[ad_1]

All through the years, I’ve introduced the case for Bitcoin to lots of people from a variety of backgrounds. The checklist contains curious cab drivers, monetary advisors, younger software program builders, skeptical policymakers, unvoiced activists, and as soon as even an IMF worker.

Evidently, most of those makes an attempt ended up falling on deaf ears. So I began asking myself “why would this particular person in entrance of me care about Bitcoin?” and instantly realized that getting a response was notably difficult as a result of—even amongst Bitcoiners—there isn’t any widespread understanding of what Bitcoin is within the first place. Is it “peer-to-peer digital money” as Satoshi initially outlined it? Or ought to we take into account it as “digital property” as Michael Saylor suggests? Or possibly take heed to Gary Gensler and outline it as a commodity?

As tempting as it’s to search for a standard definition for Bitcoin, doing so throughout a time when even the most straightforward linguistic selections are underneath scrutiny makes such a enterprise uninspiring and, frankly, pointless.

What I made a decision to do as an alternative was perceive what every of these individuals actually cared about and the way Bitcoin may match into their view of the world relatively than anticipating them to know a topic they’re barely fascinated by. Because the saying goes, “If the mountain won’t come to Mohammed, Mohammed should go to the mountain.”

By doing so, I spotted it was unreasonable to behave like Morpheus and count on my interlocutors to take a giant orange capsule. In spite of everything, if that method barely labored with Neo who was “the chosen one”, why would it not work with my brother-in-law or with a stranger sitting subsequent to me on the airplane?

As a result of I’ve identified for some time that Bitcoin’s nature is multifaceted, the very concept of 1 single entry level to a multifaceted idea didn’t sound correct. Relying on the place one lives, social standing, skilled background, set of beliefs, values, and atmosphere, there will probably be a unique (and smaller) orange capsule that will probably be extra acceptable for every particular person.

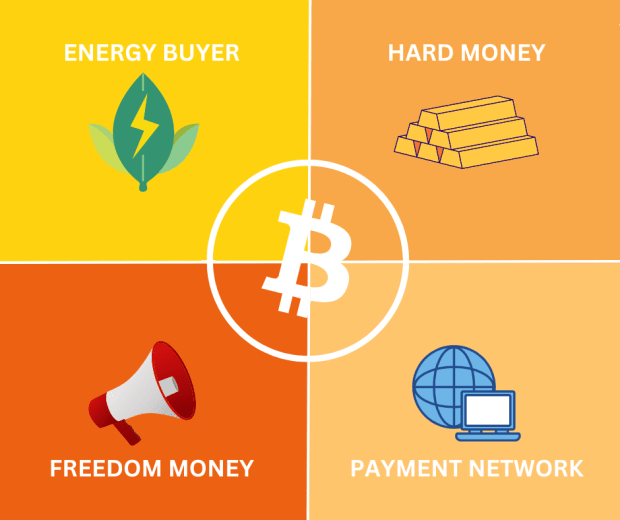

Extra classes might emerge sooner or later (Jason Lowery, for instance, proposes a military interpretation of Bitcoin and the latest ordinals frenzy reminded us how valuable Bitcoin’s block space can be as its personal use-case), however listed here are the 4 predominant buckets that I’ve recognized up to now—which symbolize 4 totally different set of issues that Bitcoin is fixing for.

1 – Arduous Cash

On this sense, it’s extra typical of a valuable steel. As an alternative of the availability altering to maintain the worth the identical, the availability is predetermined and the worth modifications —Satoshi Nakamoto

The primary units of issues that Bitcoin makes an attempt to unravel originate from a monetary system that’s damaged in its most foundational points. For these not understanding, the issue will be described as having an analogous nature (however, after all, totally different magnitude) to hyperinflation in Weimar Republic and Venezuela. The fixed debasement of currencies (even the “delicate” 2% inflation everyone knows about) has an amazing societal influence, with those that are “near the cash printer” being the one winners—a phenomenon also referred to as the Cantillon Effect.

Not like fiat cash and commodities, resembling gold, Bitcoin’s complete provide is capped, which makes it the most scarce store of value in the history of mankind and, due to this fact, a perfect retailer of worth in the long run.

For all these dwelling within the half of the world that is experiencing double-digit inflation, this can be a notably attention-grabbing second to know how cash printing and forex debasement can have an effect on so many points of their lives. In actual fact, individuals who have lived via the 70s and people dwelling in international locations resembling Venezuela, Lebanon, Zimbabwe, Argentina, and Turkey will probably be extra receptive to the concept of Bitcoin as a strategy to protect their buying energy in inflationary environments.

That is arguably one of the vital tough points of Bitcoin to know given the variety of assumptions it requires us to problem (e.g. “managed inflation is sweet for the financial system” or “fiat currencies are secure”). But, it’s arguably essentially the most highly effective orange capsule that one may take.

2 – Superior Fee Community

People have invented one of the best monetary device in our historical past, and it’s an thrilling time to be alive and use it — Jack Mallers

For the primary time in human historical past, cash and a fee community are built-in into one open and world system. Not solely can Bitcoin function a retailer of worth in the long run as defined above, nevertheless it additionally capabilities as a world medium of alternate that doesn’t require any third social gathering.

