[ad_1]

The Hong Kong Financial Authority (HKMA) is getting into the second section of its e-HKD (e-Hong Kong greenback) pilot program, testing use circumstances for a attainable central financial institution digital foreign money (CBDC).

In a brand new report issued by the HKMA, the central financial institution says the primary section of the hassle had 16 completely different corporations exploring a number of areas of CBDC use.

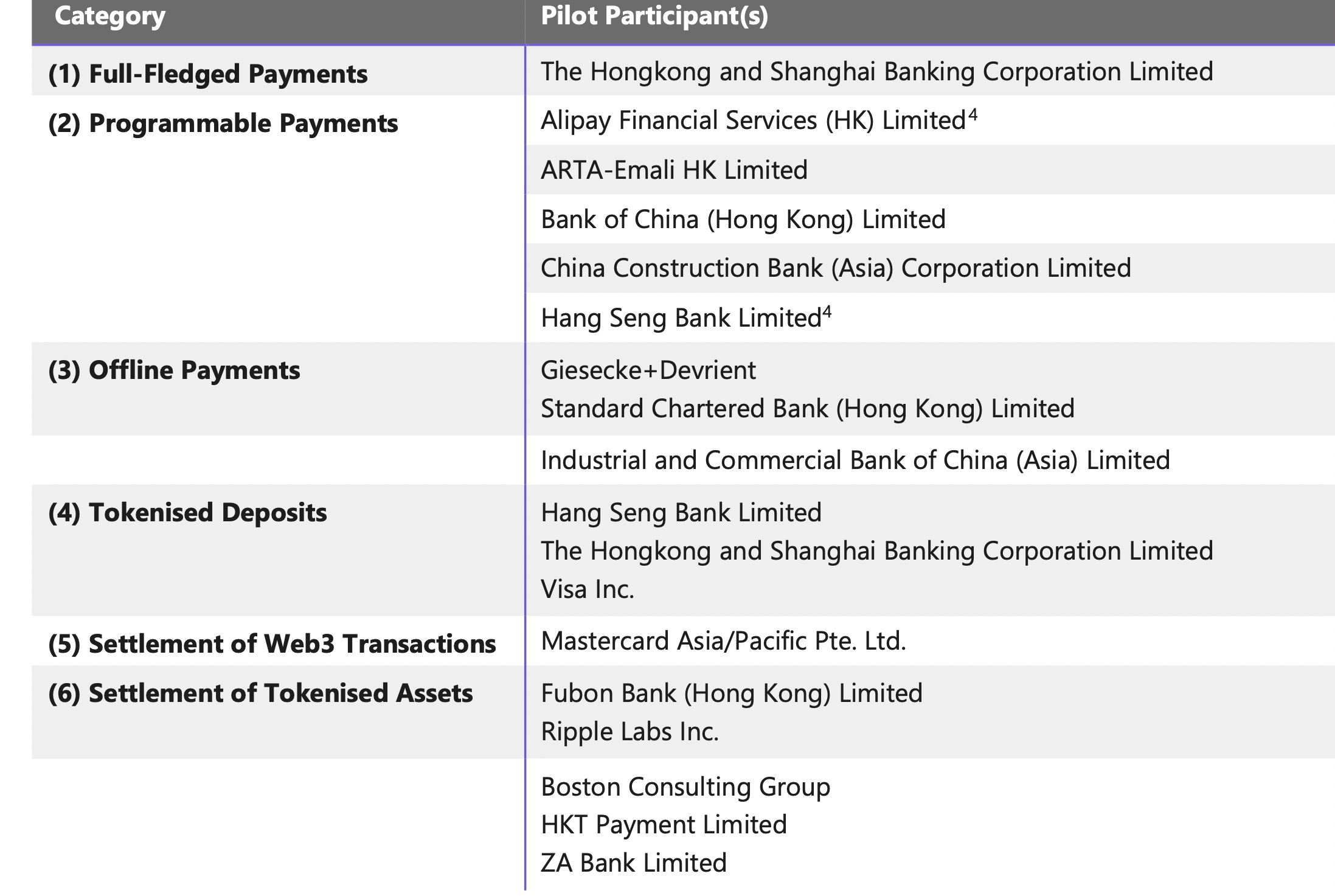

“Part one took deep dives into potential home and retail use circumstances in six classes: full-fledged funds, programmable funds, offline funds, tokenized deposits, settlement of web3 transactions, and settlement of tokenized property. Sixteen corporations from monetary, fee and expertise sectors had been chosen to take part.”

One section one participant, funds large Mastercard, explored “wrapping” e-HKD to be used throughout different blockchains by “simulating the acquisition of bodily gadgets and the contingent alternate of NFTs (non-fungible tokens) – every representing a digital certificates of authenticity for the bodily merchandise – on a tokenized asset community.”

The report notes a number of worries associated to CBDCs, together with privateness issues expressed by these surveyed main as much as the section one launch in November 2022.

“Respondents had been usually receptive to an e-HKD, though they highlighted the necessity to examine the industrial viability of use circumstances and different points corresponding to privateness protections and authorized concerns.”

The report additionally flags safety issues relating to programmable retail CBDCs (rCBDCs), which customers would use.

Says the report,

“An rCBDC issued as programmable cash could also be extra vulnerable to cybersecurity dangers, as it could current extra mediums for exterior threats to inject malicious code. A fragile stability will due to this fact must be struck between facilitating the business’s growth of modern services, and making certain the general security of financial and monetary methods.”

The second section of the pilot will “construct on the success of section one, and think about exploring new use circumstances for an e-HKD” and “delve deeper into choose pilots from section one.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Price Action

Comply with us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney

[ad_2]

Source link