[ad_1]

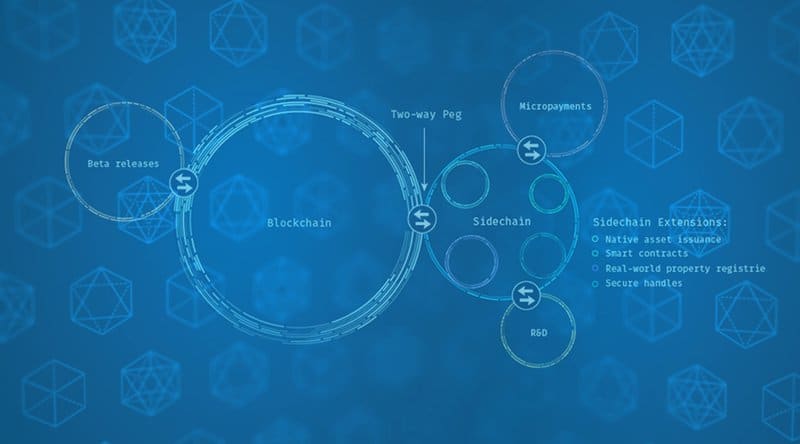

That is an extension to my earlier article sequence discussing the completely different sidechain proposals that exist. These articles might be discovered right here: Spacechains, Spacechain Use Cases, Softchains, Drivechains, Federated Chains, and Trade Offs Of Sidechains.

Botanix Labs has proposed a totally new sidechain design just lately, referred to as spiderchains, for the needs of porting the Ethereum Digital Machine to a platform anchored to the Bitcoin community. The structure is a pretty big deviation from most prior proposals for concrete designs. Firstly, it doesn’t contain miners straight in consensus or use merge-mining in any of its variant varieties. Secondly, it makes use of multisig and escrow bonds to create a second layer proof-of-stake system on prime of Bitcoin. Third, it doesn’t require any modifications to Bitcoin with the intention to deploy.

The very first thing to make clear is that, technically talking, the spiderchain is not actually the sidechain. Any sidechain deployed using spiderchains would sit “above” the spiderchain which sits above the bottom layer on the mainchain. Sidechain blocks could be produced independently by the stakers (known as orchestrators within the paper) within the consensus system. The spiderchain, somewhat than being the precise sidechain, is a form of collateral layer facilitating the custody of customers’ funds and stakers bonds on the mainchain. Consider it like the center of the sandwich between the sidechain and the mainchain.

The Proof of Stake Variant

To get a greater concept of how the system works, let’s undergo how the Botanix EVM chain interacts with the spiderchain layer. One of many first makes use of the system makes of the Bitcoin blockchain except for truly custodying funds backing the sidechain tokens is the choice of a block constructor. Proof-of-stake chains require a variety course of for which staker truly places blocks collectively from the transactions within the mempool. In proof-of-work all miners do that independently and whoever will get fortunate and finds a sound blockheader hash has their block accepted into the blockchain. For the reason that total level of proof-of-stake is to get rid of power intensive randomizing of who selects the subsequent block, these techniques want one other answer. They use a Verifiable Random Operate (VRF), a perform that permits all contributors to confirm the end result is definitely random and never biased or deterministic. Spiderchains make use of Bitcoin blockhashes with the intention to purchase verifiable randomness.

Identical to different proof-of-stake techniques Botanix divides the blockchain into discrete sections referred to as “epochs” that are finalized periodically and a brand new block constructor is chosen. At the beginning of an epoch the mainchain blockhash is taken and utilized as a supply of randomness to all of the stakers to decide on the brand new block constructor. After six blocks, to account for the potential of reorgs, the community transitions to the brand new block constructor for that epoch. Now this describes the way in which the proof-of-stake system handles block building on the sidechain and reaching consensus on whose flip it’s, time to get to how this all interacts with the spiderchain (and what precisely a spiderchain is).

The Spiderchain

Along with utilizing it periodically for choosing a block constructor, the sidechain additionally makes use of the VRF to pick a random subset of the stakers to assemble a multisig handle for deposits into the sidechain each single Bitcoin block. That is proper, a random set of members for the peg’s multisig. In contrast to a federated sidechain, which custodies funds in addresses composed of your entire set of the federation membership, spiderchains break every deposit (or change from transactions pegging out of the sidechain) off into a novel handle relying on the mainchain block it confirms in made up of a random subset of the set of stakers. I.e. If there are 50 folks staking at any given blockheight, 10 are randomly chosen to be key holders for any deposits occurring within the subsequent block. This will intuitively appear somewhat loopy, however there are just a few sound logical causes for it.

It segregates danger of funds from malicious events. Most individuals consider theft, however even lack of liveness could be a catastrophe for techniques like this. Consider a federated sidechain, you do not want a malicious majority to trigger a large downside, only a malicious minority. If a federation requires a 2/3rds threshold to maneuver cash, then simply 1/third + 1 member is sufficient to maintain these cash frozen (this is the reason Liquid has a time-delayed emergency restoration path with Blockstream held keys to forestall everlasting coin loss on this scenario). You do not even want any malicious actors strictly talking, simply key loss may create that downside. By breaking apart deposits into remoted subset keys with random members, you mitigate (not remedy) issues like this. If keys had been misplaced, or a malicious actor was capable of achieve sufficient staking share within the system to stall or steal, they statistically won’t ever have entry to the whole thing of the funds within the spiderchain. Every block has completely impartial odds of developing a deposit handle managed by a malicious majority (or impleded by a malicious minority), and if these situations are met solely the funds deposited or rolled over by way of change from withdrawals in that particular block shall be in danger as an alternative of the whole thing of the sidechain’s funds.

