[ad_1]

- Historical design shown by the MVRV ratio, led ETH to bounce.

- While traders booked some profits, the OI indicated that more was close.

On the 8th of April, Ethereum [ETH] defied the school of thought that it was a slow move this cycle as its market cap jumped by over 9%. This increase placed its market cap at over $440 billion.

During this time, the altcoin’s price surpassed $3, 700 before its slight drop. But that was not the major highlight.

The past is sometimes the present

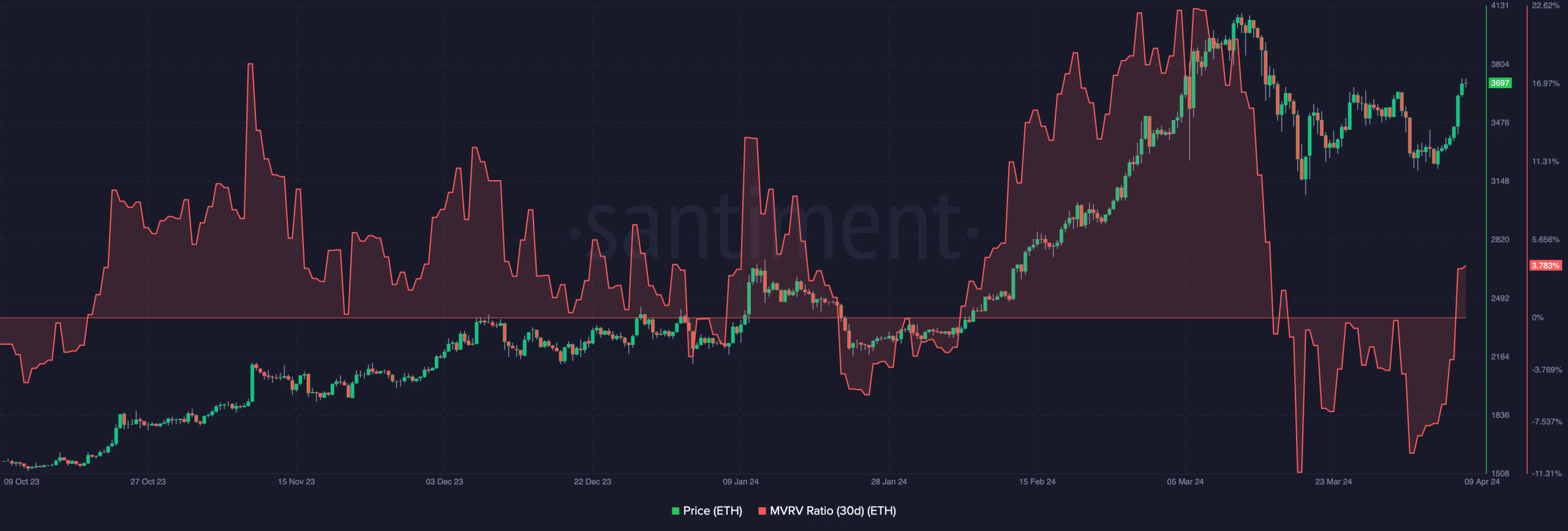

AMBCrypto analyzed Ethereum’s on-chain condition and observed the Market Value to Realized Value (MVRV) ratio. This ratio provides insights into traders’ buying and selling behavior. It can also help to spot the bottoms and tops of an asset.

Between the 1st and 7th of April, ETH’s 30-day MVRV ratio was negative, suggesting an unusual buying opportunity in the region. This prediction was based on the cryptocurrency’s history.

For instance, the ratio was -4.90 in October 2023 while ETH changed hands at $1,566. Weeks later, the price crossed $2,000. A similar scenario also occurred in January as ETH moved from $2,237 to $4,088.

On both occasions, the price increased by 21.7% and 45.27% respectively. This time, Ethereum has only increased by 7.89%. Should the historical pattern repeat itself, the price could rally toward $4,648 over the next few weeks.

But that might only be the case if the market does not experience extreme volatility that could cause prices to nosedive. If this is the case, then the bullish prediction might be invalidated.

Is it time for surplus gains?

