[ad_1]

Crypto analytics firm Santiment says that peer-to-peer payments network Litecoin (LTC) is flashing readings that could lead to a price surge.

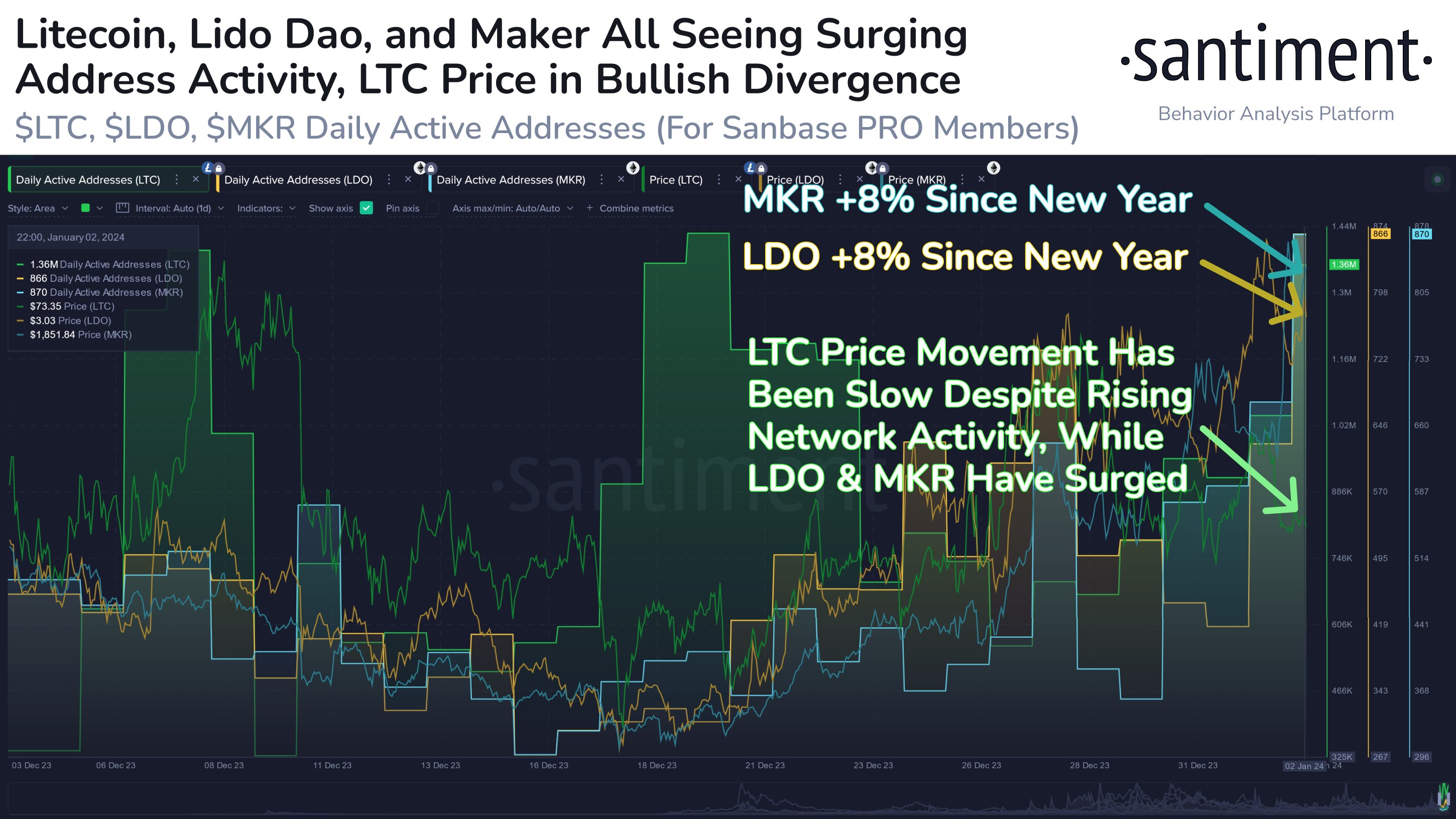

Santiment notes that Litecoin, decentralized finance (DeFi) protocol Maker (MKR) and liquid-staking service provider Lido DAO (LDO) are all witnessing rapidly rising address activity.

According to the analytics firm, the on-chain signal is typically “accompanied by market cap growth.” Santiment also notes that Litecoin is flashing a bullish divergence, a technical signal that suggests an asset may be gearing up for a price surge.

At time of writing, Litecoin is trading at $65.52, down about 11% since the start of the year when LTC opened at $73.88. Meanwhile, LDO is worth $3.54, up 30% since January 1st, and MKR is worth $1,769, a 6.16% increase year to date.

Some crypto analysts, however, aren’t predicting bullish price action for the project colloquially known as “digital silver.”

Earlier this week, the crypto trader Ali Martinez told his 39,500 followers on the social media platform X that LTC’s market outlook “appears challenging” after its price dip this week.

“If the selling pressure continues, LTC might see a push down to $38, potentially confirming a bear flag formation.”

A drop to $38 would represent a 42% decrease from Litecoin’s current price.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

[ad_2]

Source link