There’s additionally one other attention-grabbing safety property that derives from how withdrawals are dealt with. Any sidechain peg mechanism that does not combination all deposits right into a single rolling UTXO begs the query of which UTXOs to make use of for fulfilling withdrawals. The spiderchain design has settled on Final In First Out (LIFO), which means that any withdrawals from the sidechain shall be processed utilizing probably the most just lately deposited UTXOs. Consider this within the context of malicious entities becoming a member of the set of stakers with the intention to steal funds from the spiderchain. All the cash that was deposited earlier than these malicious entities change into a majority is totally protected and firewalled from them till any withdrawal necessities begin necessitating spending these funds and rotating the turn into new addresses. Now, even after they’re nearly all of stakers, they may solely have entry to funds the place they randomly wind up as nearly all of the important thing members within the deposit handle creation protocol. So even after they’ve entered and brought over so to say, they won’t have full entry to all funds deposited after that reality due to the deposit handle creation utilizing a VRF.

This chain of randomly constructed multisigs is the spiderchain, the pegging mechanism used to lock and unlock cash into and out of the sidechain.

The Staking Bonds

The final piece of any proof-of-stake system is bonds, and it is fairly easy. If stakers aren’t required to place something up for collateral in trade for participation within the consensus mechanism, then there may be nothing that may be taken from them as a penalty for malicious habits. That is completed by, you guessed it, utilizing the spiderchain. The identical manner deposit addresses are generated for customers, every block a brand new deposit handle is generated for individuals who wish to stake on the sidechain to deposit a bond right into a multisig composed of a random set of current stakers. As soon as this bond is confirmed, the brand new member is acknowledged as a staker and included within the total set that new block constructors and deposit handle members are chosen from.

At that time, if a staker fails to reply and keep on-line or engages in malicious habits they are often penalized by way of slashing and if obligatory finally faraway from the set of stakers by slashing your entire staking bond. The great factor about the way in which that is finished is the slashing coverage, i.e. the quantity in penalties for particular actions or misbehaviors, is just not programmatic or social, it is each. Slashing happens programmatically on the bottom layer of the mainchain, however is initiated socially by the keyholders of a staking bond. This implies there may be potential for issues to be just a little messy, however flexibility to finetune issues to an equilibrium that retains issues functioning in a manner helpful to stakers and customers.

Gluing It All Collectively

Take the thought of proof-of-stake as a base layer consensus mechanism, and throw the thought away for proper now. That is not what that is, and the issues that should be solved to allow proof-of-stake as a second layer system as an alternative of a stand alone base layer should not the identical. Proof-of-stake is actually a federation, however the place anybody can be part of and cannot be stopped from doing so, and with a mechanism to punish members for appearing malicious. As a base layer that creates all types of existential points, just like the objectivity of a slashing penalty. Proof-of-stake as a second layer doesn’t have that downside when the bonds for slashing are on the mainchain, ruled by proof-of-work.

The issue with proof-of-stake as a second layer is how do you assure that new members can’t be stored out of the “federation.” If all of the funds are custodied by the present members, a majority (or malicious minority of 1/third + 1) may forestall any funds from being transferred to a multisig with new members included. They may very well be stopped from becoming a member of. The way in which that deposits and staking bonds make use of the spiderchain, and it is provably randomly generated multisigs composed of subgroups of the “federation”, it elegantly solves that downside of present members with the ability to exclude new members. Every thing governing the handle members and new entrants is provably verifiable and enforced by second layer consensus with data viewable on the mainchain ruled by proof-of-work. As soon as somebody posts a bond, they’re a part of the set that will get chosen to custody deposits and different staking bonds. It is all there and verifiable.

It additionally creates some attention-grabbing safety properties and dynamics primarily based on the way it works. In a federated sidechain the moment funds had been rotated into multisigs composed of sufficient malicious entities the whole thing of the sidechains funds are compromised. With a spiderchain, the doorway of a brand new malicious majority might be virtually fully mitigated whether it is acknowledged rapidly. Simply ceasing new deposits till slashing can trim out sufficient malicious contributors can maintain the quantity of funds in danger restricted to the statistical portion of latest deposits that wound up in addresses they management since they turned the bulk. They might be unable to slash any previous staking bonds from earlier than their entrance, however pre-existing members would be capable to statistically slash a portion of their bonds.

So long as the dimensions of particular person multisigs are balanced proper with the full variety of stakers, and the worth of all deposits in contrast with staking bonds, this may very well be a really workable system.

Total it’s a very attention-grabbing proposal that proposes attention-grabbing options to the issues of “upgrading” federations to a proof-of-stake system: the flexibility for anybody to hitch, mechanisms for safeguarding in opposition to malicious members, and an incentive to take part as a result of the stakers can break up transaction charges. The kicker? Why do you have to care? It does not require any fork in any respect to allow, so it is going to occur.

[ad_2]

Source link