[ad_1]

Hello and welcome to the latest edition of the FT’s Cryptofinance newsletter. This week, we’re looking at Coinbase’s role in the industry’s newly approved bitcoin ETFs.

After two weeks of life, there are some things we know about the string of bitcoin exchange traded funds that have proliferated on US stock markets.

The largest, Grayscale Bitcoin Investment Trust, is experiencing a huge outflow of assets. The regulatory approval that opened the door for more investors to get exposure to bitcoin can also be the passage to leave a services you’re unhappy with, or simply exit the market altogether.

We also know that sometimes it’s better to travel than arrive. Since approval was confirmed bitcoin is down about 15 per cent.

But an important point has thus far flown under the radar: the safety and security of the bitcoins on which the ETFs are built.

Legally speaking the ETF sponsors such as BlackRock, Grayscale, Ark etc hold the bitcoins in a trust; in practice the assets are held by a custodian on behalf of the trust. Eight of the 11 sponsors have chosen Coinbase as their custodian. Fidelity is using its own digital asset custody business.

This raises eyebrows for two reasons: first, the exchange is being sued by the US Securities and Exchange Commission for allegedly failing to register as a national securities exchange, among other things.

In one — narrow, legal — sense, that lawsuit focuses “only” on whether Coinbase filled in correct forms or not. It doesn’t pass judgment on Coinbase’s capabilities or business practices. Even if the SEC is successful, the lawsuit won’t necessarily hinder Coinbase’s ability to offer custodial services to clients.

Secondly and more importantly — and I will emphasise this contradiction for as long as the word decentralisation is synonymous with crypto — Coinbase’s dominance of the custody market is a major single point of failure for the new sector.

Anyone who has paid attention to crypto for even five minutes knows the problems this market has always had in holding and protecting other people’s assets.

Mt. Gox customers are still waiting for their money after a hack in 2014 caused the infamous exchange to fail. Investors in Celsius and of course, FTX, are still trying to get their money back.

Coinbase is a different entity and says it maintains very strict walls between its operations. Its exchange and custody business shouldn’t be at risk from market volatility.

Still, imagine — hypothetically of course — that Coinbase was hacked or it suddenly collapsed in the manner of many crypto companies before it. What then?

“There is always a risk that a custodian could collapse, and I think the risk is heightened whenever you’re talking about a less mature market, like crypto is,” said Jeremy Senderowicz of law firm Vedder Price.

I reached out to each of the eight firms with Coinbase, and asked them what their Plan B was, as a back up. Only two responded. WisdomTree and Grayscale both said they could choose to change custodian at their own discretion.

But we’ve seen crypto companies collapse at speed: will the sponsors be fast enough to react? And if not, what happens to the stranded assets?

BlackRock’s prospectus — to take one example — makes things pretty clear.

“There is a risk that customers’ assets — including the Trust’s assets — may be considered the property of the bankruptcy estate of . . . the bitcoin custodian, and customers — including the Trust — may be at risk of being treated as general unsecured creditors of such entities and subject to the risk of total loss or markdowns on value of such assets.”

Grayscale’s risk factors are similarly blunt: “The legal rights of customers with respect to digital assets held on their behalf by a third-party custodian, such as the Custodian, in insolvency proceedings are currently uncertain.”

Ouch. It’s not much better if the custodian is hacked.

BlackRock says its bitcoin custodian has insurance coverage “of up to $320mn that covers losses of the digital assets it custodies on behalf of its clients”. That’s not a lot to cover $2bn of assets under management.

In fairness to Coinbase, it recognises its unique position. “We are committed to sharing and creating transparent industry standards to develop the security capability of industry peers, and welcome the future diversification of custodianship,” Philip Martin, the exchange’s chief security officer, told me.

Competition for custody business seems to be on its way. Anchorage Digital Bank — which holds a bank charter from the US Office of the Comptroller of the Currency — has designs on the market.

“We’re the natural diversification partner for ETF issuers,” chief executive Nathan McCauley told me on Wednesday. “We’re spending a lot of time, energy and effort to make sure we capture that.”

From a risk management perspective, diversification is always handy. But if a crypto Willie Sutton appears, ETF investors large and small have the same minimal safety net that purchasers of cryptocurrencies have.

What’s your take on Coinbase’s role as custodian for so many bitcoin ETFs? As always, email me at scott.chipolina@ft.com.

Weekly highlights

-

While we’re on the subject of bitcoin ETFs, don’t miss my story this week on bitcoin losing 15 per cent of its value over the past two weeks. Underwhelming flows into the newly approved league of bitcoin ETFs have — so far — given the lie to the market’s assumption that new investors would be drawn into bitcoin.

-

The Bank of England and HM Treasury on Thursday responded to a public consultation that brings the UK potentially closer to launching a digital pound. Concerns surrounding user privacy were raised last year, but this week the BoE and HMT committed to introduce primary legislation to parliament aimed at protecting the public’s financial privacy should a digital pound be eventually rolled out.

Soundbite of the week: Drawing battle lines

You may recall the US Office of Foreign Assets Control imposing sanctions on crypto mixing service Tornado Cash, alleging the platform helped launder billions of dollars worth of illicit funds linked to North Korea-backed criminal hackers.

Roman Storm, one of the developers behind the service, also faces a criminal trial to answer charges of money laundering and the violation of sanctions rules. He has pleaded not guilty.

Now he is seeking crowdfunding to pay for his defence.

Folks, I need your help. Whether you’re a passionate developer like me involved with Web 3, or you just care about software and privacy, this legal battle will affect you, so please help contribute to my legal defence because this case will set a major precedent for years to come.”

Data Mining: Ether falls with bitcoin

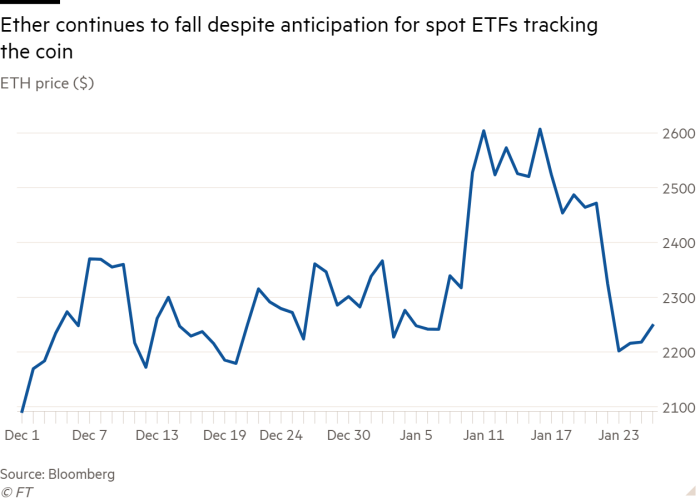

Bitcoin went on a four-month surge on expectations that the SEC would finally approve exchange traded funds. The second-largest cryptocurrency, ether, is also on the same regulatory journey — but its price isn’t enjoying the same boost.

Like bitcoin, it has dropped since the SEC approved the first spot crypto exchange traded funds. This week the SEC pushed back the date for approval of an ether ETF again but there’s still several months to go before the regulator runs out of road and has to make a decision.

But the market seems to have learned an important lesson: the approval of an exchange traded fund doesn’t necessarily mean the price of the underlying asset is going to fly. Who knew?

FT Cryptofinance is edited by Philip Stafford. Please send any thoughts and feedback to cryptofinance@ft.com.

[ad_2]

Source link