[ad_1]

Digital property supervisor CoinShares says Bitcoin (BTC), Ethereum (ETH), Solana (SOL) noticed heavy inflows from institutional traders final week.

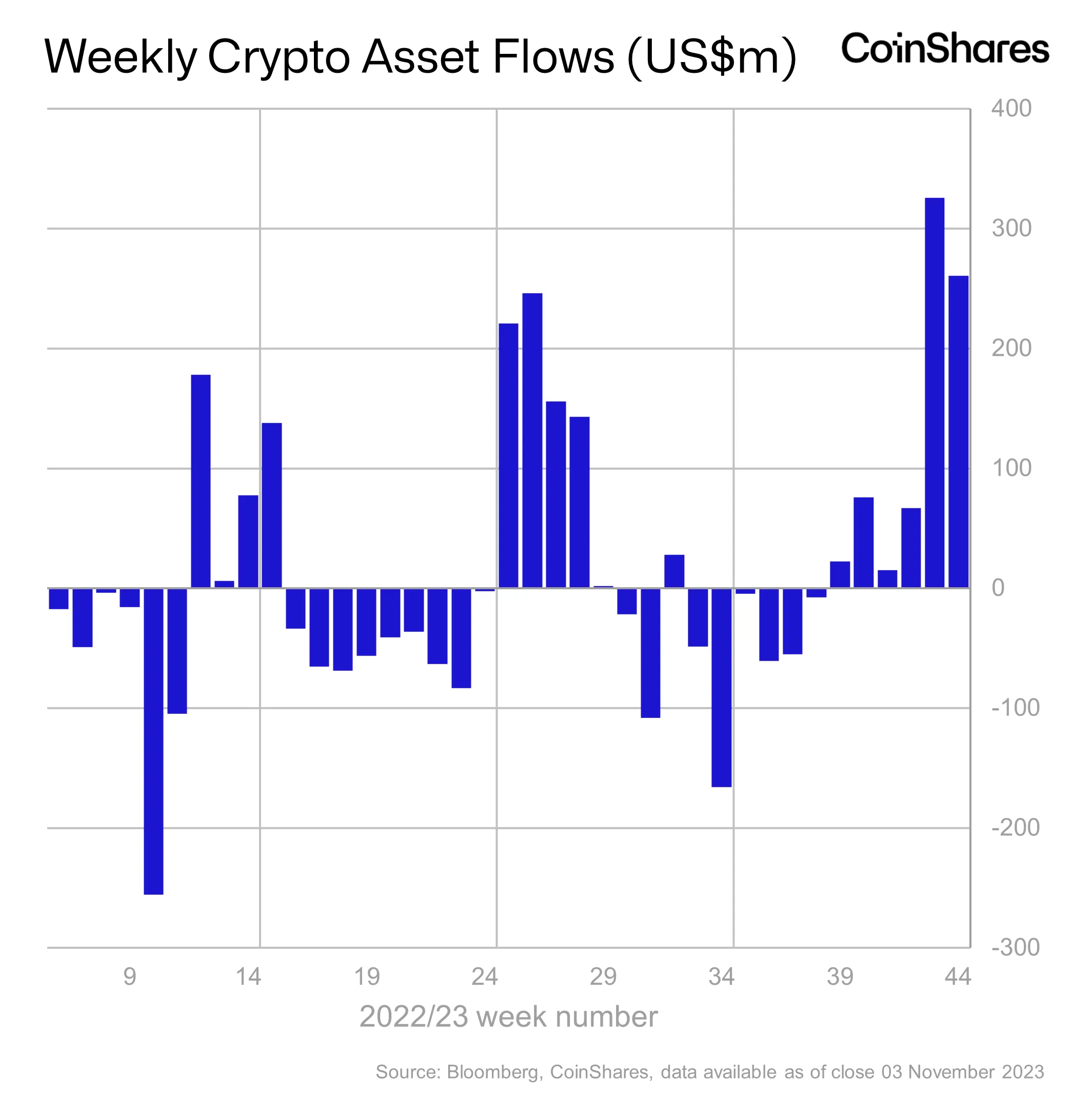

In its newest Digital Asset Fund Flows report, CoinShares finds that institutional traders are persevering with to allocate to crypto because the asset class enjoys its sixth consecutive week of institutional inflows.

“Digital asset funding merchandise noticed inflows totaling US $261 million, representing the sixth week of consecutive inflows that now totals US $767 million, surpassing the overall inflows of US $736 million seen in 2022. This run of inflows now matches the July 2023 run of inflows and is the most important for the reason that finish of the bull market in December 2021.”

Per standard, king crypto BTC took the lion’s share of inflows at $229 million, doubtless spurred by the idea {that a} spot BTC exchange-traded fund (ETF) is probably going on the best way, in response to the agency.

“Bitcoin noticed the lion’s share of inflows, totaling US $229 million, bringing year-to-date inflows to US $842 million, doubtless buoyed by the rising likeliness of a spot-based ETF within the US and weaker than anticipated macro knowledge, bringing into query the efficacy of US financial coverage.”

ETH merchandise noticed $17.5 million in inflows final week, breaking a pattern that has put ETH flows within the adverse by $107 million this yr. Solana continued to be an investor darling, raking in $10.8 million final week.

Ethereum-based blockchain oracle Chainlink (LINK) appreciated inflows of $2 million whereas Polygon (MATIC) and Cardano (ADA) noticed inflows of lower than one million apiece.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Price Action

Comply with us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/Scrudje/DDevecee

[ad_2]

Source link