In a number of seconds, cash will be despatched wherever on the planet by solely paying a fraction of a cent. In comparison with financial institution transfers, bank cards, and remittances, sending cash via Bitcoin is considerably cheaper and sooner.

Individuals who don’t like bitcoin as a retailer of worth can simply use it as a fee system by changing it to the native forex on the two ends of the transaction. Why do this as an alternative of utilizing legacy programs? Maybe to rapidly send money during earthquakes and wars. Or to bypass remittance companies that take weeks to switch cash and cost as much as 10% in charges.

The potential of Bitcoin simply as a fee community extends to essentially the most unthinkable areas. Micropayments have the potential to boost the creator economy and or solve the problems that have been haunting social networks.

3 – Freedom Know-how

It might be a darkish, darkish world if Bitcoin did not exist — Alex Gladstein

The 2 earlier views deal with the widespread criticism that “Bitcoin is ineffective”. However one other widespread criticism—usually paired with the previous despite the fact that it straight contradicts it—is the truth that (identical to automobiles, computer systems, and most applied sciences) Bitcoin is utilized by criminals.

As loopy as it’d sound to many, that’s a function, not a bug. As a result of in these cases the place it’s ethnicity, faith, intercourse, or political opinions that decide whether or not one is a legal, having a monetary system that can’t be weaponized by the federal government is without doubt one of the finest insurance coverage insurance policies you possibly can want for. That’s notably true for two-thirds of the global population that lives in backsliding democracies or autocratic regimes.

Those that care about freedom and human rights needs to be paying very shut consideration to this expertise. Bitcoin has already offered lifeline assist for people in want for over a decade. Wikileaks would haven’t been capable of expose severe violations of human rights and civil liberties with out Bitcoin. Equally, many in North Korea, Iran, Afghanistan, Ukraine, Hong Kong, Belarus, Nigeria, and Russia additionally use Bitcoin as a device to flee the management and authorities censorship.

As we transfer away from bodily cash and the potential for monetary surveillance and censorship will increase exponentially, the world will vastly profit an extra set of checks and balances to restrict the ability of governments and firms. Understanding this is essential for all these which can be lively in selling particular person freedom and human rights in essentially the most authoritarian corners of the world.

4 – Vitality Purchaser Of Final Resort

It’s a win-win-win for everyone. It is a win for the atmosphere and an inarguable win for the financial system — Dennis Porter

Lastly, there’s a comparatively small crowd of people that would possibly have the ability to respect Bitcoin for a really totally different set of causes. Bitcoin constitutes an unprecedented alternative to construct a cleaner, extra resilient, and extra environment friendly vitality infrastructure. Bitcoin can mitigate the problem of intermittency—the demand/provide mismatch that happens with renewable vitality—and assist with the $13B downside of congestion of the electric grid in rural areas.

Bitcoin miners can strengthen these grids and incentivize the deployment of extra renewable vitality by adapting to the fluctuations of energy technology schedules since their rigs will be turned off at any second with out discover. Generally known as “vitality consumers of final resort”, Bitcoin miners are excellent for Demand Response programs. Final 12 months, Bitcoin miners in Texas “returned up to 1,500 megawatts to the grid, sufficient to warmth over 1.5 million small properties or preserve 300 giant hospitals absolutely operational”.

Bitcoin miners are additionally discovering very inventive methods to utilize energy that was previously wasted and many are arguing that Bitcoin is “the one out there, sensible and scalable expertise relating to tackling the world’s most threatening greenhouse gasoline: methane.”

There’s (at the very least) 4 orange tablets, and folks don’t must take all of them.

One of many issues I discovered throughout my Bitcoin journey is that this isn’t a mono-functional expertise like a washing-machine or an elevator. As a result of Bitcoin solves many various issues, its perceived worth and utility will change considerably relying on who you speak to.

These dwelling in South Carolina may not care about censorship resistance or privateness as a lot because the native jobs which can be created by a brand new Bitcoin firm. The Turkish inhabitants might need not cared about Bitcoin as an inflation hedge (given the nation’s state of affairs, it ought to) through the earthquake earlier this 12 months, however simply wanted a strategy to receive money as fast as possible. North Korean defectors like Yeonmi Park aren’t actually fascinated by how Bitcoin micropayments can assist artists on-line whereas they are being sold for less than $300 as sex slaves.

Listening and attempting to know who you might be speaking to is crucial factor you are able to do when presenting an concept. That’s notably true with Bitcoin, given the unfavourable bias most individuals have in direction of it, how complicated it’s to know, and the way tough it’s to problem a number of the biggest assumptions that most individuals have.

This straightforward framework is an try to strategically establish the areas of curiosity of people who find themselves new to Bitcoin and keep away from overwhelming them with a giant orange capsule they won’t be prepared for.

As an alternative, by selecting between arduous cash, fee system, freedom expertise, and vitality purchaser, I’m now capable of higher construction conversations and elevator pitches when participating with individuals and answering the standard “Uh! Inform me extra about this Bitcoin factor!” query.

So go forward, select your orange capsule and bear in mind crucial query for Bitcoin is “why would one care about it?”

This can be a visitor publish by Jesse Colzani. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link