[ad_1]

One of many newest concepts that has come to not too long ago obtain some prominence in components of the Bitcoin group is the road of pondering that has been described by each myself and others as “Bitcoin dominance maximalism” or simply “Bitcoin maximalism” for brief – basically, the concept that an surroundings of a number of competing cryptocurrencies is undesirable, that it’s incorrect to launch “yet one more coin”, and that it’s each righteous and inevitable that the Bitcoin foreign money involves take a monopoly place within the cryptocurrency scene. Word that that is distinct from a easy want to help Bitcoin and make it higher; such motivations are unquestionably useful and I personally proceed to contribute to Bitcoin repeatedly by way of my python library pybitcointools. Reasonably, it’s a stance that constructing one thing on Bitcoin is the solely appropriate option to do issues, and that doing the rest is unethical (see this post for a relatively hostile instance). Bitcoin maximalists usually use “community results” as an argument, and declare that it’s futile to battle in opposition to them. Nonetheless, is that this ideology really such an excellent factor for the cryptocurrency group? And is its core declare, that community results are a strong drive strongly favoring the eventual dominance of already established currencies, actually appropriate, and even whether it is, does that argument really lead the place its adherents suppose it leads?

The Technicals

First, an introduction to the technical methods at hand. Basically, there are three approaches to creating a brand new crypto protocol:

- Construct on Bitcoin the blockchain, however not Bitcoin the foreign money (metacoins, eg. most options of Counterparty)

- Construct on Bitcoin the foreign money, however not Bitcoin the blockchain (sidechains)

- Create a totally standalone platform

Meta-protocols are comparatively easy to explain: they’re protocols that assign a secondary that means to sure sorts of specifically formatted Bitcoin transactions, and the present state of the meta-protocol might be decided by scanning the blockchain for legitimate metacoin transactions and sequentially processing the legitimate ones. The earliest meta-protocol to exist was Mastercoin; Counterparty is a more moderen one. Meta-protocols make it a lot faster to develop a brand new protocol, and permit protocols to profit instantly from Bitcoin’s blockchain safety, though at a excessive value: meta-protocols usually are not suitable with mild consumer protocols, so the one environment friendly method to make use of a meta-protocol is by way of a trusted middleman.

