[ad_1]

Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

Crypto works a bit of like Candyman: say the title typically sufficient and one thing would possibly seem from nothing.

This not-particularly-virtuous circle of token costs and a spotlight looking for is a factor we speak about very often. A yr in the past, for instance, it someway grew to become a matter of worldwide significance that ethereum was going to change its blockchain validation method:

Why are all of us speaking about it? The standard motive: crypto values correlate with publicity. Social media noise can push token costs round (Tandon et al), however not as successfully as mainstream media protection (Coulter). Essentially the most highly effective crypto value accelerant is a positive-sounding theme from an influential supply that’s encouraging to a silent majority (Mei et al). It’s subsequently instantly within the pursuits of ethereum whales (Coinbase, Binance, Kraken etc) to make The Merge seem to be a really huge deal, and we within the generalist press have been comfortable to oblige.

This yr’s ethereum Merge is the spot bitcoin ETF.

Two months in the past a US judge said it was “arbitrary and capricious” that the SEC permits bitcoin futures ETFs whereas blocking ETFs that maintain bitcoin. The ruling will in all probability drive the SEC to approve spot bitcoin ETFs as a result of its solely different possibility, withdrawing earlier approvals of futures ETFs, could be much more embarrassing.

The SEC’s defeat has been portrayed as an enormous deal for bitcoin, whose value correlates moderately properly with how typically folks say bitcoin. The under chart exhibits the greenback spot value alongside volumes of Google searches for bitcoin and articles mentioning bitcoin:

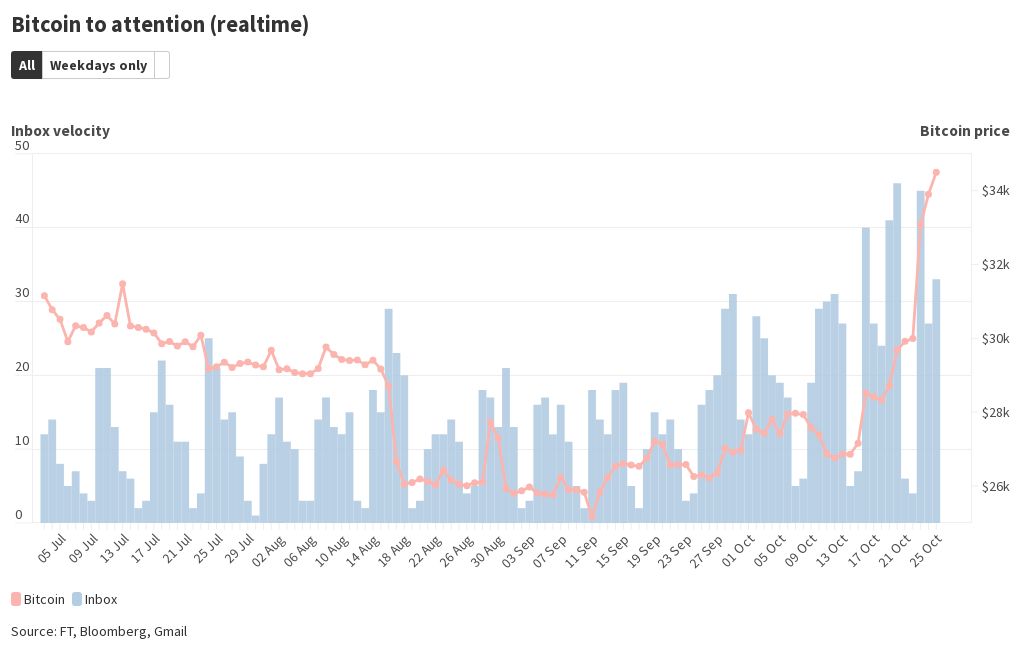

And for a real-time measure, chart two exhibits the bitcoin spot value versus the variety of emails within the writer’s inbox that reference bitcoin:

Since August 28, the day earlier than the SEC misplaced, bitcoin has added $168bn in market cap. Bitcoin’s 32 per cent acquire over the interval far exceeds that of gold (+3.7 per cent), the Nasdaq Composite (-6.5 per cent) and ethereum (+14.4 per cent, in all probability on hopes of US regulators changing into friendlier to crypto), so the principle driver does seem like ETF hype.

