMarketCap, the leading cryptocurrency was flashing all greens in its weekly chart at press time, signaling notable bullish movement within the market.

Impact of Bitcoin halving

Shedding light on the 30 days before and after the period of Bitcoin halving, Anthony Pompliano, in a recent conversation with Bloomberg noted,

“What we’ve seen historically is that the halving does take some time to kind of work in.”

Sharing insights from a Bitwise report, he added,

“In the month before the halving the average return over the last couple of bull markets has been 19% in the month after the halving it’s been 1.7%.”

This highlighted that while short-term fluctuations may occur immediately before and after the halving, the longer-term trend typically shows an upward trajectory.

If looked closely, this pattern aligns with basic economics: when demand for Bitcoin remains constant, but the incoming supply is halved, the price must adjust to ensure market equilibrium.

Pompliano suggested that this time around, the outcome was likely to follow the established pattern.

He predicted a potential upward movement in Bitcoin’s price over the coming months, consistent with historical trends.

“I think that this time won’t be any different.”

Echoing similar sentiment, Vijay Boyapati, author of “The Bullish Case for Bitcoin,” said,

“All things being equal, if demand for bitcoins were to remain constant, the halving would result in an excess of demand over supply, causing the price to rise.”

What are the numbers saying?

However, contrary to the aforementioned opinions, Layah Heilpern, Host of The Layah Heilpern Show, added,

“If don’t take profit this crypto bull run you’re making a HUGE mistake…”

This reflects Heilpern’s evolving perspective. While previously advocating for indefinite cryptocurrency holding, she now advises selling upon significant profit realization in this cycle.

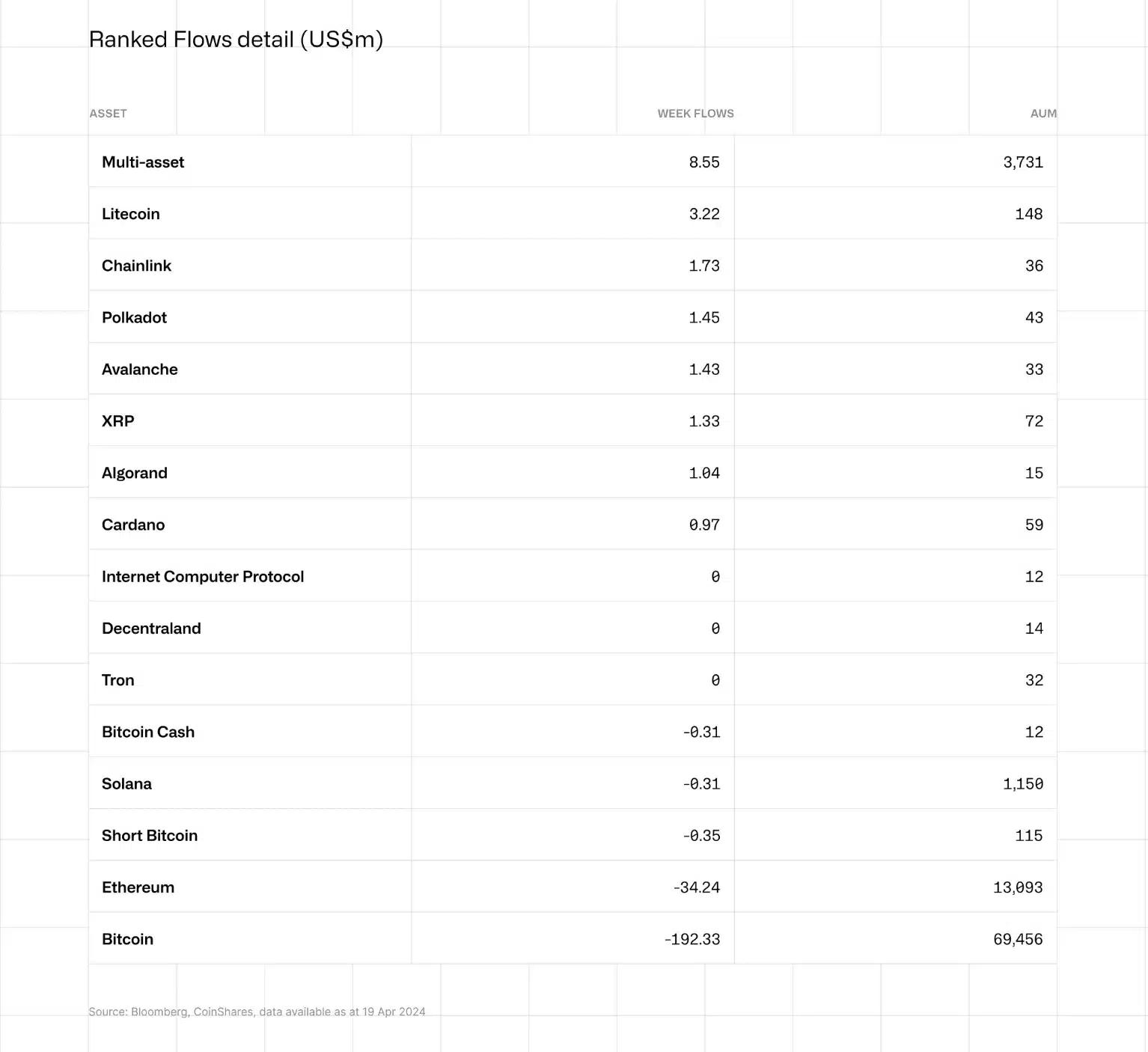

Needless to say, if we look at the data from CoinShares, cryptocurrency outflows amounted to a substantial $206 million, with Bitcoin leading the charge at $192 million, closely followed by Ethereum [ETH] with $34 million.

Thus, while short-term fluctuations may raise concerns, the long-term potential of Bitcoin holds significant benefits.

[ad_2]

Source link