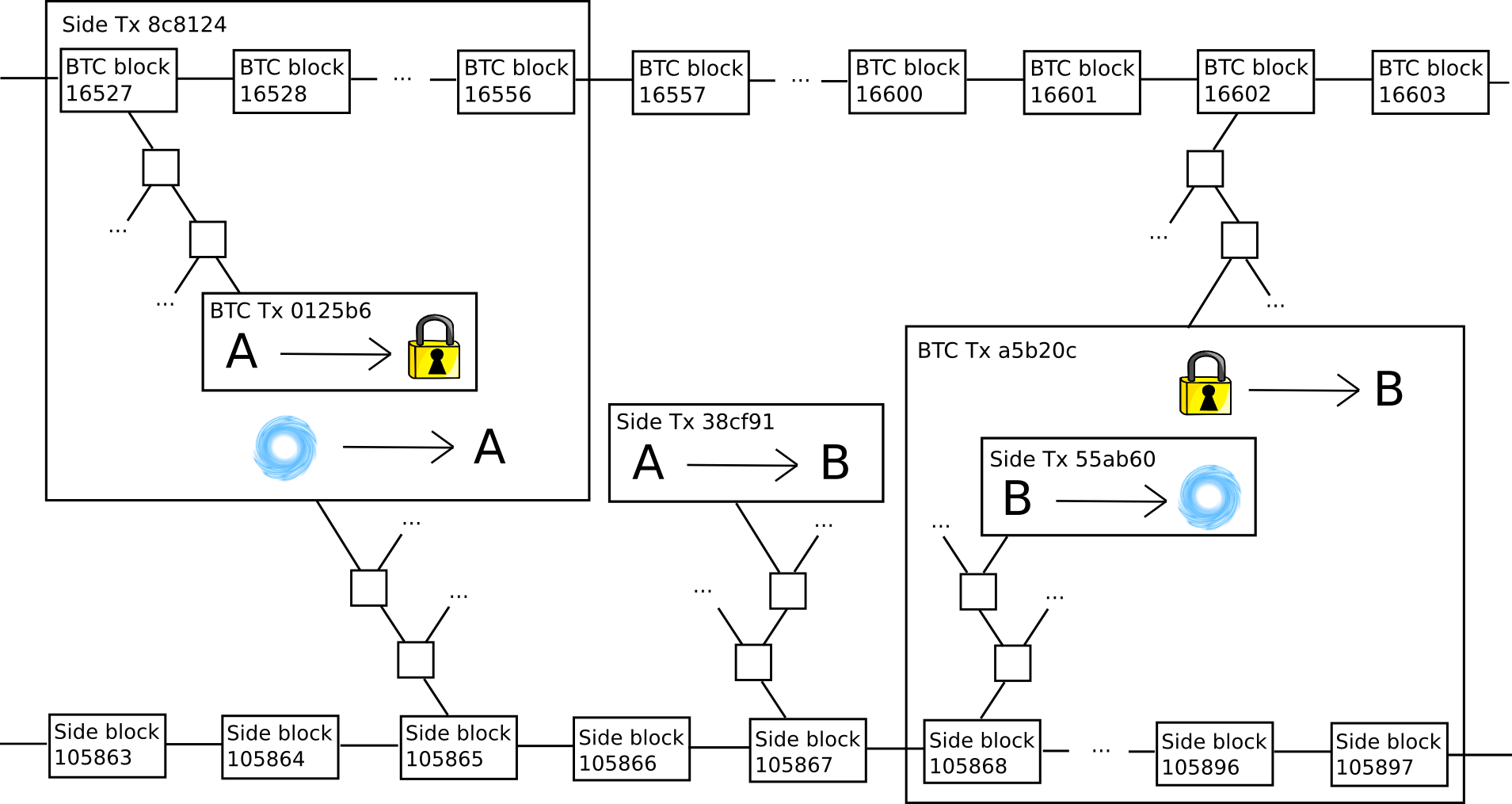

Sidechains are considerably extra sophisticated. The core underlying concept revolves round a “two-way-pegging” mechanism, the place a “dad or mum chain” (often Bitcoin) and a “sidechain” share a typical foreign money by making a unit of 1 convertible right into a unit of the opposite. The best way it really works is as follows. First, with a purpose to get a unit of side-coin, a person should ship a unit of parent-coin right into a particular “lockbox script”, after which submit a cryptographic proof that this transaction befell into the sidechain. As soon as this transaction confirms, the person has the side-coin, and might ship it at will. When any person holding a unit of side-coin desires to transform it again into parent-coin, they merely have to destroy the side-coin, after which submit a proof that this transaction befell to a lockbox script on the primary chain. The lockbox script would then confirm the proof, and if every thing checks out it might unlock the parent-coin for the submitter of the side-coin-destroying transaction to spend.

Sadly, it’s not sensible to make use of the Bitcoin blockchain and foreign money on the identical time; the fundamental technical motive is that just about all fascinating metacoins contain shifting cash below extra advanced circumstances than what the Bitcoin protocol itself helps, and so a separate “coin” is required (eg. MSC in Mastercoin, XCP in Counterparty). As we are going to see, every of those approaches has its personal advantages, nevertheless it additionally has its personal flaws. This level is vital; significantly, word that many Bitcoin maximalists’ current glee at Counterparty forking Ethereum was misplaced, as Counterparty-based Ethereum sensible contracts can not manipulate BTC foreign money items, and the asset that they’re as an alternative prone to promote (and certainly already have promoted) is the XCP.