To place $168bn in context, there’s $198bn currently invested in spot gold ETFs.

So are retail punters ingesting the crypto Kool-Help once more? Apparently not. Current bitcoin demand appears to be institutional, in keeping with JPMorgan. Whereas consideration measures just like the Google Developments rating have been flatlining since crypto winter, open curiosity in CME bitcoin futures contracts (used largely by institutional buyers) has spiked again to ranges final seen in August 2022 earlier than the collapse of FTX.

JPMorgan additionally highlights a current tick greater in on-chain transfers from small wallets to huge ones, as proven by the under chart. Bitcoin move tends to go in direction of the massive wallets when there’s one thing positive-sounding for establishments to promote — such because the launch of the primary US futures ETF in 2021 and the halving event of 2020 — then reverses after stuff blows up:

Current bitcoin demand subsequently appears like preparatory work for the ETF advertising and marketing blitz. And since shopping for makes the value go up, it’s preparation that’s self-propelling.

The SEC has till January 10 to answer a joint software from Ark Make investments and 21Shares, although nobody within the trade appears to count on it to take that lengthy. Grayscale and BlackRock have made formal registrations to launch spot ETFs and right here’s a move of filings amendments, indicating back-and-forth between the regulator and asset managers to work out who can maintain what.

It’s seemingly, says JPMorgan, that the SEC will situation mass approval notices to keep away from gifting any supervisor a first-mover benefit.

The primary advantage of a spot ETF is that it’s a extra direct type of possession than an artificial fund, whose reliance on derivatives can introduce lag and hedging risk. A cleaner construction is sweet, however to any potential purchaser of a bitcoin ETF it won’t matter all that a lot. Nobody buys crypto for its simplicity.

Nikolaos Panigirtzoglou, of JPMorgan’s international markets technique crew, has known as the spot benefit “somewhat marginal” and “unlikely to be a game-changer for crypto markets”.

Panigirtzoglou additionally highlights the dearth of curiosity in spot bitcoin ETFs that exist already.

We’ve discovered 29 bitcoin ETFs globally that might moderately be described as energetic, in addition to 11 exchange-traded notes and 11 exchange-traded commodities. (Right here’s an explainer of what those letters mean, the essence of which is that ETFs are fairness devices and the opposite two are extra like debt. For the needs of this train we’re bunching them collectively.)

Throughout the complete group there’s $5.6bn in fund belongings. Of that complete, roughly $3.1bn is in funds which can be (or say they’re) bodily backed by bitcoin. The remaining $2.5bn is in artificial funds/thriller containers.

Right here’s a clickable breakdown by worth, sort and supplier. Notice nonetheless that for a lot of smaller funds, and some of the bigger ones, the replication methodology wasn’t made clear within the truth sheet; tell us about any errors.

One other helpful measure is shares excellent. As a result of ETFs are open-end funds, their share counts give a sign of demand that’s unbiased of asset worth.

The under chart exhibits shares in situation for the Objective bodily ETF (in its unhedged Canadian greenback flavour) alongside ProShares’ artificial ETF. Objective loved a rush of curiosity across the launch, adopted by two years of nothing a lot:

We’re being informed loads that US-listed spot bitcoin ETFs might be revolutionary for institutional possession of crypto. Going by the historic demand illustrated above, they in all probability received’t even be revolutionary for ETF suppliers. Chances are high that by subsequent yr it will all be forgotten, by which era there might be one other bitcoin halving occasion to sit up for.

However when there’s an entire new market to cantillate into existence, who has time to look backwards?

[ad_2]

Source link