[ad_1]

Financial Debasement

Debasement refers back to the motion or technique of lowering the standard or worth of one thing. In relation to cash, it historically refers back to the observe of lowering the valuable metallic content material in cash whereas maintaining their nominal worth the identical, thereby diluting the coin’s intrinsic price. In a contemporary context, debasement has advanced to imply the discount within the worth or buying energy of a forex — similar to when central banks improve the availability of cash, thereby reducing the nominal worth of every unit.

Understanding Debasement

Earlier than paper cash, forex consisted of cash fabricated from treasured metals like gold and silver. Debasement was a standard observe to avoid wasting on treasured metals and use them in a mixture of lower-value metals as a substitute.

This observe of blending the valuable metals with a lower-quality metallic means authorities might create extra cash with the identical face worth, increasing the cash provide for a fraction of the price in comparison with cash with extra gold and silver content material.

Valuable metals are now not used for each day cash exchanges and have been largely changed by paper cash, which matches by a technique of debasement when the cash provide will increase. Debasement went by completely different processes and strategies over time; subsequently, we are able to outline previous and new strategies.

Conventional methodology

Coin clipping, sweating and plugging had been the most typical varieties of debasement processes used till the introduction of paper cash. Such strategies had been employed each by malicious actors that counterfeited cash and by authorities that elevated the variety of cash in circulation.

Sweating includes shaking cash vigorously in a bag till the perimeters of the cash come off and lay on the backside of the bag. They had been then collected for use within the making of different cash.

Clipping would contain “shaving” the cash’ edges to take away among the metallic. As with sweating, the ensuing clipped bits can be collected and used to make new counterfeit cash.

Plugging was a method of punching a gap out of the coin’s center space with the remainder of the coin hammered collectively to shut the hole. It may be sawn in half with a plug of metallic extracted from the inside. The 2 halves can be fused once more after filling the outlet with a less expensive metallic.

Fashionable-day strategies

Cash provide improve is the trendy methodology utilized by governments to debase the forex. By printing extra money, governments get extra funds to spend nevertheless it leads to inflation for its residents. Forex will be debased by growing the cash provide, reducing rates of interest or implementing different measures that encourage inflation; they’re all “good” methods of lowering the worth of a forex.

Why is Cash Debased?

Governments debase their forex in order that they will spend with out elevating additional taxes. Debasing cash to fund wars was an efficient method of accelerating the cash provide to have interaction in costly conflicts with out affecting folks’s funds — or so it’s believed.

Whether or not by conventional debasement or fashionable cash printing, cash provide will increase have short-sighted advantages in boosting the financial system. However in the long run it results in inflation and monetary crises, the consequences of that are felt most acutely by these in society who don’t personal laborious property which may counter the loss within the forex’s worth.

Forex debasement might additionally happen by malicious actors who introduce counterfeit cash to an financial system, however the consequence of being caught can in some nations result in a demise sentence.

“Inflation is authorized counterfeiting, Counterfeiting is against the law inflation.” – Robert Breedlove

Governments can take some measures to mitigate dangers related to cash debasement and stop unstable and weak economies, for instance by controlling the cash provide and rates of interest inside a particular vary, managing spending and avoiding extreme borrowing.

Any financial reform that promotes productiveness and attracts overseas investments helps preserve confidence within the forex and stop cash debasement.

Actual-World Examples

The Roman Empire

The primary instance of forex debasement dates again to the Roman Empire beneath emperor Nero round 60 A.D. Nero decreased the silver content material within the denarius cash from 100% to 90% throughout his tenure.

Emperor Vespasian and his son Titus had huge expenditures through post-civil conflict reconstruction tasks just like the constructing of the Colosseum, compensation to the victims of the Vesuvius eruption and the Nice Hearth of Rome in 64 A.D. The chosen means to outlive the monetary disaster was to cut back the silver content material of the “denarius” from 94% to 90%.

Titus’ brother and successor, Domitian, noticed sufficient worth in “laborious cash” and the soundness of a reputable cash provide that he elevated the silver content material of the denarius again to 98% — a choice he needed to revert when one other conflict broke out, and inflation was looming once more throughout the empire.

This course of regularly continued to the purpose that the silver content material measured simply 5% within the following centuries. The Empire started to expertise extreme monetary crises and inflation as the cash continued to be devalued — significantly through the third century A.D., which is usually known as the “Disaster of the Third Century.” Throughout this era, spanning from about A.D. 235 to A.D. 284, Romans demanded increased wages and a rise within the worth of the products they had been promoting to face forex depreciation. The period was marked by political instability, exterior pressures from barbarian invasions and inside points similar to financial decline and plague.

It was solely when Emperor Diocletian and later Constantine took numerous measures, together with introducing new coinage and implementing worth controls, that the Roman financial system started to stabilize. Nevertheless, these occasions highlighted the vulnerabilities of the once-mighty Roman financial system.

Learn Extra >> Hard To Soft Money: The Hyperinflation Of The Roman Empire

Ottoman Empire

Through the Ottoman Empire, the Ottoman official financial unit, the akçe, was a silver coin that went by constant debasement from 0.85 grams contained in a coin within the fifteenth century right down to 0.048 grams within the nineteenth century. The measure to decrease the intrinsic worth of the coinage was taken to make extra cash and improve the cash provide. New currencies, the kuruş in 1688 after which the lira in 1844, regularly changed the unique official akçe on account of its steady debasement.