Community Results

Now, allow us to get to the first argument at play right here: community results. Basically, community results might be outlined merely: a community impact is a property of a system that makes the system intrinsically extra precious the extra individuals use it. For instance, a language has a robust community impact: Esperanto, even whether it is technically superior to English within the summary, is much less helpful in apply as a result of the entire level of a language is to speak with different individuals and never many different individuals communicate Esperanto. Then again, a single street has a damaging community impact: the extra individuals use it the extra congested it turns into.

In an effort to correctly perceive what community results are at play within the cryptoeconomic context, we have to perceive precisely what these community results are, and precisely what factor every impact is hooked up to. Thus, to start out off, allow us to record a couple of of the key ones (see here and here for major sources):

- Safety impact: techniques which are extra broadly adopted derive their consensus from bigger consensus teams, making them tougher to assault.

- Fee system community impact: cost techniques which are accepted by extra retailers are extra enticing to shoppers, and cost techniques utilized by extra shoppers are extra enticing to retailers.

- Developer community impact: there are extra individuals involved in writing instruments that work with platforms which are broadly adopted, and the higher variety of these instruments will make the platform simpler to make use of.

- Integration community impact: third get together platforms can be extra prepared to combine with a platform that’s broadly adopted, and the higher variety of these instruments will make the platform simpler to make use of.

- Dimension stability impact: currencies with bigger market cap are usually extra steady, and extra established cryptocurrencies are seen as extra doubtless (and due to this fact by self-fulfilling-prophecy really are extra doubtless) to stay at nonzero worth far into the long run.

- Unit of account community impact: currencies which are very distinguished, and steady, are used as a unit of account for pricing items and companies, and it’s cognitively simpler to maintain monitor of 1’s funds in the identical unit that costs are measured in.

- Market depth impact: bigger currencies have larger market depth on exchanges, permitting customers to transform bigger portions of funds out and in of that foreign money with out taking a success in the marketplace value.

- Market unfold impact: bigger currencies have larger liquidity (ie. decrease unfold) on exchanges, permitting customers to transform backwards and forwards extra effectively.

- Intrapersonal single-currency choice impact: customers that already use a foreign money for one goal desire to make use of it for different functions each as a consequence of decrease cognitive prices and since they will keep a decrease complete liquid steadiness amongst all cryptocurrencies with out paying interchange charges.

- Interpersonal single-currency choice impact: customers desire to make use of the identical foreign money that others are utilizing to keep away from interchange charges when making strange transactions

- Advertising community impact: issues which are utilized by extra individuals are extra distinguished and thus extra prone to be seen by new customers. Moreover, customers have extra information about extra distinguished techniques and thus are much less involved that they could be exploited by unscrupulous events promoting them one thing dangerous that they don’t perceive.

- Regulatory legitimacy community impact: regulators are much less prone to assault one thing whether it is distinguished as a result of they’ll get extra individuals indignant by doing so

The very first thing that we see is that these community results are literally relatively neatly break up up into a number of classes: blockchain-specific community results (1), platform-specific community results (2-4), currency-specific community results (5-10), and common community results (11-12), that are to a big extent public items throughout your complete cryptocurrency {industry}. There’s a substantial alternative for confusion right here, since Bitcoin is concurrently a blockchain, a foreign money and a platform, however you will need to make a pointy distinction between the three. The easiest way to delineate the distinction is as follows:

- A foreign money is one thing which is used as a medium of change or retailer of worth; for instance, {dollars}, BTC and DOGE.

- A platform is a set of interoperating instruments and infrastructure that can be utilized to carry out sure duties; for currencies, the fundamental sort of platform is the gathering of a cost community and the instruments wanted to ship and obtain transactions in that community, however different kinds of platforms can also emerge.

- A blockchain is a consensus-driven distributed database that modifies itself primarily based on the content material of legitimate transactions based on a set of specified guidelines; for instance, the Bitcoin blockchain, the Litecoin blockchain, and so forth.