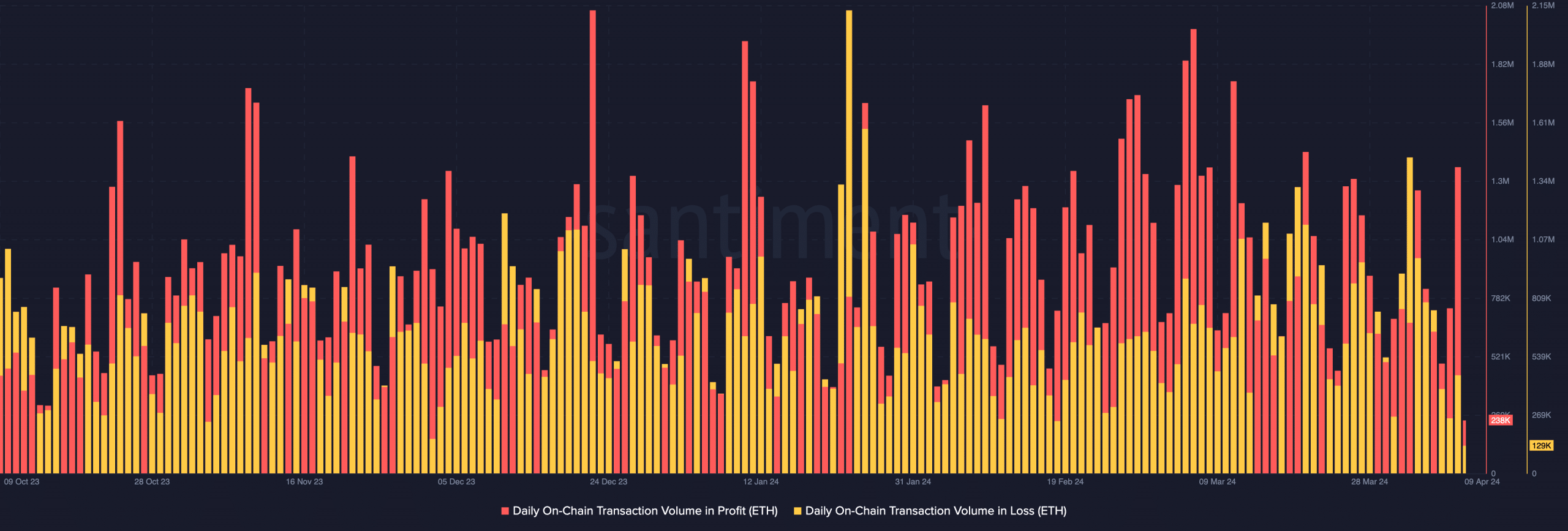

In the meantime, traders took advantage of the price increase to realize some profits. This was something that ETH holders could not boast of in recent weeks.

A look at the daily on-chain transaction volume in loss showed that it was $129,000. On the other hand, the on-chain transaction volume in profit was about 238,000.

If the price of the cryptocurrency continues to increase, then the volume in profit could be double those in the red. But will Ethereum give in to the rally?

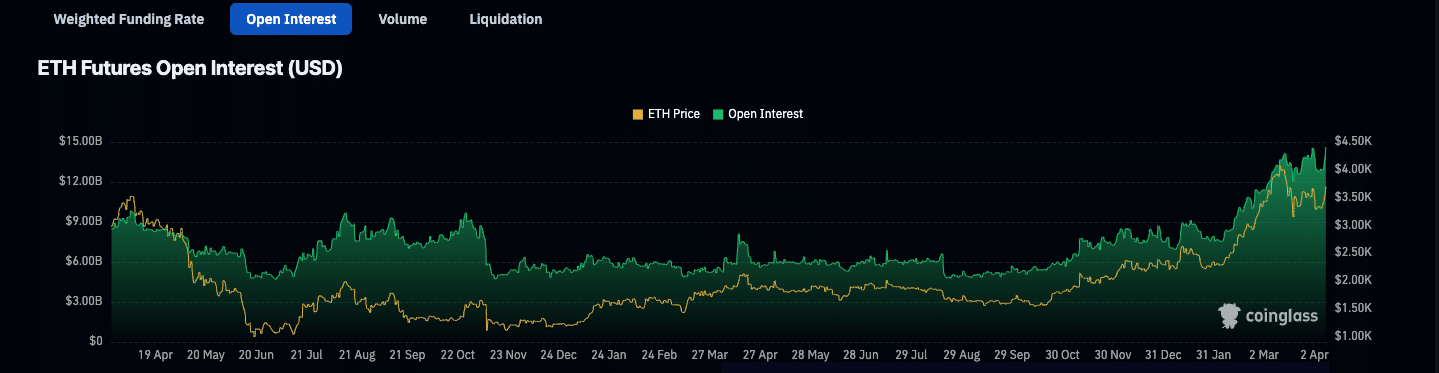

To ascertain this possibility, AMBCrypto looked at the Open Interest (OI). According to data from Coinglass, ETH’s OI jumped to $14.41 billion.

OI measures traders’ activity based on net positioning. If the OI decreases, it implies an increase in positions closed. On the other hand, an increase in the metric suggests a surge in liquidity added to open positions.

Therefore, the increase in the last 24 hours meant that more contracts had been opened, with buyers being the aggressive ones.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Looking at ETH’s price and the OI, it seems that the convergence might trigger a significant price movement.

From a trading perspective, the large OI alongside the rising value might lead to a breakout. Should this be the case, ETH’s rise above $4,000 could be next.

[ad_2]

Source link