Henry VIII

Underneath Henry VIII, England wanted extra money, so his chancellor began to debase the cash utilizing cheaper metals like copper within the combine to make extra cash for a extra inexpensive price. On the finish of his reign, the silver content material of the cash went down from 92.5% to solely 25% as a method to earn more money and fund the heavy navy bills the present European conflict was demanding.

Weimar Republic

Through the Weimar Republic of the Nineteen Twenties, the German authorities met its conflict and post-war monetary obligations by printing extra money. The measure decreased the mark’s worth from round eight marks per greenback to 184. By 1922, the mark had depreciated to 7,350, finally collapsing in a painful hyperinflation when it reached 4.2 trillion marks per USD.

Historical past gives us poignant reminders of the perils of financial growth. These once-powerful empires all function cautionary tales for the trendy fiat system. As these empires expanded their cash provide, devaluing their currencies, they had been, in some ways, just like the proverbial lobster in boiling water. The temperature — or on this case, the speed of financial debasement — elevated so regularly that they failed to acknowledge the upcoming hazard till it was too late. Simply as a lobster does not seem to appreciate it’s being boiled alive if the water’s temperature rises slowly, these empires didn’t grasp the complete extent of their financial vulnerabilities till their programs turned untenable.

The gradual erosion of their financial worth was not simply an financial difficulty; it was a symptom of deeper systemic issues, signaling the waning power of once-mighty empires.

Debasement within the fashionable period

The dissolution of the Bretton Woods system within the Seventies marked a pivotal second in international financial historical past. Established within the mid-Twentieth century, the Bretton Woods system had loosely tethered main world currencies to the U.S. greenback, which itself was backed by gold, making certain a level of financial stability and predictability.

Nevertheless, its dissolution successfully untethered cash from its golden roots. This shift granted central bankers and politicians larger flexibility and discretion in financial coverage, permitting for extra aggressive interventions in economies. Whereas this newfound freedom provided instruments to deal with short-term financial challenges, it additionally opened the door to misuse and a gradual weakening of the financial system.

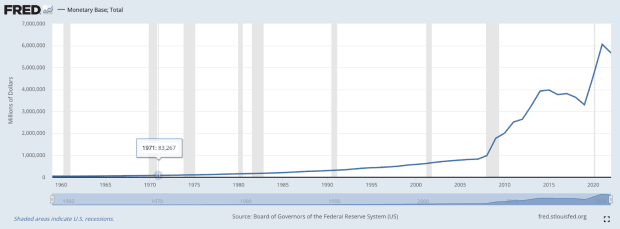

Within the wake of this monumental change, the US has skilled important alterations in its financial coverage and cash provide. By 2023, the financial base had surged to five.6 trillion {dollars}, representing an approximate 69-fold development from its stage of 81.2 billion {dollars} in 1971.

As we replicate on the trendy period and the numerous adjustments in U.S. financial coverage, it’s essential to heed these historic classes. Steady debasement and unchecked financial growth can solely go on for thus lengthy earlier than the system reaches a breaking level.

Results of Debasement

Forex debasement can have a number of important results on an financial system, various in magnitude relying on the extent of debasement and the underlying financial situations.

Listed here are among the most impactful penalties that forex debasement can generate over the long run.

- Larger inflation charges are probably the most quick and impactful results of forex debasement. Because the forex’s worth decreases, it takes extra items to buy the identical items and companies, eroding the buying energy of cash.

- Central banks could reply to forex debasement and rising inflation by growing rates of interest, which might affect borrowing prices, enterprise investments and shopper spending patterns.

- Forex debasement can deteriorate the worth of financial savings held within the home forex. That is significantly detrimental to people with fixed-income property, similar to retirees who depend on pensions or curiosity revenue.

- A debased forex could make imports dearer, doubtlessly resulting in increased prices for companies and customers reliant on overseas items. Nevertheless, it could additionally make exports extra aggressive internationally, as overseas consumers should purchase home items at a lower cost.

- Steady forex debasement can undermine public confidence within the home forex and the federal government’s capability to handle the financial system successfully. This lack of belief could additional exacerbate financial instability and even hyperinflation.

Answer to Debasement

The answer to debasement lies within the reintroduction of sound cash — cash whose provide can’t be simply manipulated. Whereas many nostalgically yearn for a return to the gold customary, which was arguably superior to up to date programs, it isn’t the last word resolution. The rationale lies within the centralization of gold by central banks. Ought to we revert to a gold customary, historical past would seemingly repeat itself, resulting in confiscation and the debasement of currencies as soon as once more. Put merely, if a forex will be debased, it will likely be debased.

Bitcoin gives a everlasting resolution to this difficulty. Its provide is capped at 21 million, a quantity that’s hard-coded and safeguarded by proof-of-work mining and a decentralized community of nodes. Because of its decentralized nature, no single entity or authorities can management Bitcoin’s issuance or governance. Moreover, its inherent shortage makes it resilient to the inflationary pressures which might be sometimes seen with conventional fiat currencies.

In instances of financial uncertainty, or when central banks have interaction in in depth cash printing, traders typically flip to property like gold and bitcoin for his or her store-of-value properties. As time progresses, there’s potential for folks to acknowledge bitcoin not simply as a store of value, however as the subsequent evolution of cash.

[ad_2]

Source link