[ad_1]

- Relatively smaller Bitcoin addresses begin to accumulate BTC as prices surge.

- Profitability remained low, reducing the chances of sell-offs anytime soon.

Ever since Bitcoin[BTC] has passed the $70,000 mark and then witnessed a correction, speculation around what will happen next to the coin has flooded the crypto sphere.

Crabs and Fishes take the pie

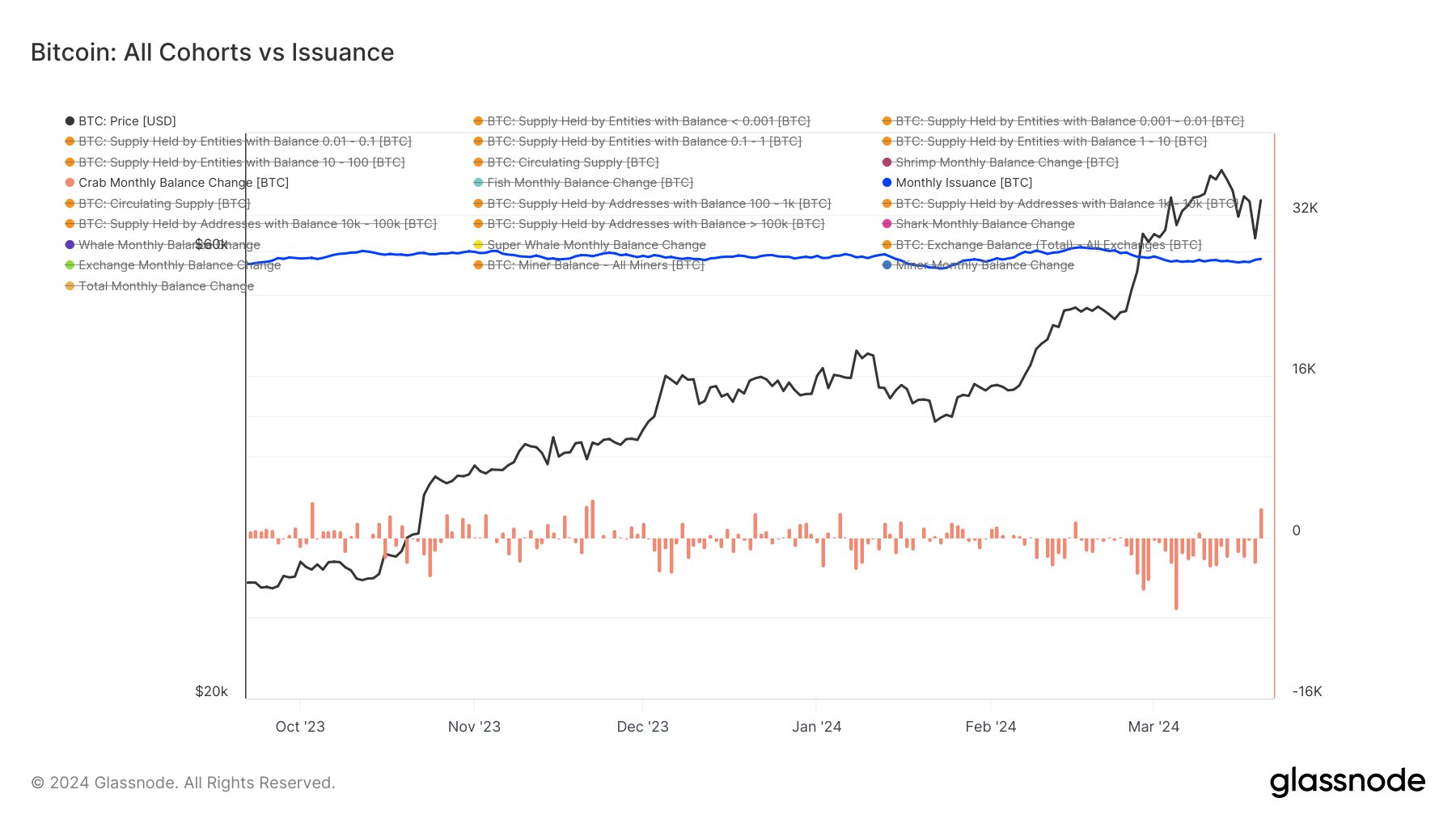

The price of Bitcoin may rally due to the behavior of two distinct groups of holders known as “crabs” and “fishes.” These terms refer to holders with Bitcoin holdings ranging from 1 to 10 BTC for crabs and 10 to 100 BTC for fishes.

