[ad_1]

These burned by the final huge Bitcoin bull run are rightfully skeptical that one other one is right here so quickly. Nevertheless, a pattern power indicator is now confirming the existence of a brand new bullish pattern rising.

Are bulls lastly again in management over crypto? Sidelined traders and merchants will wish to listen.

How Technicals May Verify A New Bullish Development In Bitcoin

Bitcoin worth is pulling again after a couple of failed makes an attempt to make it although $38,000 resistance. This sudden weak spot after a serious breakout is each reassuring for bears and complicated for bulls. These on the sidelines nonetheless aren’t sure what to do.

However that’s what technical indicators had been designed for – to remove noise and feelings, permitting the instruments to make the choices for you.

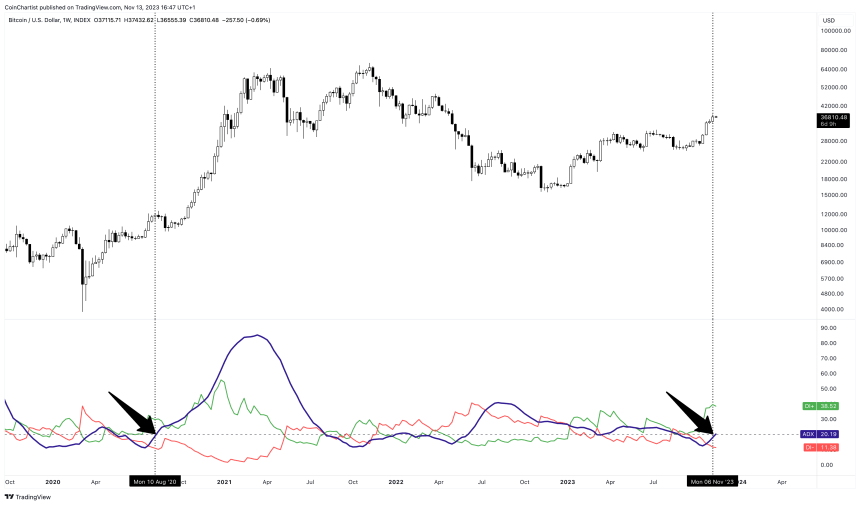

Based on a pattern power measuring software known as the Average Directional Index, the bullish Bitcoin pattern simply turned official because the indicator reaches above a studying of 20. The final time that BTCUSD reached above 20 whereas bulls had been in management was again in August 2020, previous to a 450%+ rally.

For comparability sake, one other 450% rally would put the value per coin round $200,000. Nevertheless, every particular person pattern behaves in a different way and tops out at totally different ADX studying. This implies something is feasible, however for now, the rise above 20 on the ADX is notable.

The pattern is confirmed by a studying above 20 | BTCUSD on TradingView.com

How To Inform Bulls Are In Management Of Crypto With The ADX

The Average Directional Index, as talked about, is a pattern power measuring software. It was created by J. Welles Wilder, Jr., referred to as the daddy of a number of technical evaluation indicators. Wilder additionally developed the Relative Power Index, Common True Vary, and Parabolic SAR.

The ADX confirms a pattern is lively above a studying of 20, whereas something under 20 suggests a weak pattern and potential sideways worth motion. The software typically contains two extra indicators, the DI+ and DI-, which present which facet of the market is accountable for worth motion.

If the DI+ is above the DI- bulls are in management. Bears are in management if DI- is above DI+. The premise is straightforward and gives a simple option to visually see which facet of the market is dominating.

Not solely are bulls in management, however the DI+ is at 36, whereas the very best studying again in August 2020 was 32. Which means that bulls are stronger now than they had been again then, and look what occurred.

The above chart was initially featured in Issue #27 of CoinChartist VIP: The Ethereum Issue. Take a look at the newest challenge for free.

[ad_2]

Source link