[ad_1]

- Inflows into new ETFs negated outflows from GBTC.

- Bitcoin still encountered selling pressure from long-term holders.

In a remarkable turnaround, Bitcoin [BTC] spot exchange-traded funds (ETFs) in the U.S. attracted substantial inflows on Tuesday, following a disappointing performance last week.

A strong net positive day

According to AMBCrypto’s analysis of SoSo Value data, about 6,000 BTCs, worth $418 million, flew into these investment avenues on a net basis, marking the strongest wave of inflows since the 14th of March.

With the latest influx, the total value of Bitcoins backing the spot ETFs hit $57.2 billion, constituting 4.20% of the crypto’s total market cap.

Fidelity’s spot ETF (FBTC) led the inflows chart, amassing $279.10 million worth of Bitcoins, followed by BlackRock’s IBIT fund with inflows of $162 million.

The total inflows from the nine newly-launched ETFs helped in negating $212 million in outflows from incumbent issuer Grayscale Bitcoin Trust (GBTC).

Last week, Grayscale outflows had exceeded inflows, resulting in five straight net negative days.

On a fascinating note, the accumulated amount by new ETFs included all newly mined Bitcoins on the day, the equivalent of Grayscale’s outflows, and an additional 5,092 coins from other sellers, venture capital firm HODL15Capital noted.

Bitcoin fails to lift

Despite a strong wave of inflows, Bitcoin stayed rooted around the $70,000 level, according to CoinMarketCap, implying that considerable selling was still taking place.

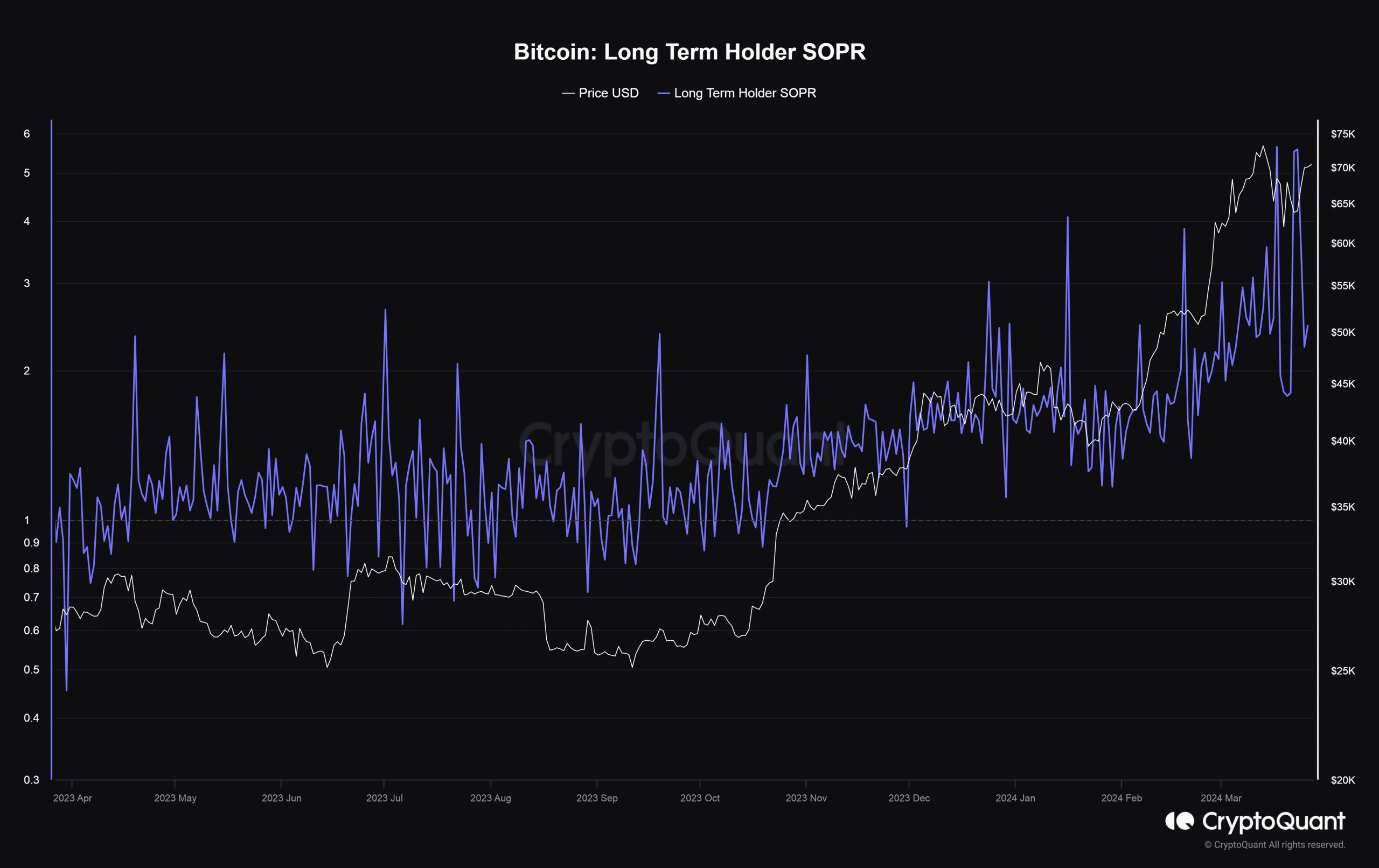

A lot of these sell-offs could be attributed to long-term holders of the coin. As per AMBCrypto’s scrutiny of CryptoQuant data, this cohort has been increasingly selling their holdings for profit lately.

Read Bitcoin’s [BTC] Price Prediction 2024-25

While events like this stem the asset’s rise, they bring previously inactive coins into the liquid supply. This could potentially lead to more demand and volatility.

A sentiment of “extreme greed” prevailed in the market, as per the latest update from Bitcoin’s Fear and Greed Index. This could lead to sustained buying pressure in the coming days, causing Bitcoin to go further north.

[ad_2]

Source link