[ad_1]

- Increased meme coin activity on Base contributed to the hike.

- A surge in active addresses could improve the number in the forthcoming weeks.

Layer-2 projects built on the Ethereum [ETH] blockchain like Polygon [MATIC] have been experiencing a surge in on-chain activity.

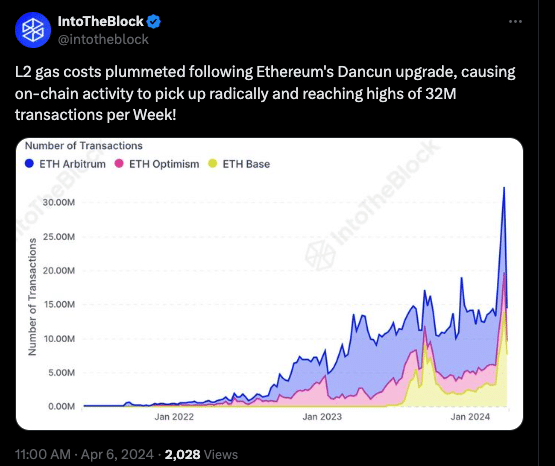

According to IntoTheBlock, transactions on the networks have hit 32 million every week since the Dencun upgrade.

However, the 32 million transactions were not for Polygon alone – it includes Base, Arbitrum [OP], and Optimism [OP].

Ethereum finalized the Dencun upgrade on the 13th of March. For the uninitiated, the upgrade helped to lower costs on Layer-2 networks. So, it was expected that activity would increase.

No more gatekeeping

Having this number for the past three weeks was tremendous. However, it was proof that the objectives of the development were working, as new entrants did not need to worry about exorbitant gas fees.

When AMBCrypto analyzed the data, we observed that Polygon led in several metrics. But Base kept it on its heels. For instance, transactions on Polygon were 4 million on the 5th of April.

Base, on the other hand, was 3 million while Arbitrum were 1.5 million and 801,400 respectively. However, one other thing we noticed was that, despite Polygon’s numbers, Base outclassed it in fees generated.

From our findings, Brett [BRETT], a meme coin built on Base, was one of the reasons the network dominated. Another one was Toshi [TOSHI].

While TOSHI was built as the face of Brian Armstrong’s cat, BRETT was referred to as Pepe’s [PEPE] best friend on the Base chain.

In the last 30 days, BRETT’s price has increased by 79.18%. At press time, it was market cap was $592 million.

TOSHI’s price jumped by 46.51% within the same period, while its market cap was a little over $179 million.

Such numbers imply that the prices and market cap could go higher. Should this be the case, the total L2 transactions on Ethereum might be higher going forward.

The tides have turned

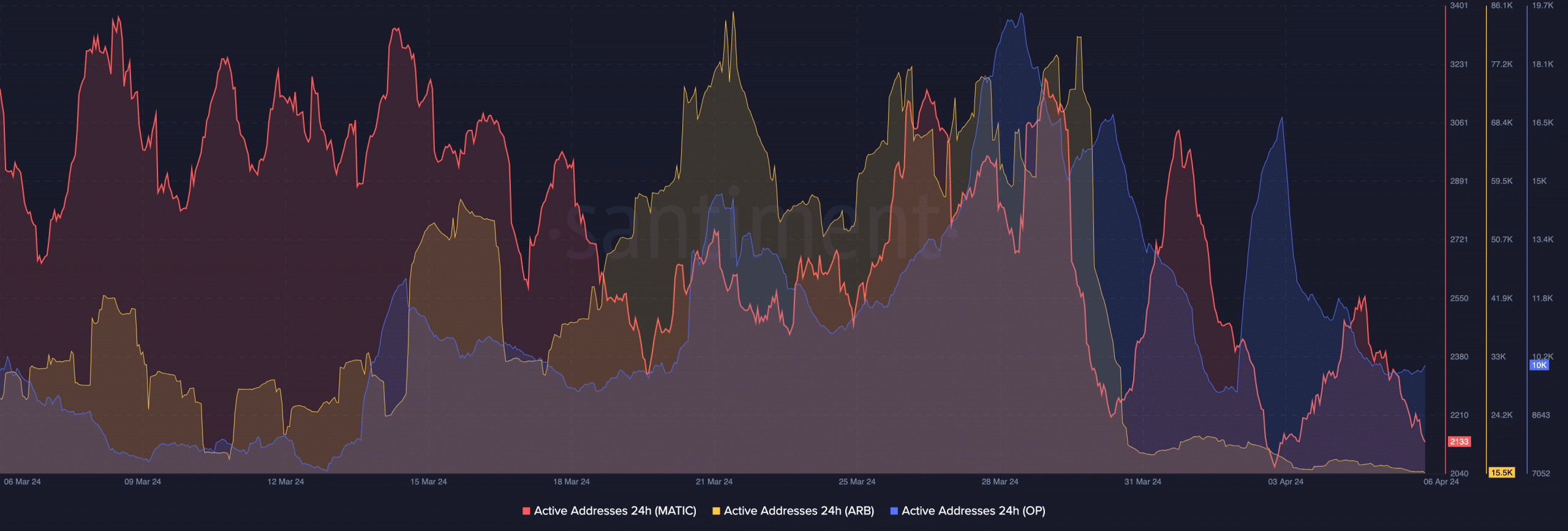

However, the dynamics were different concerning active addresses. According to data from Santiment, the 24-hour active addresses on Polygon were 2133.

On Arbitrum, it was a lower higher at 15,500. Optimism, on the other hand, had 10,000. Active addresses measure the daily level of interaction within a network.

But one thing common about the metric was that all of them decreased.

By comparing the activity with the transaction count, one can observe that fewer market participants were involved in higher transactions from Polygon’s end.

Realistic or not, here’s MATIC’s market cap in ETH’s terms

In the short term, network activity on the Ethereum L2s might drop as user interaction falls.

However, in the case where the market recovers from its “onlooking” mode, changes might occur. In this instance, active user count might improve, and weekly transactions might be more than 32 million.

[ad_2]

Source link