To see how currencies and platforms are utterly separate, the very best instance to make use of is the world of fiat currencies. Bank cards, for instance, are a extremely multi-currency platform. Somebody with a bank card from Canada tied to a checking account utilizing Canadian {dollars} can spend funds at a service provider in Switzerland accepting Swiss francs, and each side barely know the distinction. In the meantime, despite the fact that each are (or no less than might be) primarily based on the US greenback, money and Paypal are utterly totally different platforms; a service provider accepting solely money can have a tough time with a buyer who solely has a Paypal account.

As for a way platforms and blockchains are separate, the very best instance is the Bitcoin cost protocol and proof of existence. Though the 2 use the identical blockchain, they’re utterly totally different functions, customers of 1 do not know the way to interpret transactions related to the opposite, and it’s comparatively straightforward to see how they profit from utterly totally different community results in order that one can simply catch on with out the opposite. Word that protocols like proof of existence and Factom are principally exempt from this dialogue; their goal is to embed hashes into essentially the most safe accessible ledger, and whereas a greater ledger has not materialized they need to definitely use Bitcoin, significantly as a result of they will use Merkle bushes to compress a lot of proofs right into a single hash in a single transaction.

Community Results and Metacoins

Now, on this mannequin, allow us to look at metacoins and sidechains individually. With metacoins, the scenario is straightforward: metacoins are constructed on Bitcoin the blockchain, and never Bitcoin the platform or Bitcoin the foreign money. To see the previous, word that customers have to obtain a complete new set of software program packages so as to have the ability to course of Bitcoin transactions. There’s a slight cognitive community impact from having the ability to use the identical previous infrastructure of Bitcoin non-public/public key pairs and addresses, however this can be a community impact for the mix of ECDSA, SHA256+RIPEMD160 and base 58 and extra typically the entire idea of cryptocurrency, not the Bitcoin platform; Dogecoin inherits precisely the identical beneficial properties. To see the latter, word that, as talked about above, Counterparty has its personal inner foreign money, the XCP. Therefore, metacoins profit from the community impact of Bitcoin’s blockchain safety, however don’t robotically inherit all the platform-specific and currency-specific community results.

In fact, metacoins’ departure from the Bitcoin platform and Bitcoin foreign money is just not absolute. Initially, despite the fact that Counterparty is just not “on” the Bitcoin platform, it might in a really significant sense be stated to be “shut” to the Bitcoin platform – one can change backwards and forwards between BTC and XCP very cheaply and effectively. Cross-chain centralized or decentralized change, whereas attainable, is a number of instances slower and extra expensive. Second, some options of Counterparty, significantly the token sale performance, don’t depend on shifting foreign money items below any circumstances that the Bitcoin protocol doesn’t help, and so one can use that performance with out ever buying XCP, utilizing BTC instantly. Lastly, transaction charges in all metacoins might be paid in BTC, so within the case of purely non-financial functions metacoins really do absolutely profit from Bitcoin’s foreign money impact, though we should always word that in most non-financial circumstances builders are used to messaging being free, so convincing anybody to make use of a non-financial blockchain dapp at $0.05 per transaction will doubtless be an uphill battle.

In a few of these functions – significantly, maybe to Bitcoin maximalists’ chagrin, Counterparty’s crypto 2.0 token gross sales, the need to maneuver backwards and forwards rapidly to and from Bitcoin, in addition to the power to make use of it instantly, could certainly create a platform community impact that overcomes the lack of safe mild consumer functionality and potential for blockchain velocity and scalability upgrades, and it’s in these circumstances that metacoins could discover their market area of interest. Nonetheless, metacoins are most definitely not an all-purpose answer; it’s absurd to imagine that Bitcoin full nodes can have the computational potential to course of each single crypto transaction that anybody will ever need to do, and so finally motion to both scalable architectures or multichain environments can be needed.

