[ad_1]

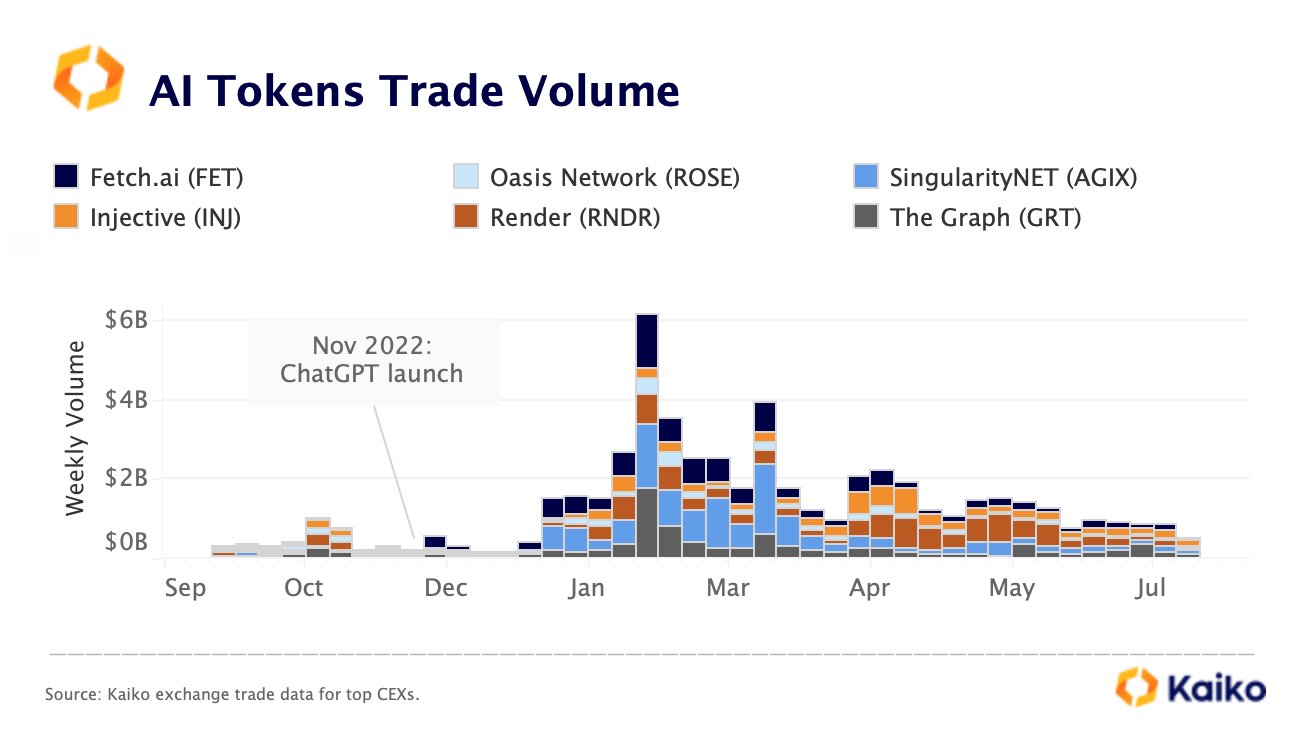

A market information agency says that synthetic intelligence (AI)-focused crypto tasks are experiencing a decline in buying and selling quantity after buzzing earlier this 12 months.

In response to crypto intelligence agency Kaiko, AI-related tokens equivalent to Oasis Community (ROSE), Render (RNDR), and The Graph (GRT), have not too long ago lost their momentum.

“AI-related tokens have been dropping momentum, hitting lowest weekly commerce quantity since January.”

In January, rumors had been swirling that tech big Microsoft could be investing a staggering $10 billion into Open AI, a US-based AI analysis laboratory that created ChatGPT, a viral AI chatbot.

On the time, AI-focused crypto tasks, together with SingularityNET (AGIX), Fetch.ai (FET), and Ocean Protocol (OCEAN), enormously benefited from the excitement surrounding the rumor, rising 136%, 91%, and 37%, respectively.

In response to Riyad Carey, a analysis analyst at Kaiko, Worldcoin (WLD), a crypto challenge co-founded by OpenAI founder Sam Altman, had a “distinctive” launch earlier this week that’s convincing individuals to make use of its eye-scanning know-how.

“Worldcoin’s WLD launch is likely one of the extra distinctive I can bear in mind: Almost 90% of circulating provide was loaned to market makers. Only one% of whole provide was launched. Itemizing was (as anticipated) very environment friendly, although there was some suspected wash buying and selling…

The launch means that the workforce felt it needed to assign an interesting greenback worth to their token. Convincing individuals to scan their eyes for 25 models of a token that doesn’t but exist may be difficult; if the token’s worth is, say, $0.10, it’s much more difficult.

The 25 WLD tokens are presently price somewhat greater than $50 and can probably keep in that vary for the following three months. To this point, this appears to be engaging individuals to enroll and scan.”

Worldcoin is presently below investigation in each the UK and France over privateness issues.

Kaiko then shifts its focus to XRP, the digital asset used to function Ripple Labs’ funds system, which not too long ago had a landmark ruling in its favor in opposition to the U.S. Securities and Change Fee (SEC).

In response to the info gathering platform, the token’s futures volume-to-open curiosity ratio signals sustained speculative curiosity for the digital asset.

“XRP perpetual futures volume-to-open curiosity ratio stays above common on most exchanges, signaling sustained speculative curiosity.”

Shifting on to the highest two crypto belongings by market cap, Bitcoin (BTC), and Ethereum (ETH), Kaiko finds that they’ve seen a large decline in volatility over the last three months.

“Each BTC and ETH have seen a decline in 90-day realized volatility this 12 months. At the moment, their volatility ranges are hovering round two-year lows.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Price Action

Comply with us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney

[ad_2]

Source link