[ad_1]

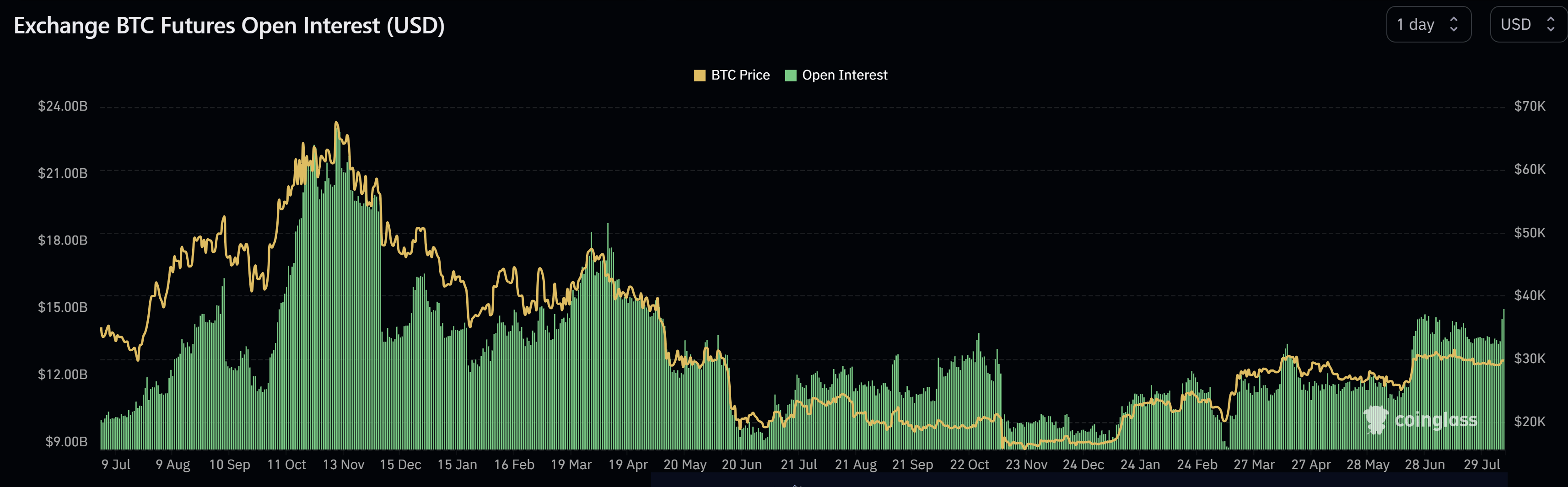

In a market that has been comparatively quiet for weeks, Bitcoin (BTC) has out of the blue sprung to life, with its Futures Open Curiosity (OI) reaching ranges not seen because the FTX crash. Open Curiosity, a metric that measures the overall variety of excellent futures that haven’t been settled, supplies a glimpse into the buying and selling exercise and potential future value actions of an asset. A surge in OI can point out heightened buying and selling exercise and curiosity out there.

Beginning early Tuesday, Bitcoin’s value motion surged by greater than 3.5%, breaking the $30,300 mark for the second time this month. This motion started round 5 am EST, pushing the worth to a 16-day-high. The catalyst behind this surge appeared to be the rumor that insiders at BlackRock and Invesco have confirmed {that a} Bitcoin spot ETF just isn’t a query of “if” however “when”, suggesting an approval throughout the subsequent 4 to 6 months.

“Bitcoin whales opened giga lengthy positions at $29k,” remarked CryptoQuant CEO Ki Younger Ju. The Head of Analysis at CryptoQuant additional added, “A whole lot of speak currently about growing chance of Bitcoin spot ETF approval within the US. Now Coinbase premium sharply up and shifting in the direction of optimistic territory (implies Bitcoin demand within the US is strengthening). GBTC value low cost has continued to slim.”

Bitcoin Futures Open Curiosity Skyrockets To Yearly Excessive

Combination OI for Bitcoin futures noticed a big soar, growing by over $1 billion from yesterday to a staggering $14.95 billion, in response to Coinglass information.

This surge marks essentially the most substantial improve in over a month. Nevertheless, derivatives exercise on the CME, usually seen as a gauge of institutional buying and selling, remained comparatively unchanged in OI, suggesting that the latest transfer may be predominantly retail-driven.

Miles Deutscher commented on Twitter, “Bitcoin open curiosity is now at its highest degree because the FTX collapse. This means elevated BTC buying and selling exercise from market contributors. Seems to be like an enormous transfer is brewing.” Equally, James V. Straten noticed, “Bitcoin open curiosity is now larger than 2.25% of the market cap, approaching YTD highs, and appears exceptionally overheated.”

The Kingfisher, a famend information supplier for Bitcoin derivatives, noted, “Coinbase promoting into each different main alternate shopping for. Seems to be like Bybit & Bitmex degens are betting on one other $BTC leg up. Whereas Bitfinex appears to be promoting right here.”

On the choices entrance, the analysts added that sellers appear bullish, able to capitalize on each upward and downward actions. Their shopping for exercise is at the moment stabilizing the worth, whereas any important upward trajectory might see them intensifying their shopping for. In the meantime, the BTC liquidation map of The Kingfisher signifies that whereas there are nonetheless “some late high-leverage shorts to liquidate to the upside, however a lot of the short-term liquidity is down.”

Famend analyst @52kskew offered insights into the BTC whale vs. algo divergence, stating, “Whales require fairly thick liquidity to exit or shut positions & most frequently that is throughout a squeeze occasion. Some corporations will use algos as a way to get one of the best value when closing out sizeable place (that is the place TWAP algos come into play).”

CPI Launch To Take Out The Warmth?

Notably, the Shopper Worth Index (CPI) within the US is scheduled for tomorrow, Thursday, 8:30 am EST. The discharge has the potential to trigger a mass liquidation of the overheated BTC futures market in each instructions. A significant transfer by the BTC value appears imminent.

Forecasts recommend a rise within the headline CPI from 3% to three.3% year-over-year (YoY) for July, marking a big transition because the optimistic impacts from the prior yr begin to wane. Notably, the Cleveland Fed’s Inflation Nowcast mannequin initiatives a 3.42% headline CPI, marginally surpassing basic expectations. Core CPI is predicted to barely decline from 4.8% to 4.7% YoY.

At press time, the BTC value was slightly below key resistance at $30,000.

Featured picture from BTCC, chart from TradingView.com

[ad_2]

Source link