Community Results and Sidechains

Sidechains have the alternative properties of metacoins. They’re constructed on Bitcoin the foreign money, and thus profit from Bitcoin’s foreign money community results, however they’re in any other case precisely similar to completely impartial chains and have the identical properties. This has a number of professionals and cons. On the optimistic aspect, it signifies that, though “sidechains” by themselves usually are not a scalability answer as they don’t remedy the safety downside, future developments in multichain, sharding or different scalability methods are all open to them to undertake.

On the damaging aspect, nevertheless, they don’t profit from Bitcoin’s platform community results. One should obtain particular software program so as to have the ability to work together with a sidechain, and one should explicitly transfer one’s bitcoins onto a sidechain so as to have the ability to use it – a course of wich is equally as troublesome as changing them into a brand new foreign money in a brand new community by way of a decentralized change. In reality, Blockstream workers have themselves admitted that the method for changing side-coins again into bitcoins is comparatively inefficient, to the purpose that most individuals in search of to maneuver their bitcoins there and again will in reality use precisely the identical centralized or decentralized change processes as could be used emigrate to a unique foreign money on an impartial blockchain.

Moreover, word that there’s one safety strategy that impartial networks can use which isn’t open to sidechains: proof of stake. The explanations for this are twofold. First one of many key arguments in favor of proof of stake is that even a profitable assault in opposition to proof of stake can be expensive for the attacker, because the attacker might want to preserve his foreign money items deposited and watch their worth drop drastically because the market realizes that the coin is compromised. This incentive impact doesn’t exist if the one foreign money inside a community is pegged to an exterior asset whose worth is just not so intently tied to that community’s success.

Second, proof of stake beneficial properties a lot of its safety as a result of the method of shopping for up 50% of a coin with a purpose to mount a takeover assault will itself improve the coin’s value drastically, making the assault much more costly for the attacker. In a proof of stake sidechain, nevertheless, one can simply transfer a really giant amount of cash into a series from the dad or mum chain, an mount the assault with out shifting the asset value in any respect. Word that each of those arguments proceed to use even when Bitcoin itself upgrades to proof of stake for its safety. Therefore, in the event you imagine that proof of stake is the long run, then each metacoins and sidechains (or no less than pure sidechains) turn out to be extremely suspect, and thus for that purely technical motive Bitcoin maximalism (or, for that matter, ether maximalism, or another sort of foreign money maximalism) turns into lifeless within the water.

Forex Community Results, Revisited

Altogether, the conclusion from the above two factors is twofold. First, there isn’t a common and scalable strategy that enables customers to profit from Bitcoin’s platform community results. Any software program answer that makes it straightforward for Bitcoin customers to maneuver their funds to sidechains might be simply transformed into an answer that makes it simply as straightforward for Bitcoin customers to transform their funds into an impartial foreign money on an impartial chain. Then again, nevertheless, foreign money community results are one other story, and will certainly show to be a real benefit for Bitcoin-based sidechains over absolutely impartial networks. So, what precisely are these results and the way highly effective is every one on this context? Allow us to undergo them once more:

- Dimension-stability community impact (bigger currencies are extra steady) – this community impact is legit, and Bitcoin has been proven to be much less risky than smaller cash.

- Unit of account community impact (very giant currencies turn out to be items of account, resulting in extra buying energy stability by way of value stickiness in addition to larger salience) – sadly, Bitcoin will doubtless by no means be steady sufficient to set off this impact; the very best empirical proof we will see for that is doubtless the valuation history of gold.

- Market depth impact (bigger currencies help bigger transactions with out slippage and have a decrease bid/ask unfold) – these impact are legit up to some extent, however then past that time (maybe a market cap of $10-$100M), the market depth is indicate adequate and the unfold is low sufficient for practically all sorts of transactions, and the profit from additional beneficial properties is small.

