[ad_1]

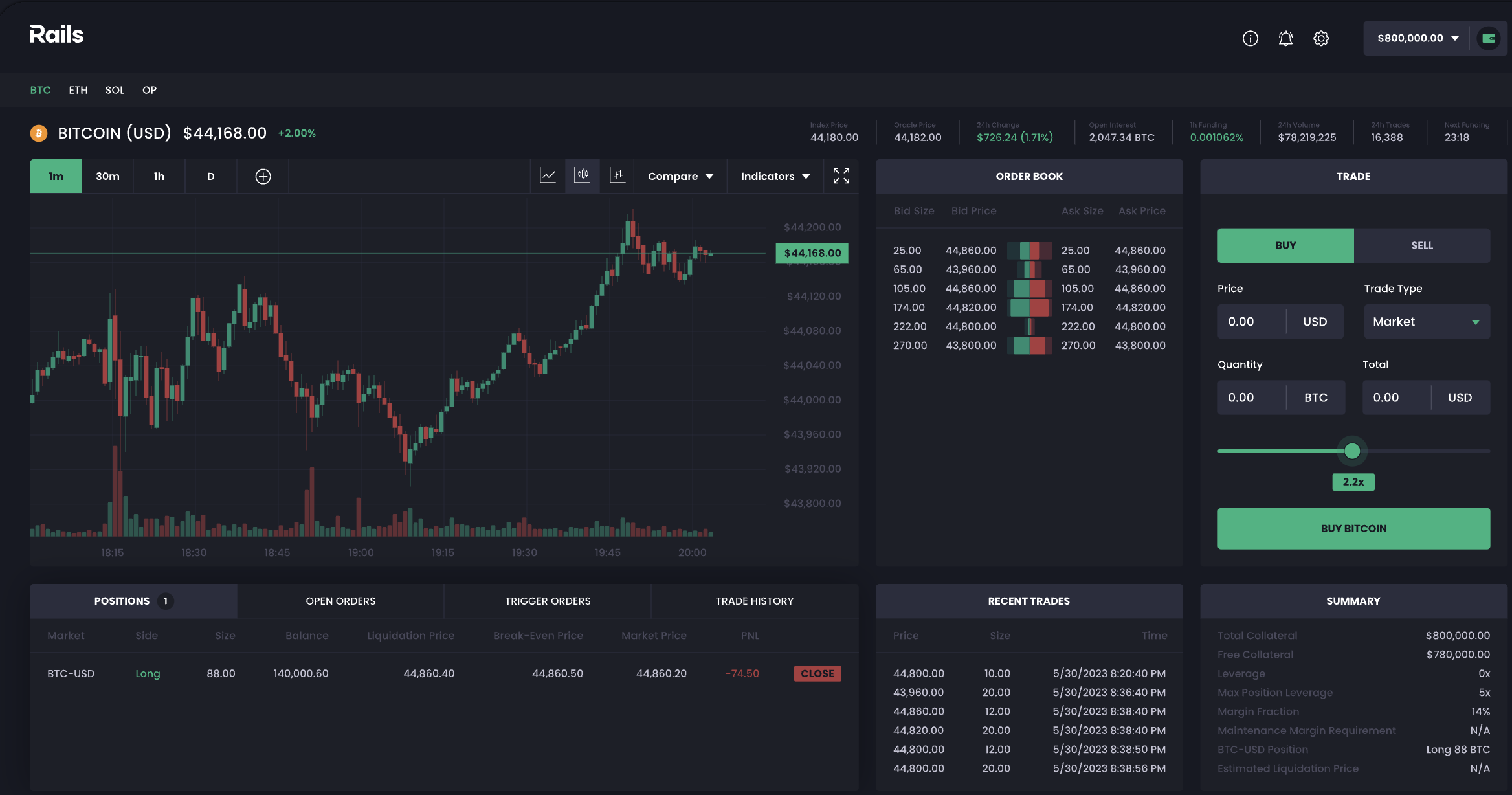

Rails, a decentralized crypto exchange, has raised $6.2 million in attempts to fill the void FTX left behind after crashing in 2022, the startup’s co-founder and CEO Satraj Bambra exclusively told TechCrunch. It is currently in the early stages of launching an offshore service in select crypto-friendly countries, which does not include the U.S.

