[ad_1]

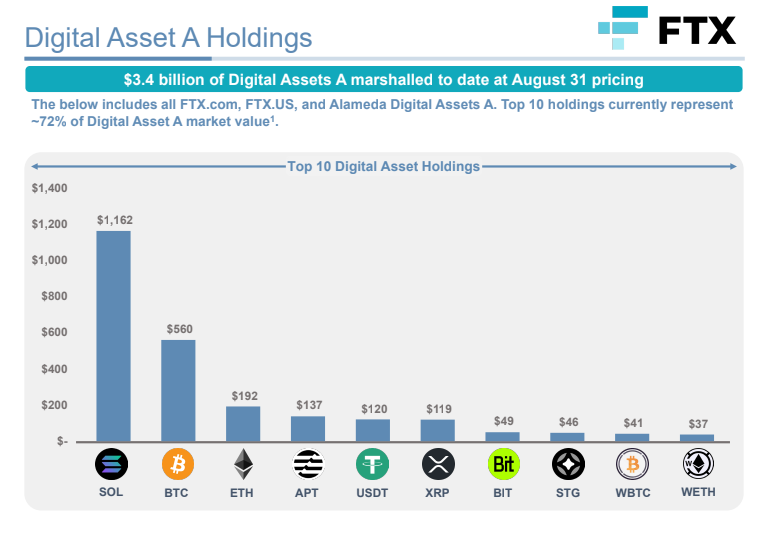

Courtroom paperwork reveal that the bankrupt crypto alternate FTX remains to be holding over $3 billion in property as August 31.

As shared on the social media platform X by crypto reporter Colin Wu, on August 31, 2023, FTX was nonetheless holding nearly $2 billion in Solana (SOL), Bitcoin (BTC), and Ethereum (ETH) alone.

“As of August 31, FTX held a complete of US$3.4 billion in crypto property, together with:

US$1.16 billion SOL

$560 million BTC

$192 million ETH

$137 million APT (Aptos)

$120 million USDT (Tether)

$119 million XRP

$49 million BIT (BitDAO)

$46 million STG (Stargate Finance)

$41 million WBTC (Wrapped Bitcoin)

$37 million WETH (Wrapped Ethereum).”

In keeping with Kroll Restructuring’s documents, the alternate has secured funds by the Chapter 11 course of. The courtroom information point out that $2.6 billion of debtor and non-debtor money has been confirmed so far.

“The Debtors navigated the Q1 2023 monetary banking turmoil and secured fiat from over 30 separate banking establishments globally. Money has been situated and pooled inside a Grasp account for functions of safeguarding property property. Unrestricted money has elevated primarily because of enterprise funding monetization and stablecoin conversions.”

The paperwork additionally present that FTX holds greater than $500 million value of securities in its brokerage accounts. The securities investments embody $70 million within the Grayscale Ethereum belief, $36 million within the BitWise 10 Crypto Index Fund, $6 million unfold throughout different Grayscale funds, lower than $1 million in BlackRock fairness, and an enormous $417 million in Grayscale’s Bitcoin belief, which accounts for 79% of FTX’s securities holdings.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/dani3315

[ad_2]

Source link