- Single-currency choice impact (individuals desire to take care of fewer currencies, and like to make use of the identical currencies that others are utilizing) – the intrapersonal and interpersonal components to this impact are legit, however we word that (i) the intrapersonal impact solely applies inside particular person individuals, not between individuals, so it doesn’t forestall an ecosystem with a number of most well-liked world currencies from present, and (ii) the interpersonal impact is small as interchange charges particularly in crypto are usually very low, lower than 0.30%, and can doubtless go right down to basically zero with decentralized change.

Therefore, the single-currency choice impact is probably going the biggest concern, adopted by the scale stability results, whereas the market depth results are doubtless comparatively tiny as soon as a cryptocurrency will get to a considerable measurement. Nonetheless, you will need to word that the above factors have a number of main caveats. First, if (1) and (2) dominate, then we all know of explicit strategies for making a brand new coin that’s much more steady than Bitcoin even at a smaller measurement; thus, they’re definitely not factors in Bitcoin’s favor.

Second, those self same methods (significantly the exogenous ones) can really be used to create a steady coin that’s pegged to a foreign money that has vastly bigger community results than even Bitcoin itself; particularly, the US greenback. The US greenback is 1000’s of instances bigger than Bitcoin, individuals are already used to pondering when it comes to it, and most significantly of all it really maintains its buying energy at an inexpensive fee within the brief to medium time period with out large volatility. Workers of Blockstream, the corporate behind sidechains, have usually promoted sidechains below the slogan “innovation without speculation“; nevertheless, the slogan ignores that Bitcoin itself is kind of speculative and as we see from the expertise of gold all the time can be, so in search of to put in Bitcoin because the solely cryptoasset basically forces all customers of cryptoeconomic protocols to take part in hypothesis. Need true innovation with out hypothesis? Then maybe we should always all have interaction in somewhat US greenback stablecoin maximalism as an alternative.

Lastly, within the case of transaction charges particularly, the intrapersonal single-currency choice impact arguably disappears utterly. The reason being that the portions concerned are so small ($0.01-$0.05 per transaction) {that a} dapp can merely siphon off $1 from a person’s Bitcoin pockets at a time as wanted, not even telling the person that different currencies exist, thereby reducing the cognitive value of managing even 1000’s of currencies to zero. The truth that this token change is totally non-urgent additionally signifies that the consumer may even function a market maket whereas shifting cash from one chain to the opposite, even perhaps incomes a revenue on the foreign money interchange bid/ask unfold. Moreover, as a result of the person doesn’t see beneficial properties and losses, and the person’s common steadiness is so low that the central limit theorem ensures with overwhelming chance that the spikes and drops will principally cancel one another out, stability can also be pretty irrelevant. Therefore, we will make the purpose that various tokens which are supposed to serve primarily as “cryptofuels” don’t endure from currency-specific community impact deficiencies in any respect. Let a thousand cryptofuels bloom.

Incentive and Psychological Arguments

There’s one other class of argument, one which can maybe be known as a community impact however not utterly, for why a service that makes use of Bitcoin as a foreign money will carry out higher: the incentivized advertising of the Bitcoin group. The argument goes as follows. Companies and platforms primarily based on Bitcoin the foreign money (and to a slight extent companies primarily based on Bitcoin the platform) improve the worth of Bitcoin. Therefore, Bitcoin holders would personally profit from the worth of their BTC going up if the service will get adopted, and are thus motivated to help it.

This impact happens on two ranges: the person and the company. The company impact is an easy matter of incentives; giant companies will really help and even create Bitcoin-based dapps to extend Bitcoin’s worth, just because they’re so giant that even the portion of the profit that personally accrues to themselves is sufficient to offset the prices; that is the “speculative philanthropy” technique described by Daniel Krawisz.