Recent observations suggest a potential regime change among these holders, transitioning from a phase of distribution to accumulation.

Both crabs and fishes have experienced the highest level of accumulation since November 2023. Moreover, there are indications that even smaller holders, with holdings of 0 to 1 BTC, are joining this accumulation trend, as evidenced by recent data.

While this accumulation broadens the investor base, it also concentrates holdings among these mid-tier investors, which could lead to more centralized control over the market compared to a scenario with a wider distribution of smaller holdings controlled primarily by whales.

Some challenges ahead

However, key metrics indicated that the market had potentially overheated, as evidenced by the Bull-Bear Market Cycle Indicator. It entered an overheated-bull phase and traders maintained high unrealized profit margins.

After this, selling among BTC traders commenced, capitalizing on these elevated profit margins. This scale of selling hadn’t been observed since May 2019.

Additionally, significant Bitcoin holders intensified their selling activities, while miners also began offloading their holdings amid the soaring prices.

These factors could impact BTC’s journey past the $70,000 mark negatively. At press time, BTC was trading at $$64,749.87 and its price had declined by 3.44% in the last 24 hours.

Realistic or not, here’s BTC’s market cap in ETH terms

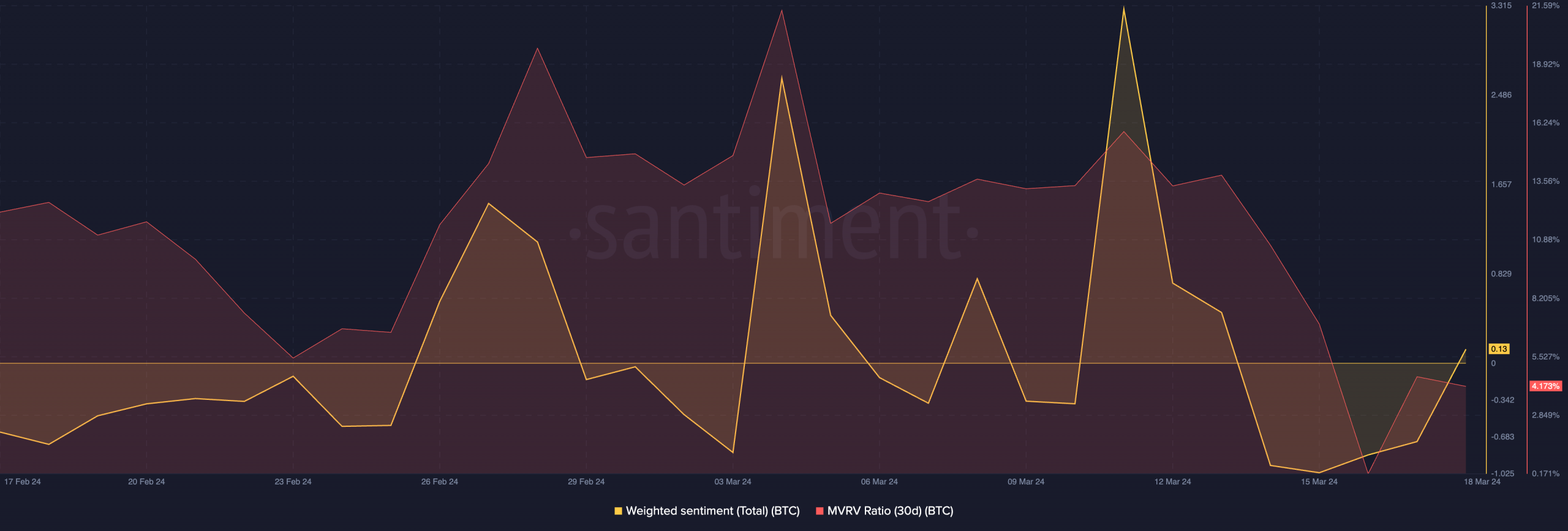

Interestingly, the MVRV ratio had remained low, signifying that many holders were still not profitable. The low MVRV ratio suggested that the current uptick in price may have been caused by new entrants who still haven’t seen profits yet.

This makes it much more likely for BTC to reach $70,000 as profit won’t be possible at current levels. However, sentiment might shift as prices grow past $70,000 and the likelihood of correction would also grow.

[ad_2]

Source link