[ad_1]

Radiant Capital, a lending and borrowing protocol for customers to borrow numerous property throughout a number of chains, is quickly closing in on Aave, earnings knowledge over the previous six months.

Radiant Capital Earnings Rising: What’s The Set off?

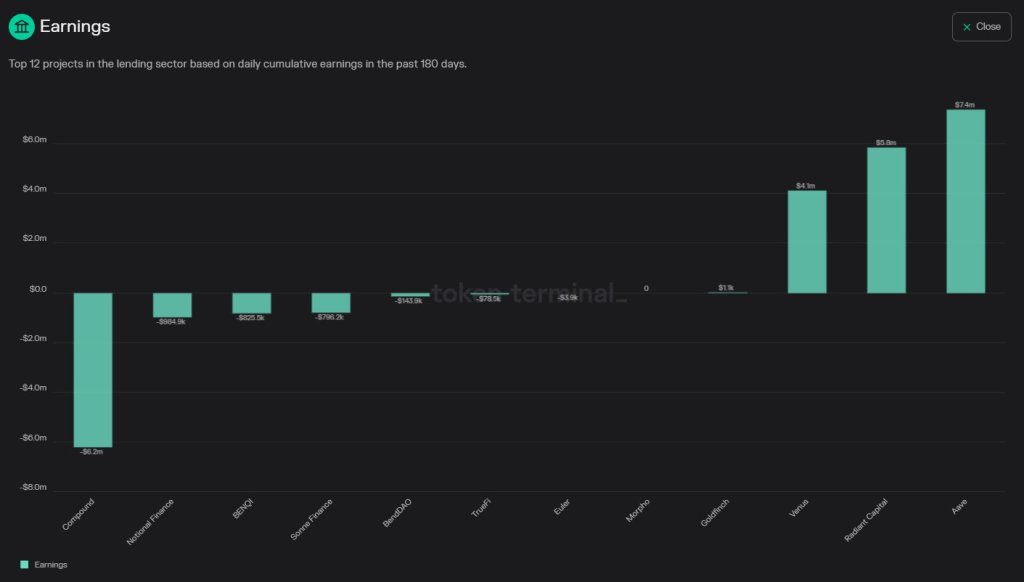

In keeping with Token Terminal statistics on November 8 shared by one person on X, @Flowslikeosmo, Radiant Capital generated $5.8 million in income regardless of a comparatively decrease stage of liquidity than Aave. @Flowslikeosmo, who claims to be a crypto researcher, mentioned Radiant Capital’s earnings will doubtless explode within the upcoming classes, particularly as soon as the two.8 million ARB begins to be deployed.

Radiant Capital is a well-liked cross-chain decentralized cash market by means of which customers, no matter their alternative blockchain, can both lend their property and earn passive revenue or borrow property trustlessly. This manner, the decentralized finance (DeFi) protocol has opened up liquidity and boosted entry to a number of blockchains.

Associated Studying: Dogecoin In Tight Zone: Why A Rally Will Happen If DOGE Clears $0.076

To carry out successfully, the protocol depends on LayerZero, which allows trustless and decentralized communication between blockchains utilizing Oracle Relays, permitting platforms to be extra interconnected and ledgers to be extra interoperable. As Radiant Capital affords providers, the DeFi protocol generates earnings or income primarily from charges.

The platform fees a protocol price on all transactions. Earnings from this permit the group to be operational whereas permitting the protocol to generate income.

Nevertheless, it ought to be famous solely 15% of this price is used to cowl operational expenditure, with the remaining redistributed to customers as yield. Moreover, there are charges billed to customers taking flash loans. The protocol rewards suppliers with RDNT to incentivize liquidity provision, relying on the quantity offered and the length locked.

ARB Airdrop, Will RNDT Rally To New 2023 Highs?

Earnings generated depend upon the exercise stage, immediately influencing protocol charges accrued and the variety of customers taking flash loans. Following Radiant Capital’s current announcement that it plans to airdrop 2 million ARB following the Arbitrum DAO‘s approval of a proposal first floated in late September, exercise may skyrocket within the coming months, boosting earnings.

Furthermore, the protocol’s liquidity is predicted to extend with this approval. The ARB airdrop shall be used to incentivize liquidity provision. Moreover, Radiant Capital will strike extra partnerships, permitting it to increase to different chains, together with Ethereum and Arbitrum.

In keeping with Dune Analytics data, the variety of RDNT holders continues to rise, mirroring its common worth efficiency. To this point, RDNT is up 40% from October lows. The quick resistance stage at $0.33 should be damaged for the coin to rally, even registering new 2023 highs.

Function picture from Canva, chart from TradingView

[ad_2]

Source link