The person impact is just not a lot instantly incentive-based; every particular person’s potential to have an effect on Bitcoin’s worth is tiny. Reasonably, it is extra a intelligent exploitation of psychological biases. It is well-known that people tend to change their moral values to align with their private pursuits, so the channel right here is extra advanced: individuals who maintain BTC begin to see it as being within the frequent curiosity for Bitcoin to succeed, and they also will genuinely and excitedly help such functions. Because it seems, even a small quantity of incentive suffices to shift over individuals’s ethical values to such a big extent, making a psychological mechanism that manages to beat not simply the coordination downside but in addition, to a weak extent, the general public items downside.

There are a number of main counterarguments to this declare. First, it’s not in any respect clear that the full impact of the inducement and psychological mechanisms really will increase because the foreign money will get bigger. Though a bigger measurement results in extra individuals affected by the inducement, a smaller measurement creates a extra concentrated incentive, as individuals even have the chance to make a considerable distinction to the success of the venture. The tribal psychology behind incentive-driven ethical adjustment could be stronger for small “tribes” the place people even have robust social connections to one another than bigger tribes the place such connections are extra diffuse; that is considerably just like the Gemeinschaft vs Gesellschaft distinction in sociology. Maybe a brand new protocol must have a concentrated set of extremely incentivized stakeholders with a purpose to seed a group, and Bitcoin maximalists are incorrect to attempt to knock this ladder down after Bitcoin has so fantastically and efficiently climbed up it. In any case, all the analysis round optimum currency areas should be closely redone within the context of the newer risky cryptocurrencies, and the outcomes could effectively go down both method.

Second, the power for a community to concern items of a brand new coin has been confirmed to be a extremely efficient and profitable mechanism for fixing the general public items downside of funding protocol growth, and any platform that doesn’t in some way benefit from the seignorage income from creating a brand new coin is at a considerable drawback. Thus far, the one main crypto 2.0 protocol-building firm that has efficiently funded itself with out some sort of “pre-mine” or “pre-sale” is Blockstream (the corporate behind sidechains), which not too long ago obtained $21 million of enterprise capital funding from Silicon Valley traders. Given Blockstream’s self-inflicted lack of ability to monetize by way of tokens, we’re left with three viable explanations for a way traders justified the funding:

- The funding was basically an act of speculative philathropy on the a part of Silicon Valley enterprise capitalists trying to improve the worth of their BTC and their different BTC-related investments.

- Blockstream intends to earn income by taking a minimize of the charges from their blockchains (non-viable as a result of the general public will virtually definitely reject such a transparent and blatant centralized siphoning of assets much more virulently then they might reject a brand new foreign money)

- Blockstream intends to “promote companies”, ie. observe the RedHat mannequin (viable for them however few others; word that the full room out there for RedHat-style firms is kind of small)

Each (1) and (3) are extremely problematic; (3) as a result of it signifies that few different firms will be capable to observe its path and since it provides them the inducement to cripple their protocols to allow them to present centralized overlays, and (1) as a result of it signifies that crypto 2.0 firms should all observe the mannequin of sucking as much as the actual concentrated rich elite in Silicon Valley (or possibly another concentrated rich elite in China), hardly a wholesome dynamic for a decentralized ecosystem that prides itself on its excessive diploma of political independence and its disruptive nature.

Sarcastically sufficient, the one “impartial” sidechain venture that has to this point introduced itself, Truthcoin, has really managed to get the very best of each worlds: the venture acquired on the great aspect of the Bitcoin maximalist bandwagon by asserting that it will likely be a sidechain, however in reality the event crew intends to introduce into the platform two “cash” – one among which can be a BTC sidechain token and the opposite an impartial foreign money that’s meant to be, that is proper, crowd-sold.

