[ad_1]

Obtain free Cryptocurrencies updates

We’ll ship you a myFT Each day Digest e mail rounding up the most recent Cryptocurrencies information each morning.

Small cryptocurrency exchanges rated as having greater ranges of danger for patrons have been the principle winners from Binance’s hefty decline in market share within the 5 months since US regulators charged it with violating federal legal guidelines.

Firms akin to Huobi World and KuCoin, each primarily based within the Seychelles, are amongst these which were in a position to improve their share of the buying and selling of crypto tokens akin to bitcoin and ether for the reason that begin of this yr, in line with knowledge from business analysis supplier CCData.

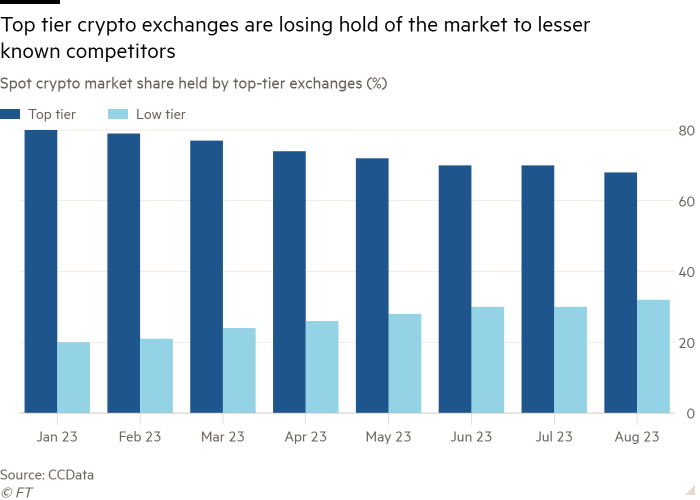

In distinction, exchanges which are rated by CCData as “high tier” — as a result of them surpassing a “minimal threshold for acceptable danger” to clients — have suffered a fall of their collective market share from 80 per cent to about 68 per cent for the reason that begin of the yr. In the identical interval Binance, the business chief, has fallen from 56 per cent to barely greater than 40 per cent.

The shifting panorama exhibits merchants’ sensitivity to 2 lawsuits filed in opposition to Binance by US regulatory companies this yr. In March the Commodity Futures Buying and selling Fee alleged it illegally accessed US clients. The Securities and Alternate Fee adopted in June, accusing 13 Binance-related entities of violations together with allegedly mixing billions of {dollars} of buyer money.

“For a big portion of crypto merchants, anonymity and the flexibility to alternate funds that will have come from a excessive danger supply is extra essential than buying and selling on an alternate with a status for compliance,” stated Tom Robinson, chief scientist and co-founder of blockchain tracing agency Elliptic.

Digital property dashboard

Click on here for real-time knowledge on crypto costs and insights

CCData defines “high tier” exchanges as those who have essentially the most strong approaches to defending buyer funds, safety and anti-money laundering requirements, to call just a few.

Huobi — which has elevated its share of the market by nearly 6 per cent since January — has led the way in which in 2023 for exchanges rising their share of the market whereas not being rated top-tier by CCData.

Others embody DigiFinex and KuCoin, who’ve elevated their share of the crypto market by 3.5 per cent and 1.3 per cent respectively since January. Huobi, DigiFinex and KuCoin didn’t instantly reply to requests for remark.

“It might be a possibility for smaller exchanges as a result of they’re nonetheless working below the radar, and so they haven’t been sued by regulators,” stated CK Zheng, co-founder and chief funding officer at crypto hedge fund ZX Squared Capital.

“If I’m a newcomer to crypto and I don’t understand how exchanges work, I might a minimum of get scared if I noticed one getting sued,” he added.

Different notable top-tier exchanges which have misplaced floor embody Coinbase and Binance US — the American arm of the Changpeng Zhao-led group — each of which have surrendered greater than 1 per cent of their share of the market since January.

“The Binance impact is big. Their market share took a giant hit after the US’s crackdown on crypto,” stated Ilan Solot, co-head of digital property at London dealer Marex.

Click here to go to Digital Asset dashboard

[ad_2]

Source link