The crypto community is watching Rails because it’s attempting to straddle the divide in crypto exchanges by building out both centralized and decentralized underlying technology.

The round was led by Slow Ventures with investment also from CMCC Global, Round13 Capital and Quantstamp. The capital is earmarked for engineering team hiring and expanding its licensing and regulatory strategy to make the exchange “fully compliant,” Bambra said.

While FTX had a plethora of problems, especially misusing customer deposits, Rails highlights its customer deposit safety as well as the crypto derivatives, or perpetual futures side of trading; something that institutions have been missing since Sam Bankman-Fried’s exchange went defunct.

“There’s a big gap, especially on the perpetual [futures] side with how institutions like to have exposure,” Bambra said. He co-founded the company with his wife Megha Bambra and the former COO of Grindr, Rick Marini. The husband and wife team previously co-founded a startup, crypto wallet BlockEQ, that sold to crypto trading platform Coinsquare for about $12 million CAD, or $8.8 million, in 2018.

Bambra shared that he’s heard from edge funds saying they want to trade crypto, but don’t have a route to do so; Rails hopes to be that opening. Its main clientele will be market makers on the supply side and primarily institutional clients and high-net-worth investors on the demand side.

For context, perpetual futures contracts trade relative to the spot price. So, for example, people aren’t buying the actual bitcoin itself but are buying contracts that mirror the price through another asset like stablecoin USDC. “It helps you play the direction of the market in a much more risk-managed way and that’s why we’re focused on that,” Bambra said.

And typically investors and users alike trust banks, financial institutions and exchanges to hold their funds, but Rails is going the self-custody route, which means the owner of the assets has total control over them.

Rails has already onboarded north of $10 million in capital early in a “private manner,” before it opens to the public in September or Q4 of this year, Bambra said. In May, it will open its exchange to select beta testing recipients to begin trading and ensure it’s working properly.

Image Credits: Rails (opens in a new window)

The startup’s exchange isn’t available in the U.S. and Bambra said it’s “still zoning through where it’ll be,” and will have an answer closer to September. “Onboarding capital will be from friendly jurisdictions.” When asked which ones, he said there were “none he can share at this time.”

“We just want people to use their money and that’s why we have decentralized custody,” Bambra said. “It’s a marriage between central computing and decentralized custody.”

Central computing helps control risk management, so trade orders can have a reliable and well-managed environment, making executions quick and fast, he added. But decentralized custody allows people to be the owners of their funds, not the exchange.

“It’s all focused on user experience. Using Rails, you’ll sign in and sign up, but we’ll educate people on having funds on [crypto] wallets and how to withdraw,” among other objectives.

To fix FTX’s problem, there needs to be an on-chain solution, Bambra thinks. That centralized computing was something Rails saw with FTX as “being really, really good,” but when it came to decentralized exchanges like dYdX that exist today it wasn’t as solid, Bambra thinks.

But being a hybrid of decentralized and centralized is better than being fully one side or another, he added. “For people who haven’t traded crypto before that want to, it’s difficult and cumbersome. For people who trade it day in and day out, they aren’t comfortable putting the size they used to put on decentralized exchanges.”

And users will feel a “centralized” experience, without realizing that “everything except your money is decentralized,” Bambra said. All the executions will be centralized, but money is kept in smart contracts, a self-executing action on the blockchain that requires no intermediaries, that will be audited.

So the team aims to bridge the gap between central computing and decentralized custodying of assets, through cryptography and blockchain technology, to provide automatic visuals into what’s actually being executed on the exchange and with funds.

After the anticipated public launch later this year, Rails wants to focus on expanding its social functions, leaderboard capabilities and create partnerships with industry players to expand the product. “We’re very product focused,” Bambra said. “We’re not an opportunistic startup.”

[ad_2]

Source link