A New Technique

Thus, we see that whereas foreign money community results are typically reasonably robust, and they’re going to certainly exert a choice strain in favor of Bitcoin over different present cryptocurrencies, the creation of an ecosystem that makes use of Bitcoin solely is a extremely suspect endeavor, and one that can result in a complete discount and elevated centralization of funding (as solely the ultra-rich have adequate concentrated incentive to be speculative philanthropists), closed doorways in safety (no extra proof of stake), and isn’t even essentially assured to finish with Bitcoin prepared. So is there another technique that we will take? Are there methods to get the very best of each worlds, concurrently foreign money community results and securing the advantages of latest protocols launching their very own cash?

Because it seems, there may be: the dual-currency mannequin. The twin-currency mannequin, arguably pioneered by Robert Sams, though in numerous incarnations independently found by Bitshares, Truthcoin and myself, is on the core easy: each community will include two (or much more) currencies, splitting up the position of medium of transaction and car of hypothesis and stake (the latter two roles are greatest merged, as a result of as talked about above proof of stake works greatest when contributors endure essentially the most from a fork). The transactional foreign money can be both a Bitcoin sidechain, as in Truthcoin’s mannequin, or an endogenous stablecoin, or an exogenous stablecoin that advantages from the almighty foreign money community impact of the US greenback (or Euro or CNY or SDR or no matter else). Hayekian foreign money competitors will decide which sort of Bitcoin, altcoin or stablecoin customers desire; maybe sidechain expertise may even be used to make one explicit stablecoin transferable throughout many networks.

The vol-coin would be the unit of measurement of consensus, and vol-coins will typically be absorbed to concern new stablecoins when stablecoins are consumed to pay transaction charges; therefore, as explainted within the argument within the linked article on stablecoins, vol-coins might be valued as a proportion of future transaction charges. Vol-coins might be crowd-sold, sustaining the advantages of a crowd sale as a funding mechanism. If we determine that specific pre-mines or pre-sales are “unfair”, or that they’ve unhealthy incentives as a result of the builders’ achieve is frontloaded, then we will as an alternative use voting (as in DPOS) or prediction markets as an alternative to distribute cash to builders in a decentralized method over time.

One other level to remember is, what occurs to the vol-coins themselves? Technological innovation is fast, and if every community will get unseated inside a couple of years, then the vol-coins could effectively by no means see substantial market cap. One reply is to resolve the issue by utilizing a intelligent mixture of Satoshian pondering and good old style recursive punishment systems from the offline world: set up a social norm that each new coin ought to pre-allocate 50-75% of its items to some cheap subset of the cash that got here earlier than it that instantly impressed its creation, and implement the norm blockchain-style – in case your coin doesn’t honor its ancestors, then its descendants will refuse to honor it, as an alternative sharing the additional revenues between the initially cheated ancestors and themselves, and nobody will fault them for that. This is able to enable vol-coins to take care of continuity over the generations. Bitcoin itself might be included among the many record of ancestors for any new coin. Maybe an industry-wide settlement of this type is what is required to advertise the sort of cooperative and pleasant evolutionary competitors that’s required for a multichain cryptoeconomy to be actually profitable.

Would now we have used a vol-coin/stable-coin mannequin for Ethereum had such methods been well-known six months in the past? Fairly presumably sure; sadly it is too late to make the choice now on the protocol degree, significantly because the ether genesis block distribution and provide mannequin is basically finalized. Luckily, nevertheless, Ethereum permits customers to create their very own currencies inside contracts, so it’s completely attainable that such a system can merely be grafted on, albeit barely unnaturally, over time. Even with out such a change, ether itself will retain a robust and regular worth as a cryptofuel, and as a retailer of worth for Ethereum-based safety deposits, merely due to the mix of the Ethereum blockchain’s community impact (which really is a platform community impact, as all contracts on the Ethereum blockchain have a typical interface and might trivially speak to one another) and the weak-currency-network-effect argument described for cryptofuels above preserves for it a steady place. For two.0 multichain interplay, nevertheless, and for future platforms like Truthcoin, the choice of which new coin mannequin to take is all too related.

[ad_2]

Source link